Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Proof that Only Fraudsters Pitch Gold as an Investment Over the Stock Market

Unfortunately, most people have forgotten how critical it is to know the credibility and reliability of the sources they choose to follow.

Instead of checking credentials and track records, they go by the number of likes, fake comments, fake reviews, and hearsay from people they have no idea about.

Those who are unfamiliar with me can find out more about my credentials, my background, as well as my investment research track record here, here, and here.

The reader can examine my unmatched track record of predicting the 2008 financial crisis and enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, and here.

-------------------------------------------------------------------------------------------------------------------------------------

I've been exposing the fraudulent precious metals pumping scene for more than a decade.

I am not only the world's foremost authority on these frauds, I'm also one of the world's most accurate gold and silver price forecasters.

One reason for my success in forecasting the price of gold and silver is due to the fact that I have no financial interest in precious metals.

I don't sell precious metals, I don't sell precious metals ads and I don't get paid to pump "junior miner" penny stock scams so that gold pumping king pins can engage in frontrunning.

Because I have achieved the highest degree of credibility as a professional investment analyst and strategist, precious metals fraudsters fear me. They don't want their cult to hear anything I have to say about gold, silver or anything else because the truth would ruin their scheme to manipulate and exploit their cult.

Remember, every single one of these precious metals pumpers has a miserable track record because they aren't analysts. They are pure pumpers. And they are in the business of profiting off selling precious metals or getting paid to promote precious metals.

Again, I do not sell precious metals, advertisements, stocks or any other types of investments. What I sell is cutting-edge investment research. My research is based on my experience, skills, and insights. And my research isn't going to be worth much if I'm frequently wrong.

Fortunately, I'm not wrong as often as many of my peers in the financial industry.

I am confident that I have the best overall investment forecasting and analysis track record in the world since 2006.

And I have been the only person in world history (as far as I am aware) who has backed this claim with money.

These fraudsters fear me because I have all the facts and I present the truth about gold and silver. Because the truth is not convenient for their business of selling gold and silver, they want to avoid me at all costs. And they have been doing that for more than a decade.

There's not a single one of their claims about gold, silver, the economy or stock market that can stand up to the truth. I've debunked them all.

These fraudsters fear me so much they won't dare mention my name. And in the rare instance that one of the gold/silver cult members asks their pumping ring leader about me, they respond by making up lies as a way to defame me in order to distract from the issue at hand. Defaming me cannot change the facts I have stated about gold.

It's simple. Ask these ring leaders to prove me wrong. And ask them to do so in my presence (on a neutral platform) so I can debunk their word games and manipulative word salad.

They will NOT EVER DO IT.

GUARANTEED.

I have been challenging them for a over decade and they run and hide like cowards because this enables them to keep ripping off people.

The worst thing they could do is to allow me to confront them because I would expose the truth and their business of selling gold and silver would collapse quite fast. They know this and that's why they avoid me like the plague.

These gold-pumping frauds want to profit from you by convincing you to waste your money on gold instead of investing it in the stock market.

