Opening Statement from the September 2020 Dividend Gems

Originally published on September 13, 2020

Interest Rates: The Good, the Bad and the Ugly

Once again, we would like to remind readers that interest rates are likely to remain very low for an extended period. We have been forecasting very low rates for several years. Fed Chairman Powell’s recent speech confirmed our notion of the Fed’s intention to keep rates low despite numerous global macro risks that have grown as a result of persistently low interest rates.

An extended period of low interest rates has many implications for the capital markets. First and foremost, as you might imagine low interest rates bodes well for dividend investors. The past decade has already been one of the best in history for dividend investors. The next decade is likely to produce comparable results.

Low interest rates have also created numerous problems. Several years of record-low interest rates has served as a catalyst for a variety of speculative behaviors. Overall, risk is not being adequately recognized in part because it has become virtually impossible to measure with any degree of confidence.

We have reminded readers that the stock market continues to reach new highs even though the world remains in the most severe recession on record. The masses have latched onto indexing and other forms of passive investing such as robo advisers as the “easy solution” to obtain superior investment returns. Aside from potential liquidity issues, passive investing has all but eliminated the vital role of fundamental analysis and securities valuation. Moreover, greater access to stocks via mobile apps and fractional shares has been multiplied by the malignant impact of social media to lure millions of clueless youngsters into the stock market, transforming it into a casino of sorts.

Finally, the wave of speculative behaviors seen in the equities market has been accentuated by recent changes to securities laws which now permit private equity funds (which lack the stringent transparency and regulatory oversight seen in publicly traded companies) to solicit investments directly to the public.

The decade-long search for yield has forced institutions to seek out higher-risk investments. As one example...

This article continues.

To continue viewing this entry please sign in to your Client or Member account.

.png)

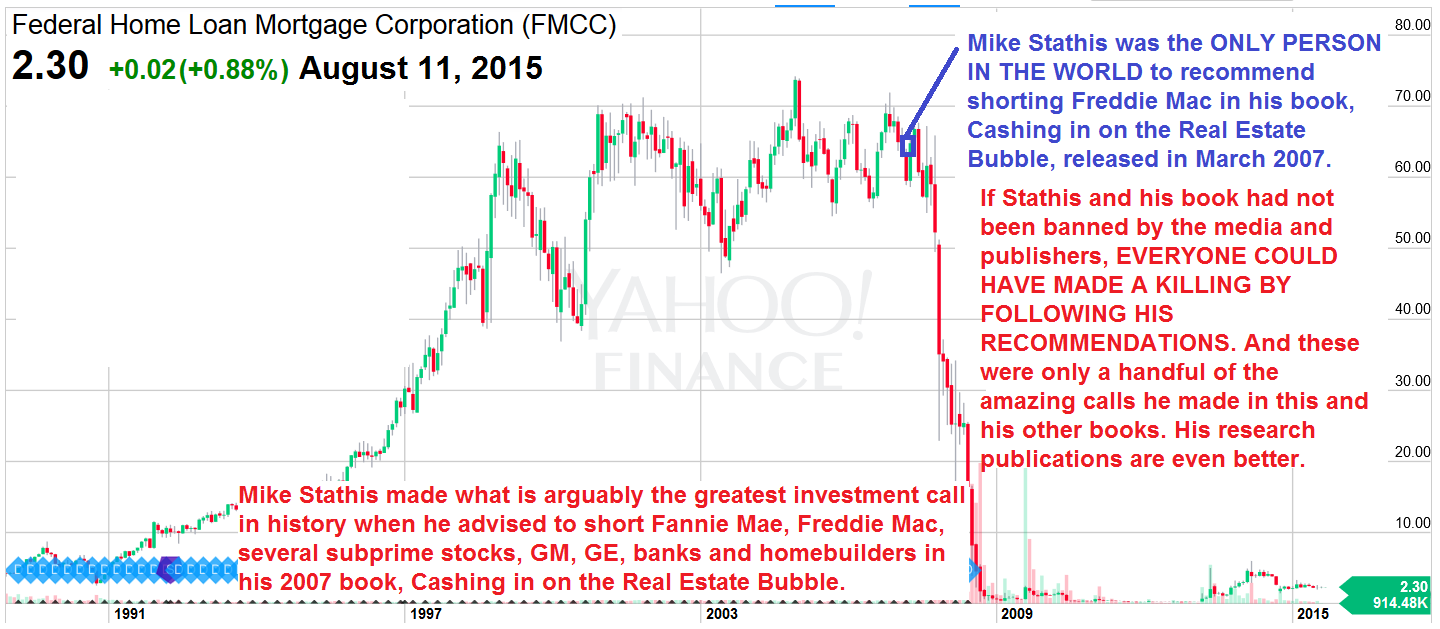

Mike Stathis holds the best investment forecasting track record in the world since 2006.

View Mike Stathis' Track Record here, here, here, here, here, here and here.

Check here to download Chapter 12 of Cashing in on the Real Estate Bubble.

This is the chapter that shows where Mike recommended shorting Fannie, Freddie, sub-primes, homebuilders, GM, GE, etc.

So why does the media continue to BAN Stathis?

.png)

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

Watch the following videos and you will learn the answer to these questions:

You Will Lose Your Ass If You Listen To The Media

.png)

.png)

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher.

These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Article 19 of the United Nations' Universal Declaration of Human Rights: Everyone has the right to freedom of opinion and expression; this right includes freedom to hold opinions without interference and to seek, receive and impart information and ideas through any media and regardless of frontiers.

This publication (written, audio and video) represents the commentary and/or criticisms from Mike Stathis or other individuals affiliated with Mike Stathis or AVA Investment Analytics (referred to hereafter as the “author”). Therefore, the commentary and/or criticisms only serve as an opinion and therefore should not be taken to be factual representations, regardless of what might be stated in these commentaries/criticisms. There is always a possibility that the author has made one or more unintentional errors, misspoke, misinterpreted information, and/or excluded information which might have altered the commentary and/or criticisms. Hence, you are advised to conduct your own independent investigations so that you can form your own conclusions. We encourage the public to contact us if we have made any errors in statements or assumptions. We also encourage the public to contact us if we have left out relevant information which might alter our conclusions. We cannot promise a response, but we will consider all valid information.