Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Did You Miss Out on the Longest Bull Market in History Because You Listened to Charles Nenner?

In the past I haven't posted much if anything about Charles Nenner in part because I believe it's pretty obvious he’s not someone who should be taken seriously.

If you aren't familiar with this clown I suggest you listen to some of his interviews if you're in the mood for comedy.

After only a few minutes of wasting your time I'm confident you'll conclude that he's a complete clown!

For instance, when discussing his doom and gloom narrative Nenner relates it to "cycles" and other nonsense.

Another reason I haven't bothered to feature Nenner in the past is because he hasn't landed into "mainstream media" as much as other financial charlatans.

That means he hasn't received as much exposure as his Jewish knuckle head contrarian indicator peers. And because my objective is to help main street realize the truth about the "experts" it airs, I tend to focus more on exposing the realities of those who receive the most media exposure since they reach the largest number of people.

After all, I have limited time available for this endeavor, so I need to pick and choose the charlatans and clowns I feel are most likely to cause the most harm to the most people.

Again, my main objective is to warn main street about the various tricks used by the criminal media to take their money and brainwash them.

However, Nenner has managed to land a good deal of exposure from the so-called "alternative media," which as I have previously discussed is even worse than the so-called "mainstream media."

Remember that all media, regardless whether you prefer to label it as "mainstream" or "alternative" is disinformation because it's funded by ad-based content.

You'll probably agree with this assessment once you note that many of the same clowns and charlatans promoted in the "mainstream media" as experts are also promoted as experts in the "alternative media."

As well, many of the same deceptive and fraudulant advertisements from the "alternative media" are inserted in between real news captions in order to deceive readers.

And we cannot forget the fact that the Jewish mafia runs each arm of this massive criminal propganda machine.

In reality, the differences between these two types of media have become so blurred over the past decade that I consider "mainstream" and "alternative" media as one in the same (unless we're talking about the most ridiculous instances of bat shit crazy trash such as Alex Jones, Jeff Rense, David Icke and so on. When compared to these blatant media frauds, the mainstream media looks very credible).

Let me be perfectly clear about Charles Nenner. Based on the rationale Nenner provides for his stock market forecasts, I can state with complete confidence that he has absolutely no idea how to forecast the stock market with any reasonable degree of accuracy and consistency. And his track record confirms this.

The basis Nenner uses for his "forecasts" ranges from idiotic to really weird and even creepy.

It's so apparent to me that Nenner is a clown that I would place him in the same "credibility" category as fellow Jewish forecasting BS artist, failed trader, compulsive liar and Ponzi scheme scammer Martin Armstrong.

The main difference between Nenner and Armstrong is that Armstrong does a better job conning his sheep by using buzz words and phrases that might make a naive layman think he knows what he's talking about when he makes up wild stories about "big investors" listening to his "forecasts."

I've previously exposed the reality about Armstrong, his shitty track record, his terrible performance as a commodities trader, and the BS tactics he uses to lure suckers to pony up $3000 for a 3-day "economic forum."

One would have to be quite stupid and/or very naive to fall for Armstrong's BS.

Incidentally, in case you hadn't noticed, both Nenner and Armstrong are Jewish.

As a matter of fact, I challenge anyone to provide credible evidence demonstrating that nearly every so-called expert and pundit promoted by the Jewish-run media is not Jewish!

By now many of you know where I'm going with this claim. There's a massive wave of discrimination being committed by a large group of Jewish individuals against gentiles. And it's been going on for a very, very long time. Yet, I know of no one other than myself that has mentioned it.

This discrimination offers one explanation as to why gentiles have historically not wanted Jews around. But there are other reasons as well which I will not address at this time.

Similar to most failures in the financial industry, Nenner aligned himself with the gold pumping syndicate many years ago as his market collapse "forecasts" failed to pan out.

Quite simply, Nenner needed an audience foolish enough to buy into his nonsense. And gold bugs fit the bill rather well.

After all, gold bugs have been falling for countless lies, wild predictions and ridiculous claims made by an army of precious metals hucksters for a very long time, so they've been primed to soak up an endless amount of BS from clowns like Nenner.

The methods used by guys like Nenner are actually quite easy to spot. When you can't cut it as a legit analyst in the financial industry, you'll seek out a different audience to pander to; anything to avoid getting a real job and providing real value; but only if you have no moral compass.

Sometimes these failures are so delusional that they actually come to believe their own bull shit. Thus, they don't think they're doing anything morally wrong. I would classify such a an indiviidual as being a delusional clown.