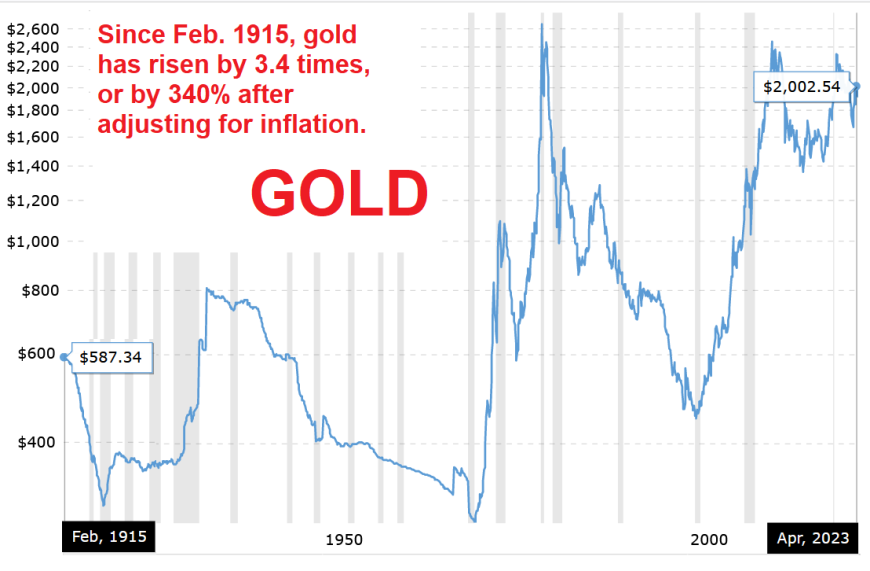

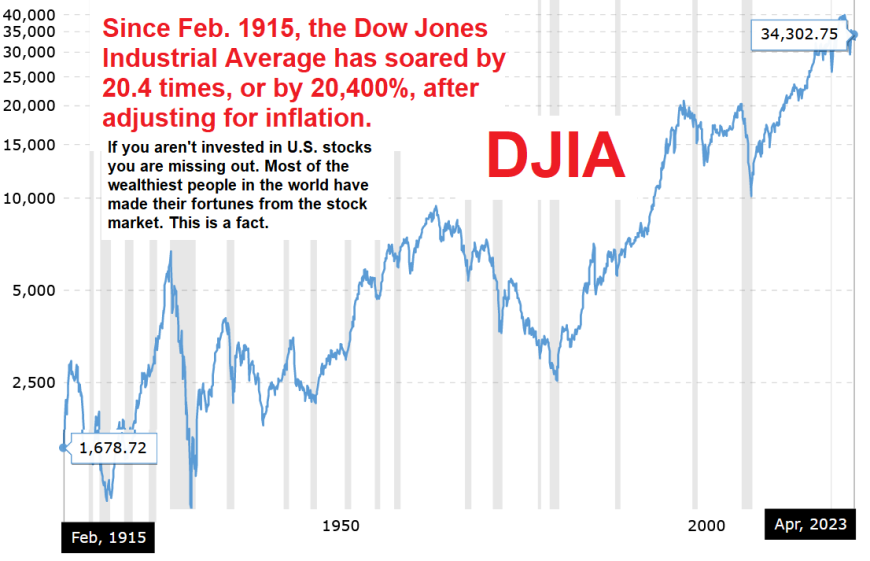

Take a look at the two charts I have posted below and you will see that gold is a terrible investment.

And remember, when you buy stocks you are buying part ownership in real companies; businesses that generate cash flows and earn profits (some newer high tech companies are not profitable but become profitable later on).

This makes stocks a productive asset because they represent ownership in the underlying business.

In contrast, gold and silver are nonproductive assets. They don't generate cash flows so neither provides you with an income.

Other than buying jewelry, gold and silver are something to put your money into if you have primative thinking.

Ask yourself why locals in Asia buy gold.

Do you realize that Asian schools don't even teach critical thinking?

Need I say more?

If you want to follow what the Chinese and Indians are doing then I suppose you should get rid of your toilet and dig a hole in the ground to use when you need to defecate because the majority of Chinese and Indians still do not have western style toilets. At best, most use "squatters" which consist of a hole in the ground.

Think about that.

Let's take a look at the performance of gold since February 1915 (the furthest back this source has reliable data) through current data, or April 2023.

Next, let's compare the performance of gold over the same time span with that of the Dow Jones Industrial Average.

As you can appreciate, the Dow soared by more than six times that of gold.

Gold bugs are always talking about how the dollar's value is being "inflated" away. They contend that gold offers an excellent way to protect against this.

But the fact is that NO ONE stashes their dollars under their mattress for decades.

People put their money in banks which pay interest, they buy real estate, which appreciates in value, they invest in their business, and most notably they invest in the stock market.

So let's compare the inflation-adjusted performance of gold over the same time span with that of the Dow Jones Industrial Average.

