Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

The Real Story Behind SEC Chair Gary Gensler's Lawsuit Against Binance, Coinbase, and other Cryptocurrencies

I began my mission helping investors steer clear of Wall Street because I learned firsthand how the game was played after having worked in the industry.

Thereafter, I learned how the media helps Wall Street after I was black balled by all media in 2006 and thereafter for trying to warn main street about what would become an unprecedented financial crisis in 2008.

My mission has been to help investors become more knowledgeable and successful by providing cutting-edge investment research as well as top-notch educational content.

I think I've done quite well in that regard.

As a part of this mission, I have also spent a great deal of time and effort exposing the criminal activities of the financial media, as it works with Wall Street to deceive and defraud main street.

Unfortunately, most people have forgotten how critical it is to know the credibility and reliability of the sources they choose to follow.

Instead of checking credentials and track records, they go by the number of likes, fake comments, fake reviews, and hearsay from people they have no idea about.

Those who are unfamiliar with me can find out more about my credentials, my background, as well as my investment research track record here, here, and here.

The reader can examine my unmatched track record of predicting the 2008 financial crisis and enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, and here.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Don't Be Fooled. Gary Gensler is a Shill for the Cryptocurrency Industry.

A few years after Gary Gensler left his position as head of the Commodities Futures Trading Commission (CFTC) in 2014, he began lecturing at MIT.

Immediately upon being appointed as a lecturer at the MIT Sloan School of Management, Gensler began promoting cryptocurrencies through the guise of blockchain technology.

But cryptocurrencies and blockchain technology are quite different, as I have previously discussed.

See Understanding the Difference Between Cryptocurrencies and the Blockchain

"In early 2018, the MIT Sloan School of Management and the MIT Media Lab announced the joint appointment of Gary Gensler as Senior Lecturer at the MIT Sloan School of Management and Senior Advisor to the Director of the Media Lab."

Reference: Gary Gensler’s active first year at MIT (August 23, 2018)

The ploy used by Gensler is known well among con artists.

Here's generally how it works. Link something credible (in this case the blockchain) to something that's not legitimate (in this case cryptocurrencies) and you're likely to convince lemmings that the illegitimate thing you're pitching (cryptocurrencies) is/are wonderful and promising.

Gensler could have explained the differences between the blockchain and cryptocurrencies, but he didn't because he was intent on pitching cryptocurrencies as being legitimate.

This is a very odd position to take as a former securities regulator unless you've exchanged that hat for one worn by a crypto shill.

Had Gensler been bought off?

During his talk at the MIT Digital Currency Initiative on April 22, 2018, Gensler stated,

"Blockchain technology has led to a new means to provide digital services and to raise capital—initial coin offerings, or ICOs.

This innovative crowdfunding usually offers pre-functional transferable tokens for use on a future blockchain application.

ICOs have a mixture of economic attributes of both investment and possible consumption.

The fungible nature of tokens and an expectation of profit distinguishes them from concert tickets or personal seat licenses.

The presence of a transferable or usable token and an expectation of profit further distinguishes ICOs from donation-based crowdfunding such as Kickstarter or GoFundMe.

Though lacking traditional features of stocks or bonds, the investing public is clearly hoping for possible appreciation based upon the efforts of promoters and a development team.

These are longstanding criterion in the US legal definition of a security."

Reference: Gary Gensler: Remarks at the Business of Blockchain event (April 23, 2018)

Note the words I have underlined from a passage in Gensler's lecture (above).

Gensler basically admits cryptocurrencies are backed by nothing and are being used to speculate by the public. But he's being very subtle about his overall message because he clearly wants to focus on the so-called "merits" of cryptocurrencies.

He goes on to add that these "speculators" expect the price of their cryptocurrency to appreciate due to the "efforts of promoters."

Gensler's description sounds like a definition of a "passive" Ponzi scheme to me.

I call it a "passive" Ponzi scheme in that no one is (necessarily) directly paying early investors with the proceeds that newer investors have used to buy cryptos.

But along the way, many key players who both bought and promoted/pumped cryptocurrencies undoubtedly sold after they helped push the price up.

At the very best of all scenarios, Gensler has described widespread price manipulation, which is illegal.

I believe most (if not all) cryptocurrencies should be classified as Ponzi schemes.

Furthermore, I believe most (if not all) coin staking programs are operating as Ponzi schemes.