Even if you're a failure as an analyst, forecaster or whatever you might call yourself, the fact of the matter is that you can boost your newsletter subscriptions, consulting services and professional speaking business by appealing to misguided individuals, many of which are conspiracy loons who side with the doom & gloom / dollar collapse / stock market collapse / hyperinflation / soaring gold / big foot / flat earth crowd.

This crowd has grown to a very large size over the past several years, ensuring a nice pay day if you cater to their delusional beliefs.

These are often the same individuals who turn to Alex Jones, Max Keiser, RT, Zero Hedge, Peter Schiff, Glenn Beck, David Stockman, Jim Rickards, Jim Rogers, Marc Faber, Edward Griffin, Robert Kiyosaki, Mike Maloney, Doug Casey, Ron Paul, James Turk, Eric Sprott, Rick Rule, Jeff Berwick and other disinfo sources that constantly blame the government for everything.

Dedicated gold bugs are usually unsophisticated at best and pure nut jobs at worst. While many gold bugs are both naive and ignorant, there's a much smaller segment of this group that's sharp and lucky enough to escape the precious metals cult if they take the time and effort to look at things objectively, raise critical questions and demand answers from precious metals charlatans.

Even at this stage cult members can be manipulated by these professional con artists. It is indeed the rare cult member who realizes when they've been had. But reaching this stage is asking quite a lot from cult members, which is why it's rare that they ever escape.

Although there are some fairly intelligent gold bugs that possess the ability to analyze things objectively, they lack sufficient knowledge and understanding to form more rational conclusions regarding all things related to precious metals. As a result, the con artists who run these cults are usually able to convince prospectve dissenters that their thoughts are misguided.

Perhaps an even bigger hurdle faced by potential dissenters of gold cults is that there are no gold bugs I know of that truly understand the investment world, for if they did they would only utilize gold (at best) during seldom seen periods for its very limited role in the entire spectrum of the investment world.

Most investors would be acting prudently if they never bothered with gold or silver. Furthermore, such individuals would spend nearly all of their time and money focusing on real investments and the investment process. I've covered this topic many times in the past.

Getting back to Nenner....as he continued to sink into the depths of zero credibility, he wanted to generate sales for his fear-mongering "forecasts."

Hence, in order to land more interviews as a way to sell his newsletters (which I'm willing to bet became more focused on pumping gold in order to please his new audience) Nenner began spewing the kinds of ridiculous lines gold bugs were used to hearing. These are the lines that put a smile of the face of gold bugs.

And that's precisely what the gold charlatans want.

They constantly seek out sources that will help validate their myths in order to demonstrate a false consensus.

I plan on getting back to Nenner more in the near future (hopefully) if I find the time and inspiration.

For now I'll spoil the plot by telling you that I have a good deal of content revealing Charles Nenner to be one of the world's worst market forecasters.

Perhaps one reason why Nenner can't seem to get much of anything right is due to his reliance on Elliot Waves theory.

In my professional view as someone who has worked in various capacities on Wall Street and the financial industry in general for more than two decades, anyone who points to "cycles" as a way to time something is most often wrong and always clueless. This is especially true for market forecasting.

For those who might doubt my view on this I would suggest you first research my market forecasting track record. I will guarantee you won't find a better record by anyone in the world.

Note that I only added the condition of being "most often wrong" because there's always the possibility of getting lucky versus the certainty of anyone who relies on Elliot Waves, astrology, biblical scriptures and other nonsense to be clueless if not delusional.

On the other hand, maybe they know exactly what they're doing. If so, that would transform them from being a clown into a con artist.

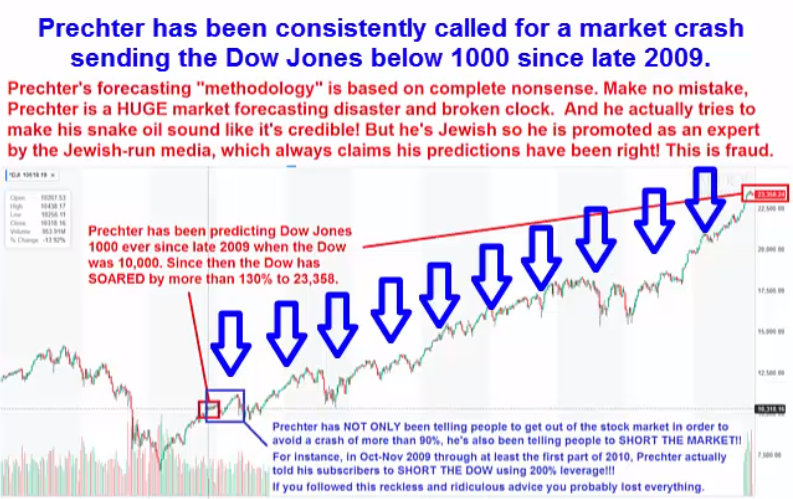

As another example pointing to the lack of merit behind Elliot Waves, those who are familiar with Robert Prechter have seen that his use of Elliot Waves as a tool to predict major stock market moves has most often led to disaster.