As you can appreciate, the Dow soared by more than sixty times that of gold.

How do you think you buy stocks in the Dow?

You use dollars.

GREAT INVESTMENT RETURNS REQUIRE A COMPETITIVE ADVANTAGE

> Do you have a competitive advantage to help you beat the market indexes?

> If not, you stand no chance of beating the indexes in the long run.

We Have the Competitive Advantage Investors Need

> Mike Stathis is the Only Person Who TRULY Predicted the 2008 Financial Crisis

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #1

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #2

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #3

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #4

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #5

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #6

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #7

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #8

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #9

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #10

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #11

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #12

Articles on Gold and the Gold Pumping Syndicate

- Why Hyperinflation Isn't Coming To The U.S.

- Understanding the Proper Use of Gold and Silver

- The Importance Of China To The US Economy

- Understanding Manipulation of Gold by the Media

- Gold Charlatans Strike It Rich While Their Sheep Get Fleeced (Part 1)

- Gold Charlatans Strike It Rich While Their Sheep Get Fleeced (Part 2)

- Gold Charlatans Strike It Rich While Their Sheep Get Fleeced (Part 3)

- Gold Charlatans Strike It Rich While Their Sheep Get Fleeced (Part 4)

- Gold Charlatans Strike It Rich While Their Sheep Get Fleeced (Part 5)

- China Has Increased US Treasury Holdings By Over 2000%

- Blast From The Past - Peter Schiff Was Wrong

- Understanding Manipulation of Gold by the Media

- The California Gold Rush of the Twenty-First Century

- Dismantling John Williams' Hyperinflation Predictions

- The Best Video Ever Created Exposing The Gold Pumping Scene

- Manipulation of Gold and Silver Prices

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 1)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 2)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 3)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 4)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 5)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 6)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 7)

- Debunking the Myth that China is Selling U.S. Treasury Securities

- We Predicted The Market Selloff Yet Again

- Comprehensive List of Gold Hacks

- Mike Shows How Gold Pumpers Have Screwed Those Who Fell for Their Lies

- Gold Pumping Charlatans Promote Coronavirus Fake News to Pitch Gold

- Greg Hunter (Promoter of Gold-Pumping Con Artists) Said Gold is Cheap on Aug 11, 2011

- The Gold Price Paradox

- Two Images Illustrate Why Gold is Owned by Dummies

- Revisiting Another Gold-Pumping Doomsday Idiot: John Williams

- Kitco Senior Gold Analyst Agrees With My Views On Gold

- The California Gold Rush of the Twenty-First Century

- Manipulation of Gold and Silver Prices

- The Dow-Gold Ratio Scam and the Pricing of Gold in Foreign Currencies Scam

- Top 20 Gimmicks and Lies of Gold Charlatans - 100 pg e-book

- The Best Video Ever Created Exposing The Gold Pumping Scene

- Mike Explains Why Gold and Bitcoin Price Target Predictions Are Bogus (Jan 10, 2021)

- Gold and Deflation (Part 1)

- Gold and Deflation (part 2)

- Gold Charlatans Too Stupid to Realize Fear Mongering Spawned Formation of Cryptocurrencies 1

- Gold Charlatans Too Stupid to Realize Fear Mongering Spawned Formation of Cryptocurrencies 2

- Kitco: The CNBC of Gold

- An Alternative Way to Play Gold

- Patrick Byrne's Deep Capture Blog Promotes Gold Pumpers and Fake News

- "It is a Fact that All Gold Dealers are Con Men" - Mike Stathis

- Gold Charlatans Running Out of Excuses as the Dow Hits a New High

- EXPOSED: Paid Off Gold Pumping Con Man Dupes YouTube Sheep

- Gold Has NO Intrinsic Value. This is a FACT Based on Finance and Economics.