Under the most optimistic scenario plausible, all coin staking programs qualify as securities according to the SEC (although I do not even believe they are securities based on my own definition). Therefore, if they are not registered with the SEC they are in violation of U.S. securities laws.

Yet, Gensler praised cryptocurrencies, while highlighting the use of blockchain technology. In other words, his lecture focused on the use of the blockchain as he spoke about cryptocurrencies in order to validate cryptocurrencies.

In reality, the most useful and promising applications of blockchain technology have little to do with cryptocurrencies. And Gensler knows this. But he deceptively positioned cryptocurrencies as one of the promising applications of blockchain technology.

What's the reality about these "promoters" of cryptocurrencies Gensler mentions?

Promoters often pitch cryptocurrencies, crypto exchanges, and crypto staking programs by reading from scripts without bothering to check the validity of the written material.

Thus, most of these promoters make false and misleading statements with willful neglect, which exposes them to significant legal issues.

They even state bold-faced lies about cryptocurrencies to get people to buy them. Moreover, they make baseless price predictions to lure more people into these scams.

Mike Explains Why Gold and Bitcoin Price Target Predictions Are Bogus

The bottom line is that most cryptocurrency promoters are receiving compensation in return for making false and misleading statements about cryptocurrencies and exchanges.

These promoters think they bear no responsibility, but they are quite wrong.

They are also being paid to solicit what the SEC considers as unregistered securities.

This is an even bigger problem for them.

As you can imagine, the biggest liability faced by promoters is that they are receiving compensation to promote cryptocurrency Ponzi schemes.

Even worse, many of these crypto-promoting scammers aren't disclosing their compensation.

All of these activities present major legal problems for promoters, as many are now learning.

See here, here, here, here, here, here, and here.

Make no mistake. Anyone who receives some form of compensation, whether direct or indirect as a result of promoting cryptocurrencies or crypto exchanges is working as a business partner for these illegal operations.

Even when cryptocurrency scams have blown up, some promoters have tried to cover their tracks making more false statements to absolve themselves from guilt.

A great example of this may be seen upon examination of YouTube fake investment guru, liar, and fraudster, Tomer Nesher who goes by the name Tom Nash.

I'll refer to him as his fake name, Tom Nash going forward.

Nash lured what might be tens of thousands of people into FTX without ever disclosing the terms of his compensation. For his dirty deeds, Nash was paid ridiculous sums of money for leading his followers into the FTX crime factory. That makes Nash a business partner of the FTX Ponzi scheme.

Nash was all smiles as he proudly boasted being paid $50,000 each month for promoting what would turn out to be the biggest scam in the cryptocurrency industry to date.

But Nash never apologized to his naive subscribers for serving as a paid whore for the FTX Ponzi scheme. Once FTX filed for bankruptcy, Nash made a video telling his naive subscribers that he didn't screw them over by promoting the defunct FTX.

His "logic" was that he only promoted the U.S. version of FTX, which he claimed was fine.

This was clearly a lie, as the U.S. version of FTX filed for bankruptcy the following day.

Of course, Nash deleted the original video used to make this one above, thinking he could erase all traces of his guilt.

In fact, Nash has deleted or later edited several videos in order to remove evidence that reveals him to be a liar and investment disaster. For instance, you might recall the video in the following link.

Fake Guru Tom Nash Claims No One on Wall Street Pays Attention to P/E Ratios

There are several more examples I have not yet published.

Any way you look at Nash, he is a complete liar, fraud, and scam artist. And he needs to face justice.

The links below point to some additional material on Nash (Tomer Nesher).

- YouTube Fraudster Tom Nash is a Paid Pumper for Israeli Scam TipRanks

- FTX Whore Tom Nash Claims FTX is Fine One Day Before Collapse (Nov 12 2022)

- Tom Nash is a Fake Investment Guru, Idiot, Liar and Fraud

- Cathie Wood Pumper, Tom Nash Exposed as a Fraud by Leading Investment Expert

- Exposing YouTube Fake Investment Gurus Series: Introduction to Tom Nash

Because YouTube consists of the same kinds of degenerate parasites as Nash (i.e. dishonest scum bags who make content only to sell scammy advertisements and endorse scams) they're able to move past this disaster relatively unscathed because there's really no movement on YouTube to go after the many frauds that have come to define YouTube.

