Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Proof that Mike Stathis is THE TOP Investment Mind in the World

Mike Stathis

- Nearly three decades as an investment professional.

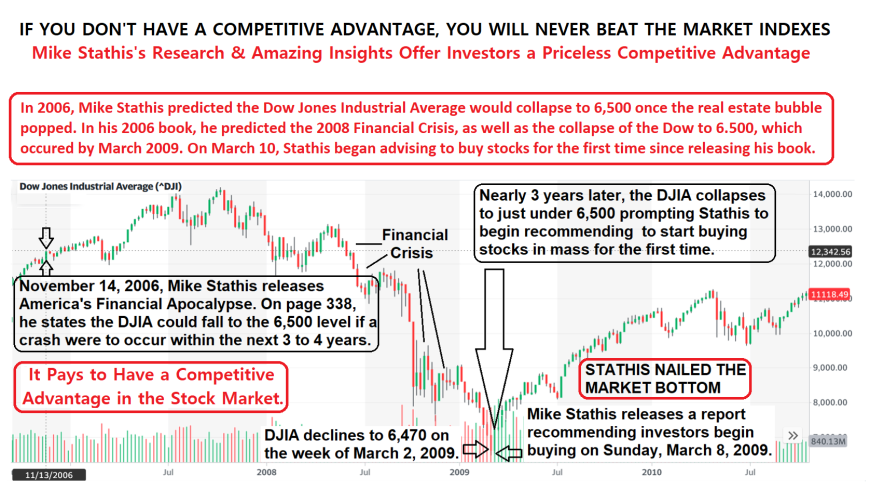

- Predicted the 2008 financial crisis with more accuracy and detail than anyone in the world.

- Worked at major Wall Street firms (UBS and Bear Stearns).

- Worked in the venture capital industry.

- Has advised multi-billion dollar mutual funds, hedge funds, and pension plans.

- Has advised Fortune 100 corporate treasury departments.

- Has advised ultra high-net worth individuals and high-level executives of Fortune 100 firms.

- Has advised countless companies.

- Is an Ivy League graduate with graduate degrees in the physical sciences.

- Was a recipient of an NSF research grant.

- We have made this claim and have continued to stand by it since (at least) 2009.

- No one has so much as attempted to legitimately challenge this claim.

We have backed this claim by a $50,000 challenge which remains active to this day (March 6, 2023).

If you think you or someone else has a better track record of having predicted the 2008 financial crisis, stock market, and economic collapse, simply escrow $50,000 into the account of a legal firm chosen by us and we will do the same. We will also hire a third-party management consulting firm to examine the written and oral arguments from both sides. Whoever wins will received the total amount held in escrow, or $100,000.

Contact us only if you are serious about submitting a challenge to this claim and you are willing to provide us with your source of funds as well as your identification credentials. We will followup with more details on this challenge. Otherwise, please do not waste our time.

We believe there is no one in the world who can match the accuracy and insight of Mike's forecasts, which predicted the economic collapse, the stock market collapse, (with nearly perfect accuracy) the bottom in the residential real estate market, the major causes of the Financial Crisis of 2008 all before they materialized, enabling those who read his books and articles to make a fortune.

We also believe there is no one in the world whose pre-crisis work can match the comprehensiveness and prescient of Mike's analysis and discussions on America's most problematic and long-standing issues, such as the U.S. healthcare system, problematic consequences of free trade including U.S.-China trade, Wall Street fraud, illegal immigration, political correctness, and the wealth and income disparity. Remember, this book was published in 2006.