- Mike Exposes the Gold Money Mind Control Scam

- Peter Schiff Calls Social Security a Ponzi Scheme While Pitching Gold

- Lesson of the Day: Dissecting Gold Propaganda from Peter Schiff

- Broken Clock Gold Pumper Peter Schiff Tries to Create Bank Runs Using Disinformation

- EXPOSED: Jim Sinclair and (Select) Gold Pumping Websites

- Why Gold and Silver Aren't Investments

- Mike Stathis Exposes Jim Rickards and His Gold Pumping Shit Book

- Peter Schiff's Terrible Track Record on Gold and US Economy 2009 - 2014

- Ron Paul: Tool of Controlled Opposition and Gold Pumping Clown

- Mike Explains Why You Should Not Use Gold to Hedge Against Market Decline

- Michael Pento, Another Gold Pumping, Doomsday Clown

- Remember Who Keeps Telling You to Buy Gold

- John Rubino, Promoter of Fear-Mongering, Gold-Pumping, Fake News Syndicate of Con Artists

- Blast from the Past (2014): A Few Notes About Gold Con Men

- The IRS Might Be Interested in What Gold Pumping Clown John Rubino Has to Say

- Bonehead Financial Planner & Friend of Robert Kiyosaki Recommends Schiff's Useless Gold Fund

- Blast from the Past (2014): This One Video Sums Up the Gold-Pumping Con Artist Movement

- Steve Bannon Whores for Very Shady Birch Gold to Con Suckers

- Scam Artist Chris Greene AMTV Uses Alex Jones Tactics to Sell Gold and Crypto Trash

- Market Sanity: Another Kosher Scam for Fear-Mongering Broken Clock Cons and Gold-Pumping Charlatans

- Is Goldmoney is a Scam? Listen to What a Customer Has to Say.

- VIDEO: Survey Says Gold Bugs Are Uneducated, Low-Income Sheep

- VIDEO: More "Gold is Money" Brainwashing from Peter Schiff

- VIDEO: Is Gold a Ponzi Scheme? Listen to Marc Faber's Answer

- Stathis Discusses the Fate of Gold and the Global Economy

- Perhaps the Biggest Joke of All of the Gold Pumping Scam Artists

- Consumer Finance Clown Robert Kiyosaki Pumps Gold As a Way to Sell Disinfo Books

- Gold, Currencies and US Market Forecast Update

- Gold and Oil Outlook and Guidance - Jan 9, 2015

- More Proof that Gold Bugs are Clueless

- Brief Statement About Gold Charlatans and Their Victims

- Veterans Today Promotes Gold Charlatans and Doomsday Idiots

- Mr. Gold Scam Man

- Stathis Shows the Reality Behind Gold-Pumping Doomsday Charlatans

- Aussie Destroys the Gold-Pumping Con Men

- Lynette Zang is Another Jewish Gold Pumping Disinfo Con Artist

- Precious Metals Con Man Mike Maloney Uses Fake News to Sell Gold and Silver

- Mike Maloney Uses Fake News, Lies and Scare Tactics to Sell Gold

- Lessons from Fear-Mongering, Currency Collapse, Hyperinflation, Gold-Pumping Charlatans

- Gold Pumping Fraud and Liar, Lindsey Williams Warned Dollar to Lose Reserve Currency Status (2011)

- Jewish Scammer Chris Greene Pushes Christian Theme to Peddle Gold, Cryptos and Other Trash

- Exposing More BS from Gold Dealers (first published Jan 2015)

- Lynette Zang Pitching Disinfo and Fear-Mongering in Order to Sell You Gold

- Venezuela & Gold. Critical Lessons for Gold Bugs

- Only Scam Artists and Idiots Tell You to Buy Gold Instead of Stocks

- Gold Pumping Fraud and Liar, Lindsey Williams Warned Dollar to Lose Reserve Status (2011)

- John Rubino, Promoter of Fear-Mongering, Gold-Pumping, Fake News Syndicate of Con Artists

- Is This the Best Video Exposing the Gold Pumping Con Artists?