Nash simply blocks anyone on his YouTube channel who is critical of him, his scams, and his terrible investment advice which have cost many people their life savings.

We see a similar situation with thousands of other crypto scammers and fake investment gurus on YouTube, like Meet Kevin, Andrei Jikh, and Graham Stephen to name a few.

Incidentally, most of the fake investment gurus found on YouTube happen to be Jewish, including the three named above along with Nash (Tomer Nesher).

As I have been saying for over fifteen years, all ad-based content is trash.

If you consume ad-based content you're going to get screwed.

If you think it's a coincidence that less than 2 percent of the U.S. population and less than 0.1 percent of the world's population dominate this type of crypto scam, you will soon see evidence that the cryptocurrency industry is controlled by the Jewish mafia.

I suggest you examine the Jewish representation of the Federal Reserve, banking and finance industries, Wall Street, the media, and Hollywood. Only then will you begin to realize the Jewish mafia has a stranglehold on the west.

Patreon should have terminated Nash's account for scamming people (due to lying about his credentials as well as being a promoter of a crypto Ponzi scheme). But Patreon is a disgusting company run by the same kinds of dishonest, money-worshipping parasites as Nash.

The truth is that Patreon enables ebeggars and scam artists like Nash because it profits from scum.

As well, YouTube should have terminated Nash's account. But because YouTube is also run by the Jewish mafia, it's in the business of facilitating scams and scammers, so Nash is kosher.

As far as YouTube is concerned, as long as you don't say anything "hateful" you can run any scam you want and you'll be fine.

You can post content that solicits illegal prostitution, nudity, includes material that sexually exploits minors, and content that encourages pedophilia.

But you cannot post content that's "hateful."

YouTube, under instructions from the world's largest hate group, the Anti-Defamation League (ADL) decides what's "hateful."

Needless to say, any content against White people is considered kosher.

I have previously documented several examples of the types of vile content permitted by YouTube.

- YouTube is Funded by Ads from Corporate America to Promote Porn & Pedophilia

- YouTube Partners With Illegal Brothels in Thailand for Profit

- Digital Nomad Using YouTube to Sell Hooker Contacts

- Mike Exposes YouTube and Google as Scam Companies Run by the Jewish Mafia

- YouTube Profits from Porn, Pedophilia, Scams and Fake News

- Looking for Hookers? YouTube is the World's Best Guide

- YouTube and Corporate America Profiting from Pedophilia

- YouTube Caters to Pedophiles

- Jewish Mafia-Run YouTube Tags Ads to Soft Core Porn Claiming It's "Educational"

- YouTube Supports Fake News, Panhandlers, Porn, Pedos, Corporate Welfare but Bans Truth

At the very least, Nash should have been shamed off YouTube by others making videos calling him out nonstop. But this never happened because again, YouTube consists of the same types of scammers as Nash.

They are all unemployable, immoral, scam artists pretending to be experts, seeking to make money by selling ad-based content, posting affiliate links for scammy companies, selling useless courses, and being paid to endorse scams.

Some of YouTube's Fake Investment Guru Scam Artists

Perhaps the saddest part is that their subscribers are too ignorant to even see that the YouTubers they trust are out to screw them for any amount of money.

Back to Gensler.

Gensler also stated (below) that ICOs are securities which are being sold to the public. Hence, if they have not been properly registered with the SEC they are breaking U.S. securities laws.

"As I currently see things, though, there is significant non-compliance with respect to many ICOs and other crypto-tokens."

"There are likely over 1000 ICOs launched tokens in significant non-compliance. Add to this the possibility of some noncompliant large-cap tokens."

Reference: Gary Gensler: Remarks at the Business of Blockchain event (April 23, 2018)

As you may have already concluded, the event held by MIT was created solely for the purpose of promoting the (illegal) cryptocurrency industry rather than to discuss the potential of blockchain technology.

I'd like to see the list and amounts of donations going to the MIT Digital Currency Initiative, but this information has been kept private.

Note that Gensler also served as senior adviser to the MIT Media Lab, of which the MIT Digital Currency Initiative was a part.

While blockchain technology shows great promise for many applications, most cryptocurrencies and "staking" programs operate in a manner similar to Ponzi schemes.

Furthermore, all cryptocurrencies are being used by crime syndicates as well as criminal individuals to fund a wide variety of illegal activities.