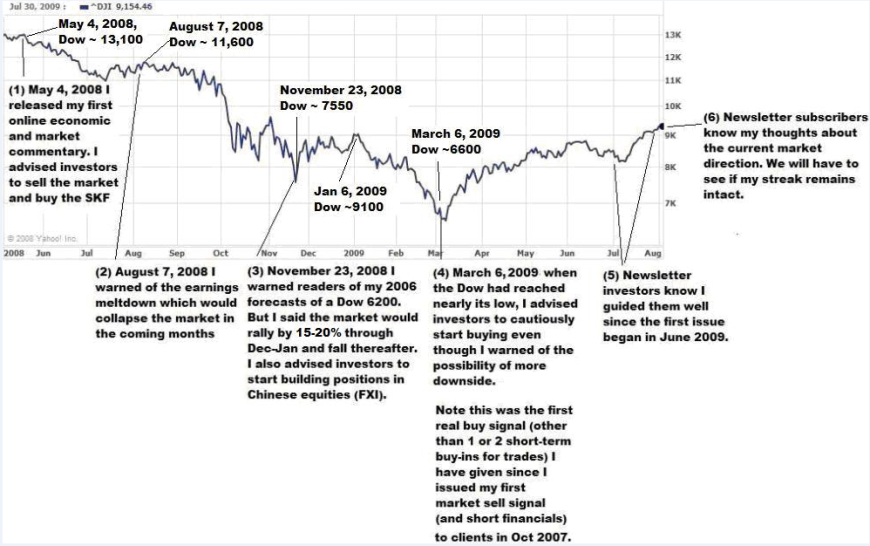

Based on his prescient analysis and recommendations provided in his two pre-financial crisis books, along with several articles published in the public domain during 2008 and 2009, investors who followed his analysis and recommendations were able to capture remarkable profits.

More details on Mike Stathis' Track Record on the 2008 Financial Crisis

Briefly, Mike's books and public domain publications enabled investors to:

1) Sell Stocks at the Market Top (2007) and Buy at the Bottom (March 2009)

Mike's analysis and recommendations enabled investors to sell stocks towards the top (2007) and buy back at the exact market bottom (March 2009 at 6,500).

2) Buy Alternative Assets after the Collapse (gold, commodities, Chinese funds)

>> See America's Financial Apocalypse (2006)

3) Invest in Demographics-Driven Sectors (drug and cruise ship stocks)

>> See America's Financial Apocalypse (2006)

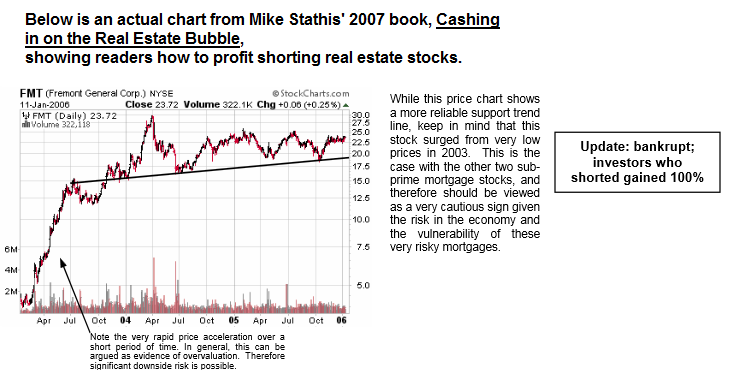

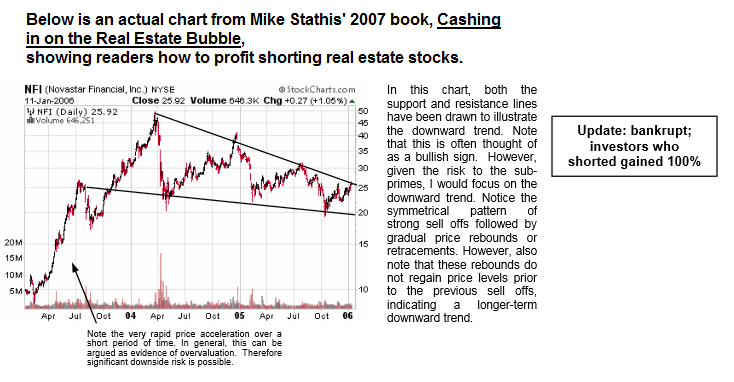

4) Short Sub-Prime and Prime Mortgage Stocks (shown below)

>> See Cashing in on the Real Estate Bubble (2007)

5) Short Homebuilder Stocks (shown below)

>> See Cashing in on the Real Estate Bubble (2007)

6) Short Bank Stocks (shown below)

>> See Cashing in on the Real Estate Bubble (2007)

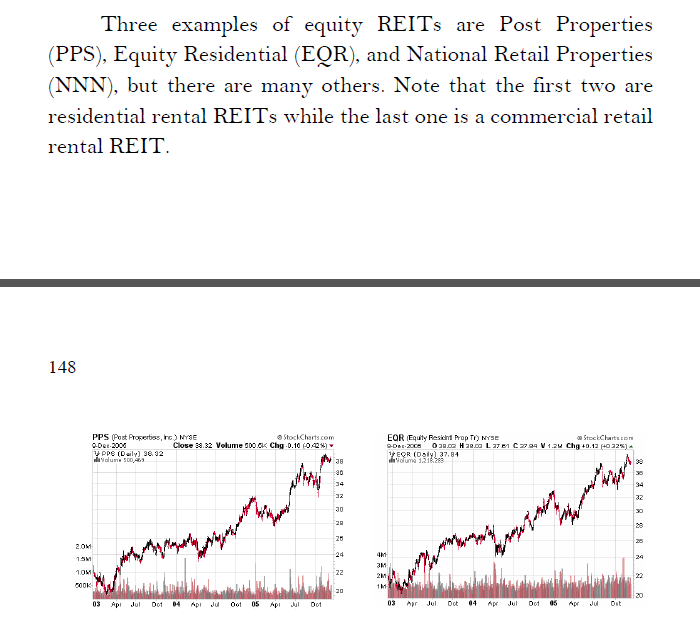

7) Buy REITs after the Bubble Popped

>> See Cashing in on the Real Estate Bubble (2007)