- Peter Schiff Exposed and the Truth About Gold

- Peter Schiff Gets Robert Kiyosaki to Pitch His Gold Fund

- Why the Gold Bugs Got it All Wrong

- Stathis on Commodities, Gold and Treasury Yields

- Failed Chiropractor Bo Polny Claims to be the Top Gold and Bitcoin Forecaster

- YouTube Real Estate Clown George Gammon Changes to Doom Porn /Gold Pumping for Views

- Paul Craig Roberts, Enemy of the People and Gold Pumping Charlatan

- Peter Schiff's Valcambi Gold Destroys Customers' Purchasing Power

- Ron Paul is a Paid Doomsayer for Gold Companies and Con Artists

- Lost Audio Archives: Gold is NOT Insurance They are Lying to You

- Mike Discusses GameStop, the SEC and Gold Pumpers

- Guess Who Nailed The Most Recent Gold Trade AGAIN

- Mike Stathis Nails The Latest Gold & Silver Trade (Jan-Feb 2015) Updated

- Stathis Nails The Gold & Silver Selloff AGAIN - Jul - Sep 2014

- March 25, 2013 Gold Analysis & Forecast

- August 5, 2013

- August 19, 2013 Update

- The REAL Precious Metals Expert Shows You How it's Done

- Stathis Nails the Gold & Silver Trade AGAIN

- August 2012 - We Nailed The Gold Breakout

- The Best Video Ever Created Exposing The Gold Pumping Scene

- Fool's Gold (Part 1)

- Fool's Gold (Part 2)

- Fool's Gold (Part 3)

- Dow-Gold Ratio Scam and Pricing of Gold in Foreign Currencies Scam

- Patrick Byrne's Deep Capture Blog Promotes Gold Pumpers and Fake News

- Another Gold-Pumping YouTube Scam Artist Exposed

- Seek Justice Against Gold and Silver Con Men and More (originally recorded on Nov 6, 2014)

- Mike Sheds More Light on the Gold Pumping Syndicate

- Wall Street Pumps Gold to Lure the Doomsday Morons

- Mike Stathis Exposes the Tactics Used by the Gold Doomsday Crime Syndicate

- Mike Stathis Nails the Gold and Silver Trade Again (Oct - Nov 2015)

- Gold Pumping Fear Mongering Mind Control

- The Dark Future of Gold, Silver, the EU, China and the Doomsday Douchebags

- Jim Sinclair: Exposed as a VERY Shady Gold Pumping Clown

- Addressing More Myths about Gold and Silver

- Is This the Best Video Exposing the Gold Pumping Con Artists?

- Gold Propaganda from Raymond Dalio

- The Best Video Ever Created Exposing the Gold Pumping Scene

- Gold Pumping Snake Oil Specialist Lynette Zang Preaches the Hyperinflation Hoax

- MUST-WATCH Video if You Own Gold

- EXPOSED - Jim Sinclair and (Select) Gold Pumping Websites

- YouTube Doomsday Con Men, Conspiracies, Media Fraud, Gold Lies, and IMF Puppets (2014)

- Future Money Trends Scammer Ameduri Promotes Adrian Douglas Who Claims Gold to $57,000

- Gold Pumping Charlatan David Morgan Makes Money Preaching Fear and Disinformation

- Is Mike Maloney a Gold and Silver Pumping Con Man and Fake News Fraudster? You Decide

- Mike Stathis Exposes Tactics Used by Gold Pumping Crime Syndicate

- The Doug Casey Scam Explained: Luring Suckers into Gold Penny Stocks

- Is Gold and Silver Pumper David Morgan a Bozo or Con Man? Watch This and Decide for Yourself

- John Stadtmiller of RBN: Jewish Shill for Gold Fraudsters, Pitching Hyperinflation Hoax

- Casey Research, Stansberry Research, Agora Financial - Fear-Mongering, Gold-Pumping Cons

- Which of the Gold Pumping Clowns Claimed Gold Would Double and Silver Would Triple in 2016?