Therefore, whether cryptocurrencies are registered with the SEC or not, they should be banned.

Gensler knows this.

So what happened?

Why has the SEC failed to take appropriate measures against cryptocurrencies?

Before I answer this, let's take a closer look at Gensler's time spent at MIT.

In addition to giving lectures promoting the use of cryptocurrencies, Gensler established a close relationship with MIT computer "science" Professor Silvio Micali, creator of Algorand (ALGO).

You guessed it. Micali is another Jew. It's a club. And you aren't invited unless you're Jewish.1

Thereafter, Gensler would promote "Algo" as a "great technology" which he claimed "could support other tech firms such as Uber and Lyft."

Ironically, as I've been discussing for several years Uber are Lyft are illegal companies. But they bribe officials and evade regulatory requirements and sovereign laws from around the world. Airbnb is no different.

Yet, along with several other companies (e.g. Fiverr, Upwork, TripAdvisor, Facebook, and many more) whose primary business allows customers to be scammed along with involvement in other illegal activities, Uber, Lyft, and Airbnb are listed on U.S. securities exchanges.

Once you learn who runs these companies, who has made vast amounts of money from them, and who the securities and trade regulators are, you will realize why these companies have been granted a license to steal.

There's even more irony to this story as you will soon learn.

Notice in the videos (above) that Gensler seems so proud to tell us he was working with Silvio Micali, the creator of Algorand at MIT.

Why was Gensler working with Micali anyway?

Doesn't that seem a bit odd?

What were the details of the discussions they had?

Don't you think the public should know about these discussions given that Gensler is now the top official at the SEC?

Gensler said he was "working" with Micali, so there may have been some kind of payment involved.

If so, how much was Gensler paid to work with Micali?

Incidentally, if you check Micali's background he claims to be "Italian."

But Micali is merely an Italian citizen with a Jewish bloodline. That's a huge difference due to the unparalleled tribalism practiced by most Jews.

I can't tell you the number of Jewish individuals I've come across who have Italian sounding names and claim to be Italian because there's been so many.

Not surprisingly, Micali was under the direct tutelage of a Jewish professor. And he now serves as a graduate adviser for a crew of mostly Jewish graduate students. Remember, it's a club. And unless you're Jewish, you aren't invited.

These types of mathematically improbable (virtually impossible) associations are typically seen from within the confines of the Jewish mafia.

Once you venture down the cryptocurrency rabbit hole, you'll learn these same relationships remain firmly in place.

Relationships always explain the actions.

Gary Gensler is Working for the Jewish Mafia. 2

Let's not forget that Gensler characterized bitcoin as a commodity. But he refused to include any other cryptocurrencies as commodities.

The fact that Gensler claims bitcoin is a commodity as opposed to a Ponzi scheme and illegal platform harboring criminal activity discredits him from everything pertaining to finance and investments.

Thus, Gensler should be prohibited from holding any executive position with all securities regulatory agencies.

When Gensler labelled bitcoin as a commodity, it confirmed my suspicion that he was working for his tribesmen in the Jewish mafia.

I've pointed out on more than one occasion my view (via videos/webinars) that Gensler was named Chair of the SEC specifically because of his support for bitcoin futures trading.

By promoting cryptocurrencies while lecturing at MIT, Gensler convinced his Jewish cryptocurrency tribesmen he would "go to bat" for them if he were in a position to do so. It was for this reason he was appointed as chair of the SEC in April 2021.

In short, Gensler was promoted as Chair of the SEC in order to ensure that the Jewish-controlled cryptocurrency industry is able to continue defrauding people.

By October 2021, just months after taking the head spot at the SEC, Gensler approved the first bitcoin futures ETF. See here.

SEC Kosher Mafia Boss Gary Gensler Opens Bitcoin Scam for Tribesmen to Fleece Sheep*

SEC Kosher Mafia Boss Gary Gensler Opens Bitcoin Scam for Tribesmen to Fleece Sheep (part 2)*

* Note that the two-part video series above contains a minor error. Mr. Stathis stated that Gensler approved bitcoin futures trading while at the CFTC. Gensler was not working at the CFTC when bitcoin futures were approved for trading, but he expressed his support for it.

Now here's where the irony continues.

Recently, SEC Chair Gary Gensler filed suit against several cryptocurrencies including Algorand (ALGO) along with notable cryptocurrency exchanges Coinbase (COIN) and Binance, alleging they are selling unregistered securities.