The following video summarizes some of the material found in the 2006 extended edition of America's Financial Apocalypse.

More details on Mike Stathis' Track Record on the 2008 Financial Crisis

Skeptics should conduct a careful and comprehensive investigation of Mr. Stathis' track record of having predicted the 2008 financial crisis and enabling investors to capture life-changing profits here, here, here, here, here, here, here, here, here, here, here, and here.

*See below for more evidence backing this claim.

Furthermore, Mike is the ONLY person in the world to have predicted the extent of the collapse who ALSO turned BULLISH on the US stock market at the EXACT BOTTOM at 6,500 on March 9, 2009.

After getting investors out of the stock market well before the financial crisis began, and getting them back in at the very bottom, Mike went on to nail the majority of major stock market moves. Today, as of July 21, 2023, Mike's market forecasting remains as accurate as ever.

.png)

.png)

Mr. Stathis' Forecasting Track Record Since 2015

Mike Stathis Warned About the 2022 Bear Market Before it Began

Can You Beat the S&P 500 Index? You Can If You Have Access to Our Research

Mike Stathis Predicted the Coronavirus Bear Market and Nailed the Bottom

Mike Shows You How to Make 100% in 2 Weeks and 200% in 6 months

Did You Own the Best Stock of 2016? Intelligent Investors Did

Mike Stathis is the Only Person to Have Nailed the First and Second Interest Rate Hikes

Mike Stathis Nails the Stock Market Breakout from November 2016 Months in Advance

Our Interest Rate Forecasts Have Yielded HUGE Gains

Mike Stathis Was The Only Person To Have Nailed The First Rate Hike

Our Clients Avoided Being Exposed To The Market Collapse

Mike Stathis Predicted The August 2015 Stock Market Collapse

Guess Who Advised His Clients To Go To Cash BEFORE The Market Collapse?

*See below for more evidence backing this claim.

- We have shown extensive evidence supporting this claim.

- He might even be the very best equities analyst in the world.

Below are some charts showing just a few of his great forecasts.

1) Fundamental Analysis - Predicted Collapse of Facebook Before the IPO

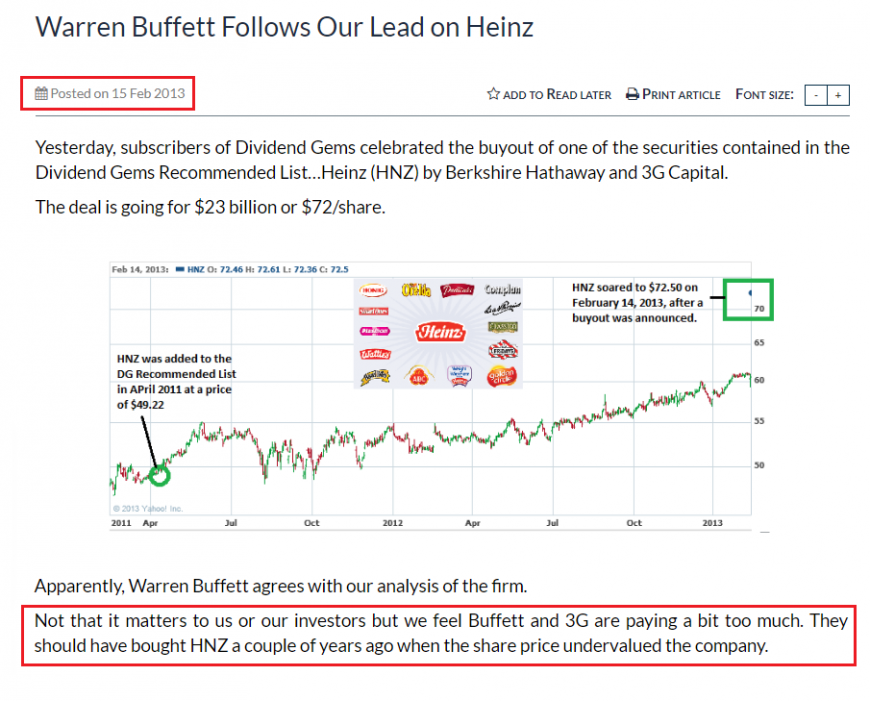

2) Fundamental Analysis - Recommended Heinz Before Buffett Got Involved

I also stated that Buffett paid too much for Heinz. A few years later Buffett's Berkshire Hathaway announced a $15.4 billion impairment charge.