Blast from the Past: If You Listened to Robert Prechter You Lost You Ass BIG TIME!

As you watch the video below, I want you to notice how the Bloomberg media scum have deceived their audience regarding Nenner's track record by stating that he "called the market top in 2007" and "predicted the real estate bubble in 2006."

In addition, I want you to notice how these bold-faced liars from Bloomberg keep posting the following lines as Nenner speaks:

"Chart Guru Who Called '07 Top: Sell Stocks Now"

"Dow 5000 Correction Begins This Year At the time the Dow was around 14,000"

Okay, so if Nenner "called the '07 top and recommended to sell stocks now," and if he claims the "Dow is headed to 5000 this year," ask yourself what you'd be thinking.

Is this not market manipulation?

Only if the media is misrepresenting Nenner's claims, his track record and his background.

Ask yourself whether or not Bloomberg verified the claims it posted regarding Nenner.

I will guarantee you no one at Bloomberg verified these claims.

How am I so sure?

Because you cannot verify something that's not true!

You see, all media organizations post what they're told by those they interview without taking the time and effort to verify the claims made by the "expert" they plan to interview.

So every time one media firm makes claims about Nenner (and these claims come from a bio Nenner sends them) future interviews at other firms feed off of these bogus claims. Before you know it Nenner's alleged track record has been formed based on what he has fed the media.

This activity ultimately leads to the creation of a track record that's not based on reality because the next media outfit that interviews Nenner will see the claims made by Bloomberg and assume that everything must be true. The fact is that no vetting takes place.

As you can imagine, over time these claims are transformed into "urban legend" status, being accepted as factual and repeated by each disinformation source that interviews Nenner.

Meanwhile, Nenner's real track record is quite different from the one he and his media buddies have helped him spread to the sheep.

In my view this type of behavior constitutes fraud. Yet, it happens on a daily basis with virtually every so-called expert interviewed in the media.

The mechanism I have described is extremely common. That is, guys like Nenner work with the media to promote track records that don't jive with reality. We see this with Peter Schiff, Jim Rogers, Marc Faber, Harry Dent and every other so-called expert in the media. It's clearly a huge problem that no one has ever addressed.

And it's the same mechanism that creates folklore from decades ago that are difficult to disprove such as "he predicted the '87 stock market crash."

As I've stated in the past, the '87 crash was absolutely NOT predictable. It was like predicting the flash crash of 2010, which was not predictable.

But of course nearly everyone latches onto this claim that this person or that person predicted the '87 crash without bothering to even question whether they did indeed do so based on hard evidence (not here say) and whether it was even a predictable event.

Just because you keep claiming a crash is going to occur year after year does not mean you were successful in predicting when it finally happened (think of Peter Schiff, Marc Faber, Harry Dent, Jim Rogers and the rest of the broken clock crowd).

But again, there was no rational basis for the crash of '87 making it possible to predict. Hence, the crash of '87 was NOT something that was possible to predict. And anyone who states anything to the contrary should be labeled as a source of disinformation.

Unlike the financial crisis of 2008 which was due to numerous activities that had been going on for many years and that resulted in a market collapse over a period of more than one year, the '87 crash was a one-day event that was not the result of identifiable activities that were going on over an extended period. It was a random event that was not precipitated by any particular event or series of events. Hence, it was not a predictable event.

Finally, remember that the 1987 crash led to the beginning of what was to become the longest bull market in U.S. history up until 2018.

So for everyone who claims to have predicted the '87 crash, you need to provide solid evidence which includes showing all of your forecasts several months prior to the crash. If you cannot show that you were not crying wolf for months and even years before the '87 crash that means you are a broken clock and you predicted nothing.

More important, you also need to provide evidence that you were not telling investors to stay out of the stock market after the crash.