This is the same Algorand that Gensler was promoting a couple of years ago.

Although the lawsuits by the SEC are valid, the potential consequences are quite mild relative to the scope and scale of criminal activities facilitated by cryptocurrencies.

Thus, even if the SEC prevails with its lawsuits, enforcement actions will have minimal effectiveness because the agency is doing too little, too late.

Instead of wasting time and taxpayer funds with these ridiculous lawsuits, the SEC should label all cryptocurrencies to be illegal.

Gensler should have gone after the industry immediately upon being appointed SEC chair in April 2021 instead of flapping his jaws.

Recall that in 2018 Gensler went on record stating that some 1000 ICOs were breaking SEC laws. Why then, did he wait two years after being appointed as SEC chair to take action?

As well, where are the 1000 lawsuits against these illegal ICOs and coins?

"There are likely over 1000 ICOs launched tokens in significant non-compliance. Add to this the possibility of some noncompliant large-cap tokens."

Reference: Gary Gensler: Remarks at the Business of Blockchain event (April 23, 2018)

The cryptocurrency industry should have been dealt with appropriately by regulators and government officials more than a decade ago, but this never happened.

Quite simply, the Jewish mafia got its hands all over the industry early on. That's why regulators stood by and did nothing. The mafia was making too much easy money and their tribesmen (the regulators) weren't about to crash the party.

This makes sense if you understand the criminal nature of the Jewish mafia, you're familiar with Jewish tribalism, and you are aware of the following facts:

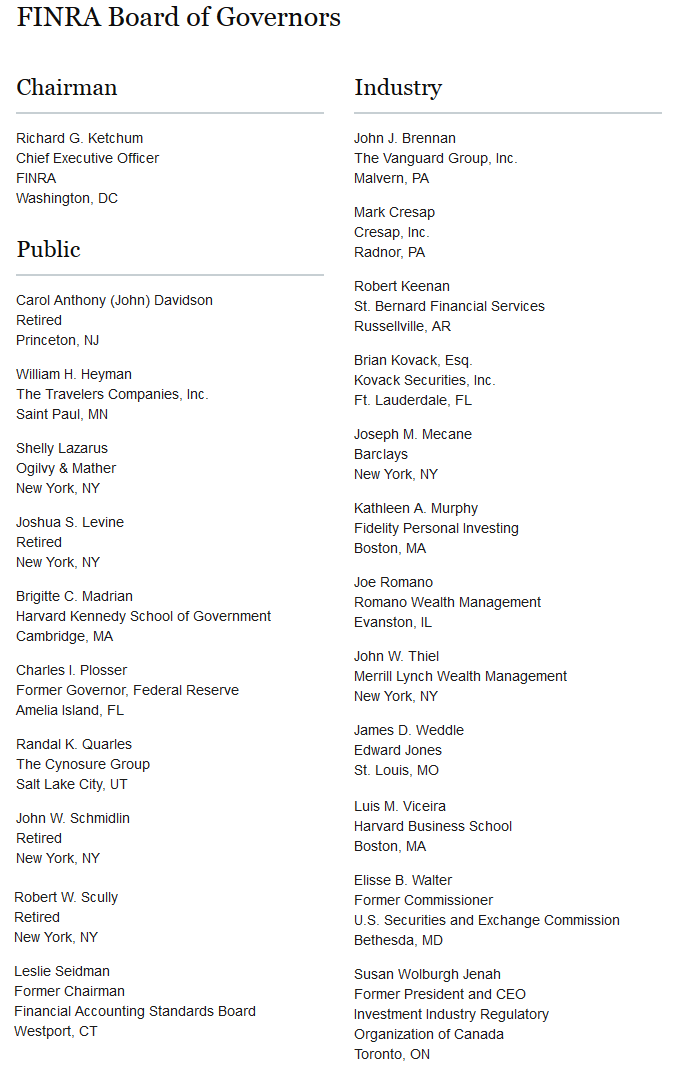

1. Nearly all securities and other key regulators are Jewish.

2. The cryptocurrency industry is controlled by the Jewish mafia.

None of the previous SEC chairs dating back to Mary Shapiro took appropriate measures against cryptocurrencies. Therefore, in my opinion they should all face intense public scrutiny along with potentially severe legal consequences.