3) Fundamental Analysis - Predicted JC Penny Bankruptcy

I warned JC Penny would eventually file for bankruptcy and recommended shorting it several times starting around $40 during a period when so-called "great investors" were buying it.

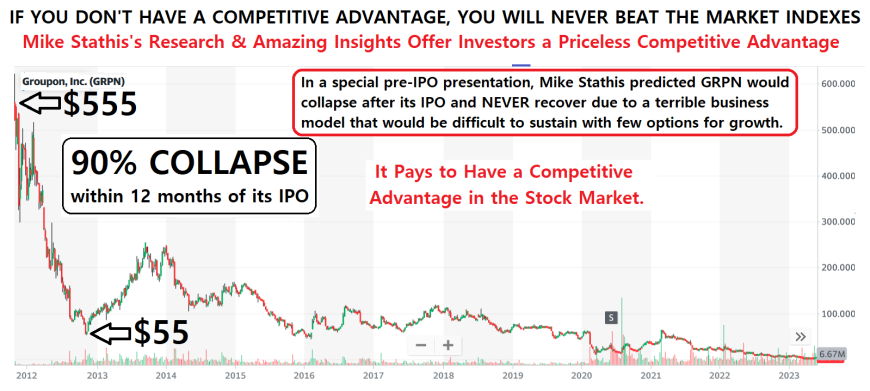

4) Fundamental Analysis - Predicted the Collapse Groupon Before the IPO

5) Fundamental & Macro Analysis - Warned About Alibaba (BABA) Collapse

I predicted the collapse in BABA during a time when Charlie Munger Was Buying it.

6) Fundamental Analysis - Recommended Netflix (NFLX) in 2008

I recommended to buy Netflix (NFLX) and short Blockbuster Video (BBI) in 2008 (Wall Street Investment Bible). And I have been mostly bullish on NFLX since then.

Blockbuster would file for bankruptcy a couple of years later.

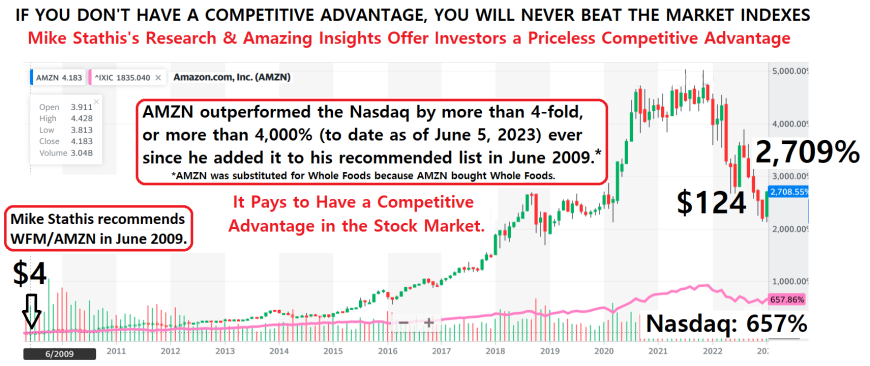

7) Fundamental Analysis - Recommended Whole Foods/Amazon Since 2009

I named Whole Foods (WFM) as my #3 Stock for Long-term Growth Since 2009.

Whole Foods (WFM) was bought by Amazon (AMZN) a few years later.

8) Fundamental Analysis - Recommended Unitedhealth (UNH) Since 2009

I named Unitedhealth (UNH) as my #2 Stock for Long-term Growth Since 2009.