- Dispelling Common Myths About Gold, Silver and Related Topics

- From Failed Real Estate Agent to Fear-Mongering Gold Pumper - Jeremiah Babe

- Failed Chiropractor & Contrarian Indicator, Bo Polny Claims Top Gold and Bitcoin Forecaster

- Liberty and Finance Religious Scam - Jewish Cons Use God to Pump Gold to Religious Zealots

- Mike Exposes Penny Stock Pump and Dump Scam Goldmining

- Twin Airheads on JewTube Pretend to be Investment Experts to Advertise for Gold

- Mike Shows How Gold Pumpers Have Screwed Those Who Fell for Their Lies (Video 1)

- Mike Shows How Gold Pumpers Have Screwed Those Who Fell for Their Lies (Video 2)

- Jewish Mafia Uses Legal Means to Create Gold Stock Pump and Dump

- Jewish Gold Pumpers, Libertarians and Cryptocurrency Scam Artists

- Hyperinflation in Venezuela Lessons from Gold Charlatans

- Real Estate Clown George Gammon Changes to Doom Porn and Gold Pumping to Get Views

- Blast From the Past (2014): Stathis Exposes the Gold Pumping Syndicate

- Exposing More Lies about Gold Pumping Con Men

- World's #1 Precious Metals Analyst Reveals How Sheep Are Being Conned by Gold Pumpers

- Blast From the Past (2014): Stathis Exposes the Gold Pumping Syndicate

- YouTube Ad Fraud: Gold Pumping Clown Claim Stock Market is Rising Because Fed Buying Stocks

- Economics Professor Tells the Truth About Gold to a Mike Maloney Cult Member

- Patrick Byrne's Deep Capture Blog Promotes Gold Pumpers and Fake News

- MUST-WATCH Video if You Own Gold

- Stathis Nails the Gold & Silver Trade AGAIN

- The Quote of the Year Goes to Charles Munger When Speaking about Gold

- Fat Dancing Guy Competes with Gold-Pumping Losers for Laughs

- Peter Schiff Using Amateur Bloggers to Write His Gold Propaganda

- EXPOSED: Gold and Silver Manipulation by Gold-Pumping, Doomsday Douchebags

- August 5, 2013 Gold & Silver Forecast

- Gold Analysis & Forecast from March 25, 2013

- Mike Stathis Educates CNBC Morons on Gold

- Blast from the Past: World's Best Video Exposing Ridiculous Claims Made by Gold Hucksters

- Mike Stathis Nails Latest Gold & Silver Trade (Jan-Feb 2015) Updated

- Mike Exposes the Grand Scheme of Gold Pumpers and Other Con Men

- Gold Pumping Doomsday Losers Exposed Again!

- Send in the Gold-Pumping Clowns

- Blast from the Past: Mike Stathis versus the Gold Pumping Syndicate

- Take a Look at Some of the Fake News Gold Pumping Scam Artists on YouTube

- Blast from the Past: Exposing the Gold Pumping Syndicate

- Blast From the Past: Gold Doomsday Scam Artists

- Only the Most Ignorant Stooges Fail to See Why Gold Dealers Hate Cryptocurrencies

- Is the Digital Nomad Scam Any Different from the Gold Pumping Scam?

- Where is Gold Headed? Exposing Fear-Mongering, Broken Clock, Clowns & Con Artists

- Blast from the Past: Gold & Silver Manipulation Exposed

- Blast from the Past: Gold Pumping Losers Exposed

- Blast from the Past: Survey of Gold Pumping Cons & Clowns on YouTube

- Top Wall Street Strategist on Why Retail Investors Should NEVER Own Gold (March 2016)

- Gold Pumping, Fear-Mongering Con Man Now Cryptocurrency Con Man - Chris Greene (AMTV)

- Gold Pumping Blogger and All-Around Idiot Launches His Own Cryptocurrency Scam

- More YouTube Idiots & Gold Pumping Con Artists Exposed - Greg Mannarino

- Lost Videos - Exposing Gold-Pumping Charlatans Alex Jones, Gerald Celente and Ted Anderson