But of course, they won't face anything other than praise because they're members of the "protected" group of parasites whose M.O. is to act either as heroes or victims after they have defrauded and helped Wall Street defraud main street.

Ironically, this is the same group of parasites who are appointed by their tribesmen to find solutions to the fraud that was created by their tribesmen.

Take a guess who the regulators and watchdogs are who were supposed to prevent the fraud?

Let's just call it what it is.

A big fat Jewish wedding.

But you better not state publicly that Jews are ridiculously overrepresented in key segments of the economy and government.

Even if you back these claims with evidence, you will be passed over for a job promotion, or you might lose your job for being a "racist" and "antisemite."

You should consider anyone who uses this tactic of trying to paint you as the villain for speaking the truth (which can be verified with factual data) as a dishonest and sleezy fraudster.

And if you live in Europe, you could face jail time simply for stating facts about the Jewish mafia.

You know you hold complete control over the world when you are able to transform the victims of your crimes into villains if they expose your crimes.

I challenge you to calculate the probability that a group of people (Jews) who represent less than 2% of the U.S. population will comprise the following:

At least 6 out of 9 Supreme Court Justices (the tenth slot is currently vacant), or 66%, or 3300% overrepresentation.

Approximately 28% of Congress, or 1400% overrepresentation (statistically impossible unless there is some kind of “boy’s club”)

99% of the Federal Reserve Banking officials, or 5,000% overrepresentation (statistically impossible unless there is some kind of “boy’s club”)

95% Wall Street and large bank executives, or 4750% overrepresentation (statistically impossible unless there is some kind of “boy’s club”)

95% of financial regulators and 90% of all federal regulators, or 4,750% and 4,100% overrepresentation, respectively (statistically impossible unless there is some kind of “boy’s club”)

99% Hollywood and media executives, or 5,000% overrepresentation (statistically impossible unless there is some kind of “boy’s club”)

Over 90% of major law firms, major judges, and federal prosecutors, or 4100% overrepresentation (statistically impossible unless there is some kind of “boy’s club”)

It seems that Jews are always calling for “more fair representation” and more “diversity” and “inclusion” when Whites are in control.

Why hasn't anyone called for more fair representation in sectors which are dominated by Jews?

And if you think the ridiculous misrepresentation ends with these sectors you are greatly mistaken.

The Jewish mafia has a response for anyone who dares to speak the facts when these facts are not convenient or not complimentary of them.

They will call you a racist or antisemite as a way to try to discredit your claims.

Think about.

Open your eyes.

Do your own research.

We are talking about a racist, discrimatory, and criminal mafia.

The Jewish mafia.

I repeat. All cryptocurrencies, crypto exchanges, and cryptocurrency-related assets should be shut down and categorized as illegal operations, and in many cases as Ponzi schemes.

I have held this view about cryptocurrencies from the beginning.

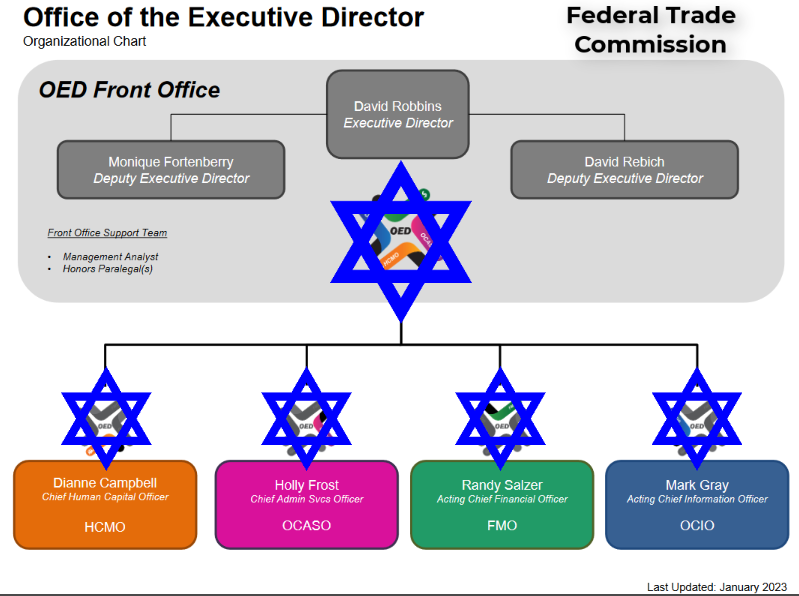

It is indeed more than bizarre that the FTC and FBI have not acted to shut down cryptocurrencies and cryptocurrency exchanges considering that they are known to the facilitate transfer of illicit funds used for human sex trafficking, drug trade, terrorism, and many other criminal activities.