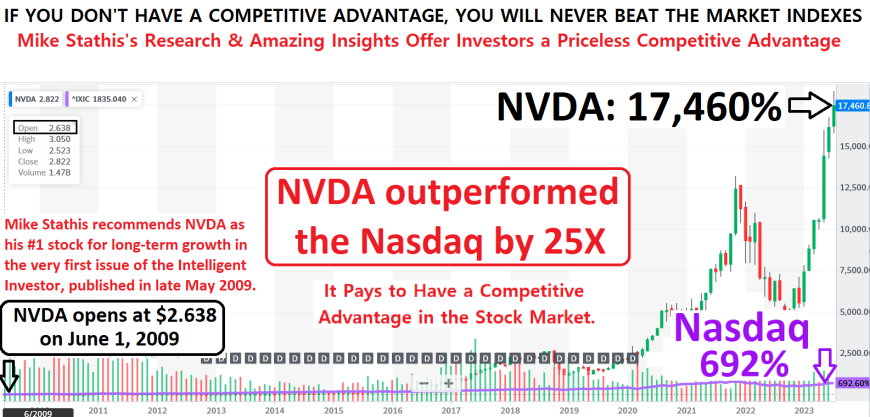

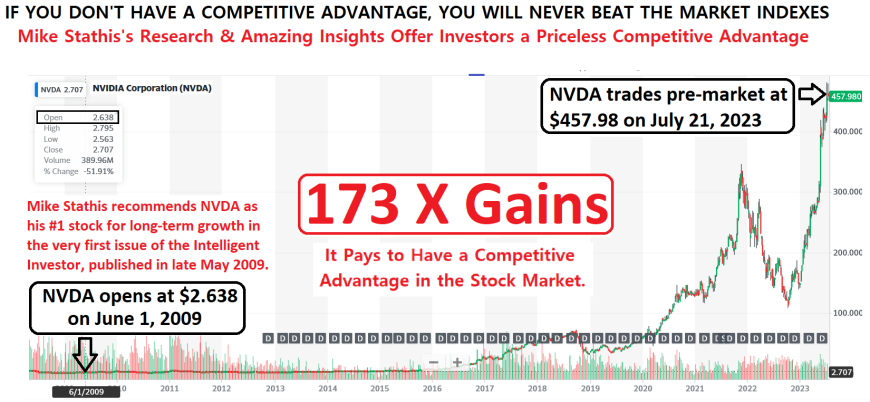

9) Fundamental & Macro Analysis - Recommended Nvidia (NVDA) Since 2009

I named Nvidia (NVDA) as my #1 Stock for Long-term Growth Since 2009.

10) Fundamental & Macro Analysis - Predicted Fannie Mae (FNMA) Bailout

I recommended to short Fannie Mae in my 2007 book (along with several sub-prime mortgage, bank, and homebuiler stocks),

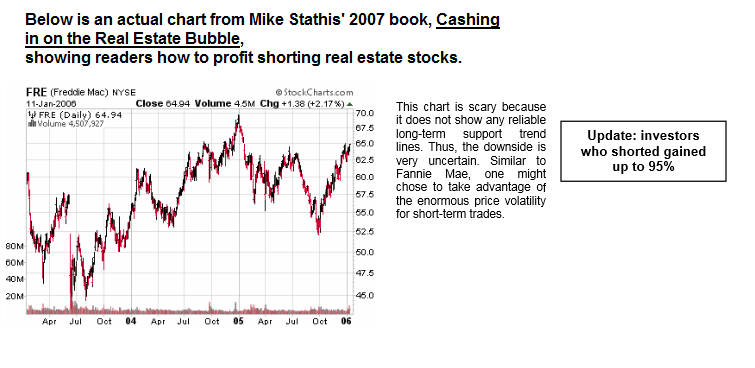

11) Fundamental & Macro Analysis - Predicted Freddie Mac (FMCC) Bailout

I recommended to short Freddie Mac in my 2007 book (along with several sub-prime mortgage, bank, and homebuiler stocks).

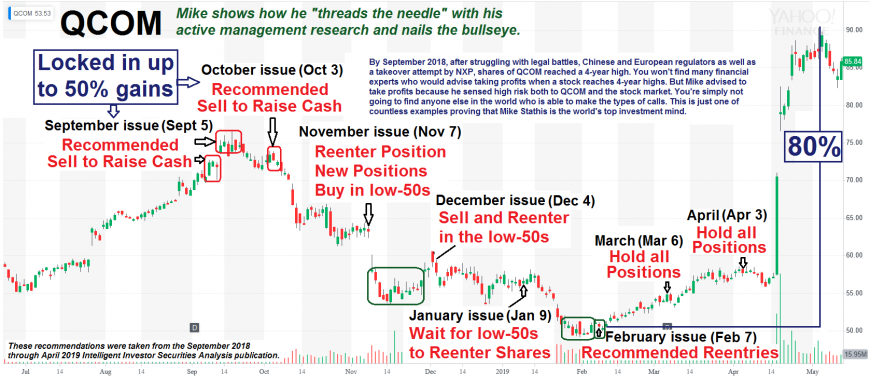

12) Fundamental & Technical Analysis - Qualcomm (QCOM)

An example of active management of securities on our Recommended List.

This is indeed a very bold claim that we have not made lightly. We have devoted many years towards researching and documenting many of the best known research firms including the most presigeous Wall Street firms and we are confident that Mr. Stathis holds the top investment forecasting track record since he began formally publishing investment research which was in 2006.

This claim emcompasses all of Mike's research coverage, from equities analysis including distressed securities analysis, to commodities and precious metals forecasts and trading guidance, along with U.S. stock market and emerging market forecasts.

We backed this claim by a $1 MILLION guarantee.

We extended this challenge for many years and raised the initial $10,000 award to $1,000,000.

This challenge expired in April 2021 after no one came forward since we initially launched it in 2009.

Although this challenge is now closed, we are potentially willing to reopen it. And we will also consider lowering the amount of money involved, as long as you demonstrate that you are serious and you are willing to provide us with your source funds along with ID verification.

* See below for evidence backing this claim.

Evidence Backing Our Claims

Note that we have been publishing research for nearly two decades, so we have thousands of research papers, videos, webinars, and special presentations which we cannot possibly show or even fully summarize in this entry. Therefore, the following materials should be taken to reflect a broad representation of our research forecasts, insights, and guidance.

1. Mike Stathis has the best published track record on the 2008 financial crisis.

We are as confident today as we were back in 2009 that no one can match the accuracy, detail, and comprehensiveness of Mike's 2008 Financial Crisis forecasts and recommendations.

The reader can find out more about Mr. Stathis' credentials, experience, background, and his investment research track record here and here.

The reader can examine Mr. Stathis' unmatched track record of accurately predicting the 2008 Financial Crisis and enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, here, and here.

While Mike Stathis recommended to short an entire basket of the sub-prime stocks, he took things to a much higher level with one of the boldest calls in investment history.

The really amazing call he made was to also recommend shorting the prime lenders, Fannie Mae and Freddie Mac (GSEs), as well as the banks and homebuilders.

No one else recommended to bet against the GSEs until it was obvious they were in big trouble.

And no one else recommended to short ANY of these stocks (including sub-primes and banks) in a book.

Two years before the financial crisis, Mike already knew the GSEs would get hit hard.

Mike detailed his analysis in two books including his recommendation to short these stocks.

He also predicted the GSEs would be bailed out by taxpayers, which is exactly what happned.

Furthermore, he even predicted the collapse of the banks, hombuilders, GE and GM.

No one else in the world made those calls before the financial crisis.

And Mike he made this analysis available to the public in two books.

If the media had not banned Mike and his books, main street could have made a fortune by following the recommendations in Mike's books.

But this would have enabled main street to take money from Wall Street. And the financial media would never allow that because they are partners in crime with Wall Street.

Mike presented a detailed analysis of the real estate bubble in the 2006 extended edition of America's Financial Apocalypse here.

Meanwhile, in early 2007 Mike released another book focused on profiting from the real estate bubble after it popped. The title of this book is Cashing in on the Real Estate Bubble.

You can access the chapter which recommended shorting real estate-related stocks and banks here.

The following charts are just a few of the examples from the book.

See here. for the remainder of the charts, the analysis and recommendations.

You can read the exact material presented in this book (chapter 12) here.

See Mike Stathis is the leading real estate forecaster

Shorting the Sub-Primes Was Child's Play

Forget the sub-primes.

That was the easy call to make if you knew what was really going on.

Unfortunately, very few people knew what was really going on.

Virtually no one from Wall Street or the Federal Reserve had an idea.

The problems with the risky sub-prime mortgage stocks were known by many leading experts.

But still, NO ONE other than Mike Stathis advised people to short the sub-primes IN A BOOK.

Stathis also recommended to short the homebuilders, banks and even discussed that GE and GM would likely collapse.

It's important to keep in mind that once something is pubished in a book, you can't go back and change it if it goes the wrong way.

But Stathis was confident most sub-prime mortgage companies would go bankrupt once the real estate bubble popped. This is why he showed readers in his 2007 book, Cashing in on the Real Bubble how to profit from taking short positions in these stocks.

Sub-prime mortgages were packaged into what was essentially junk bonds. Because junk bonds have low credit quality during economic expansions, if you suspect that an economic contraction (recession) is on the way an easy call would be to short junk bonds (i.e. sub-prime mortgages) because defaults soar the most in junk bonds during recessions.

Despite this common sense logic, the media will never mention it because they prefer to create superheroes out of the fund managers who shorted the sub-primes.