But again, ask who runs the FTC and FBI, and then you will understand why nothing has been done.

I Knew Early on Bitcoin Would be Used to Defraud People

From the very beginning I predicted bitcoin would lead to countless scams.

I also realized that it was being used to launder money and fund all kinds of illegal activities.

I think it's safe to say that I have been proven correct.

The Cryptocurrency Scam is Not the First and Will Not Be the Last Scam

Around ten years ago I publicly expressed my view that bitcoin and all other cryptocurrencies were scams being marketed based on false claims, while facilitating illegal activities.

It was obvious to me from day one that cryptocurrencies would be used to defraud many people.

Let's get real here.

How could an honest, reasonably intelligent, and sane person with at least an ounce of common sense not see bitcoin and all other cryptocurrencies as scams?

Given the promotion of bitcoin by con artists like Max Keiser, it was even easier to realize that cryptocurrencies were being positioned as a "revolutionary" payment system and novel way to "avoid the bankers" in order to lure people into the various scams that blossomed within the crypto industry.

See Max Keiser is a Fraud and Jews Run Cryptocurrency Industry - April 2018

Wall Street Became Involved in Cryptocurrencies Early On

The fact that cryptocurrencies were devoid of regulation opened the door from the very beginning for all kinds of scams and other criminal activities.

It was this same characteristic - lack of regulation - that made the cryptocurrency industry much more appealing to Wall Street.

What the so-called crypto "purists" (those who look to cryptocurrencies as a way to avoid bankers and the banking system) don't realize is that it's been professional investment capital from "bankers" that's largely funded the crypto industry.

What the so-called crypto "purists" (those who look to cryptocurrencies as a way to avoid bankers and the banking system) don't realize is that it's been professional investment capital from "bankers" that's largely funded the crypto industry.

That fact alone means the little guy stands to lose.

When I say "bankers," I'm talking about guys with deep pockets and strong Wall Street connections, like Jewish homosexual libertarian vulture capitalist Peter Thiel, as well as other prominent Jewish vultures like Tim Draper, Marc Andreessen, Ben Horowitz, Barry Silbert, Michael Novogratz, and many others.

See Cryptocurrency Con Man Tim Draper Says Theranos is Transforming the World

This cabal of money-worshipping parasites began to push bitcoin onto main street knowing they could easily orchestrate pump and dump schemes for huge gains.

And because cryptocurrencies weren't regulated, they knew they would get away with price manipulation without legal repercussions.

Even the Jewish Facebook bozos, Cameron and Tyler Winklevoss noticed all of the Jewish VCs, Wall Street whales, and hedge fund managers tossing huge amounts of money into the crypto industry.

Being greedy money-worshippers lacking any sense of morality, the twins decided to "follow the money" so they too could exploit retail suckers who had been brainwashed by delusional cryptocurrency propaganda.

But we cannot forget that the financial media was also in on the crypto promotion game as well.

- Jim Cramer Recommends Coinbase for "Long Haul" (April 13, 2021)

- CNBC "Expert Trader" Jon Najarian Touts Voyager Digital Days Before Bankruptcy

- CNBC's Jon Najarian Promotes "Crypto King" Ponzi Scheme Crook John Caruso

- Will CNBC Be Shamed for Glamorizing Cryptocurrency Crooks Like Sam Bankman-Fried?

- Leading Investment Authority Rips FTX Paid Whore Kevin O'Leary Apart

- FTX Parasite Promotor and Media Celebrity Kevin O' Leary Caught Lying Again

- Jewish Scam Artist Jim Cramer Pumped Cryptocurrencies at the Peak

- Hollywood Puppet Matt Damon Shills for Cryptocurrencies Which Collapse Soon After

The financial media is always a big fat Jewish wedding.

America's controlled media tells you what to think.

In 2014, the Jewish Winklevoss twins launched a cryptocurrency exchange called Gemini.

Copyrights © 2026 All Rights Reserved AVA investment analytics