Moreover, keep in mind that anyone can make a trade. And if it goes the wrong way, you can exit before it blows up and no one will know. If the fund managers were confident that the sub-primes would blow up, why weren't they in the media telling everyone about this "imminent" blow up? Instead, they waited for the trade to pan out. Then they disclosed their gains.

It's also important to note that these same fund managers have registered anywhere from terrible to modest performance since 2008. That means this guys benefited from a one-hit wonder and really have no clue how to perform well long-term.

Mike detailed the risks and problems with the sub-primes in his 2006 book, America's Financial Crisis.

In his 2007 book, Cashing in on the Real Bubble Mike actually recommended to short the sub-prime mortgage stocks, along with the homebuilders, and banks.

You can see for yourself here and here.

Again, he put his forecasts and insights in these books before the collapse. This is how confident he was.

Finally, imagine how many people from main street could have made a fortune if Stathis and his book had not been banned.

The Real Call Was Shorting Fannie Mae and Freddie Mac (GSEs)

Not a single fund manager so much as even thought about shorting Fannie Mae and Freddie Mac because these government-backed agencies were considered to hold only the best investment grade mortgages, or mortgages of high credit quality.

As well, they didn't short the banks or homebuilders.

And who else but Mike Stathis predicted that GE and GM would also collapse?

Mike Stathis understood the full extent of what was to unfold.

This is why he also recommended investors to short Fannie Mae and Freddie Mac (GSEs) in addition to the sub-prime mortgage stocks in his 2007 book, Cashing in on the Real Bubble.

Mike also accurately forecast the bottom in real estate (35%) in 2006 (the bottom was reached in 2011), the bottom in the Dow Jones (6500) in 2006 (the bottom was reached in March 2009) and much much more.

You can see for yourself here and here.

Mike Stathis' analysis of the MBS market and recommendations to short the sub-primes, GSEs, banks and homebuilders was one of the greatest investment calls in history.

Despite this fact, Mike remains unknown to the world as a result of him having been black-balled by all media upon trying to release his 2006 book, America's Financial Apocalypse.

The first two charts show the results of those who followed Mike Stathis' recommendations to short Fannie Mae and Freddie Mac in his 2007 book.

Also not shown are similar results for additional stocks he recommended to short such as the sub-prime mortgage stocks, homebuilders, and banks.

He even warned that General Electric and General Motors would get hit hard because he realized these companies had grown to become essentially consumer finance companies.

Check here, here and here for more evidence proving that Mike Stathis predicted the extent of the real estate bubble and resulting financial crisis with more insight and accuracy than anyone in the world.Note that this was just the "tip of the iceberg" as far as his predictions and insights.

The first two charts show the results of those who followed Mike Stathis' recommendations to short Fannie Mae and Freddie Mac in his 2007 book.

Also not shown are similar results for additional stocks he recommended to short such as the sub-prime mortgage stocks, homebuilders, and banks.

Please check the following links for Mike Stathis' 2008 financial crisis forecasts and insights which enabled investors to capture life-changing profits here, here, here, here, here, here, here, here, here, and here.

There were no books released at any time prior to for after the release of these books which remotely came close to pinpointing the details and accuracy of the events as they would later unfold. And this serves as just one of numerous illustrations.

Mike also accurately forecast the bottom in real estate (35%) in 2006 (the bottom was reached in 2011), the bottom in the Dow Jones (6500) in 2006 (the bottom was reached in March 2009) and much much more.

Mike also recommended buying REITs after the real estate bubble burst.

And he even provided some specific examples.

Finally, Mike also predicted the reverse mortgage boom in his 2007 book. As we know, reverse mortgages did in fact boom in years after the financial crisis.

Here we show his remarkable market forecasting track record and recommendations prior to during and just after the 2008 financial crisis published in his 2006 book, America's Financial Apocalypse as well as in several articles in the public domain in 2008 and 2009.

.png)

Proof That Mike Stathis Has The Leading Track Record On The Economic Collapse

Meanwhile, Stathis was black-balled by all media for trying to warn main street about the 2008 financial crisis despite holding the leading investment forecasting track record since 2006.

View more of Mike Stathis' Track Record here, here, here, here, here and here.

America’s Financial Apocalypse remains as the most accurate, comprehensive and insightful book 17 years after it was first published. Some might counter that's it's even more important than before because it detailed America's trade issues with China.

Others feel the need to release 2.0 versions of their book because they missed so much and got so many things wrong the first time.

Some financial professionals spend all of their time marketing.

Others spend all of their time doing research. In the end, the track record is the only thing that matters.

The following is only a PARTIAL LIST of accurate forecasts and insights from the extened edition of America's Financial Apocalypse (2006).

Because we do not have the time to go through the book and list more, if you feel there are some important additions to this list, please email us with your entry and page number.

In this book, Mike...

(1) Predicted the collapse of the commodities bubble by 2008/2009, and told readers that would be the time to buy - Chp. 14

(2) Warned that the credit rating agencies were passing AAA ratings to risky mortgage debt – p. 219

(3) Warned of the lack of adequate regulatory authority over the MBS market positioned it for a massive collapse – p. 222

(4) Predicted a mortgage-related derivatives meltdown resulting in losses in the trillions of dollars – p. 221

(5) Predicted the banks would suffer due to the implosion of the MBS market – p. 223

(6) Warned that once the MBS market collapsed it would lead to a massive sell-off in global stock markets - p. 223

(7) Advised readers to short LEND, FRE, NFI, FMN, FRE, banks and homebuilders (Cashing in on the Real Estate Bubble)- Chp. 12

(8) Predicted that Fannie and Freddie would be bailed out by taxpayers – p. 221

(9) Predicted real estate prices would decline by 30%-35% on average (50-60% in certain regions) – p. 223

"I would estimate at its bottom, the deflation of the housing bubble will cause a 35 percent correction for the average home. And in “hot spots” such as Las Vegas, Northern and Southern California, and South Florida, home prices could plummet by 50 to 60 percent of their peak values." (Cashing in on the Real Estate Bubble) --pp. 67-8

(10) Predicted Dow 6500 - Chp. 16, pp. 336-342

(11) Warned the collapse of real estate and stock market would lead to the “Poor Effect” – p. 201

(12) Provided exhaustive evidence of a massive real estate bubble ready to burst – Chp. 10 – the most exhaustive and insightful analysis anywhere

(13) Warned that GM and GE would also collapse due to the real estate implosion – p. 223

(14) Warned of the implosion of the ABS market – p. 223

(15) Presented irrefutable evidence there would be a depression – Entire Book

(16) Predicted there would be a "New Deal" – p. 346

(17) Warned about the entitlements tsunami that would lead to massive tax hikes -- Chp. 11

(18) Detailed "free trade" as America's #1 chronic macroeconomic problem - numerous chapters

(19) Addressed healthcare as the second biggest long-term problem faced by America - Chp. 7

(20) Recommended gold and silver - Chp. 17

(21) Advised investors to trade the volatility of gold rather than buy and hold – p. 381

(22) Recommended oil trusts as a way to deal with the high volatility of oil - Chp. 17 and 18

(23) Recommended going to cash and waiting for the disaster - Chp. 17

(24) Mentioned the Fed might create massive inflation to pay off the huge national debt – p. 362

(25) Provided a generic asset allocation for conservative, moderate and aggressive investors – in each case, Cash was the #1 asset (so they would be able to buy after the market crashed). p. 383

Other recommended assets: oil trusts, gold, silver, Chinese funds (note I warned China’s economy would correct, indicating a time to buy below), healthcare, TIPS, dollar hedge with euro – p. 383

(26) Predicted an inflationary depression followed by brief periods of deflation if things got really bad (we experienced deflation during Q4, 2008) -- Chp. 16 and 17

(27) Discussed effective ways to manage risk – pp. 376-385

(28) Detailed how the government manipulates economic data (GDP, inflation, unemployment) - Chp. 11

(29) Explained how gold was a hedge against deflation, not inflation – pp. 360-362 -- he followed up on this in detail to help the sheep who are being taken by the gold bugs despite the fact that he forecast gold to soar to above $1400 and perhaps $2000 in this book.

(30) Explained how America today (2006) shared many similarities to pre-depression America – Chp. 16, pp. 343-346

(31) Warned of the possibility of China dumping U.S. Treasuries or using this threat for economic (such as unfair trade and currency manipulation) and political leverage pp. 308-309, 312

(32) Explained how corporate America is destroying middle class – Chp. 12, pp. 322-325, 257-262

(33) Detailed America’s two-decade period of declining living standards – pp. 243-248

(34) Explained how the SEC permits legalized insider trading – pp. 255-256

(35) Proved how the economy under Bush was a disaster and was set to implode – Chp. 15

(36) Explained how the SEC is useless and serves as a partner in crime with Wall Street – Chp. 12

(37) Explained how the dollar is backed by oil and how the Saudis have a huge amount of control of the fate of the U.S. economy, pp. 310-311

(38) Predicted most baby boomers would never be able to

Copyrights © 2025 All Rights Reserved AVA investment analytics