If you cannot provide evidence that you recommended to buy stocks after the '87 crash and you claim to have predicted it, all that means is that you caused people to miss out on the Great Bull Market of the 1990s.

Now if you have never thought about these things in this manner before, I'd say you're probably going to have a very difficult time navigating the web of lies by the media and its experts.

Don't take offense at this. It takes a great deal of experience and expertise to see through the endless tactics used by the media. After all, we're talking about one of the most powerful and pervasive criminal operations under the umbrella of the world's most powerful crime ring known as the Jewish mafia.

As well, if you want to be positioned to even stand a chance to filter through the propaganda you need to know a good deal about the capital markets. The best way to gain a competitive advantage in understanding what's going on in the capital markets is to go through our Boot Camp series.

Remember that if the media wasn't crafty about things, it wouldn't do such a good job fooling main street. So stick with me and I'll guide you.

So did Nenner "call the top in the stock market in 2007"?

Did he really recommend to "sell stocks" in October 2007?

Maybe he did.

But the real question is what was Nenner recommending in the previous month and several months before that?

I'm willing to bet Nenner was saying the same thing for many months if not years before the '87 crash. If so, that means he's a broken clock. And it's impossible for a broken clock to accurately forecast anything.

Verification of the first claim mandates inspecting all of Nenners so-called "research" before and after 2007 so as to ensure he had not stated the same thing many times over.

Because Nenner is a fear-mongering broken clock, one should assume he claimed the market made a "top" several times prior to 2007.

In fact, I'm willing to bet Nenner himself $10,000 that he made several "market top" claims prior to October 2007.

But there's more to this analysis. From the earlier discussion on the crash of '87, you should already know the next question.

What were Nenner's recommendations after October 2007?

That is, what did Nenner recommend in November 2007 and December 2007?

What about January, February, March and April of 2008?

Moreover, what did Nenner recommend each month from October 2007 through the market bottom in March 2009?

And what were his recommendations since March 2009?

The media won't even begin to go down that road because they know Nenner is a joke and his track record sucks.

The media knows all of its "experts" are little more than snake oil salesmen at best and broken clocks at worst.

But the media is not concerned one bit about accuracy or credibility. The media's only aim is to convince its audience that it has valuable content from "experts" so you will be inclined to tune into the broadcasts and read the articles which generate advertising revenues for them. The media wins. And if you pay attention to the so-called "experts" aired by the media, I'll guarantee you're going to lose most of the time.

Later in the video you'll notice how the Bloomberg market manipulation monkeys post the following claim about Nenner:

"Predicted Dow top in 2007 (claim 1) and housing decline in 2006 (claim 2)"

I've already shown how the first claim is complete bull shit.

Hell, if you don't even agree with my argument all you have to do is check where the Dow went since that time!

In other words, if you claim the market top is in and recommend to sell stocks in 2007, but you never told people when to get back into the market, those who listened to you have missed out on 100 percent upside in the market since October 2007 as of September 27, 2019.

Verification of the second claim involves seeing evidence that Nenner had published or at least discussed a detailed analysis of the real estate bubble. But he never did.

As well, one needs to ensure that Nenner had not been saying the same thing for years. I'm willing to bet he was doing just that. Checking all of his media interviews confirms this claim.

Furthermore, you cannot just say "there's a real estate bubble" and then once everything blows up claim you predicted it. This kind of "prediction" amounts to hand waving.

It's not credible.

You need hard evidence.

You need to detail the causes.

You need to discuss the full ramifications.

You need to provide a detailed analysis similar to what I did in America's Financial Apocalypse.

Furthermore, you cannot claim to have predicted the top in the market when you never predicted the bottom and when you never told people to get back into the market.

That is, did Nenner ever tell us all when to start buying?

Where was the stock market if and when he did?

All I've heard from Nenner over the past nine or ten years is how the Dow Jones Industrial Average is poised to collapse to 5000 or lower.

Nenner has been ranting the same song and dance as the other fear-mongering broken clock charlatans.

If Nenner never came out with a market bottom call this means he has kept the suckers foolish enough to listen to him out of the stock market since 2007, which means he caused these saps to miss out on the longest bull market in US history!

You should note that since at least 2011 Nenner has been issuing largely market collapse forecasts.

What that means is that if you listened to him you may have missed out on the longest bull market in stocks in U.S. history.

You have no credibility if you continue to fear monger several years later as the market keeps rising.

Later on in the video Bloomberg posts that he previously worked for Merrill Lynch and Goldman Sachs, albeit some twenty years earlier.

The Bloomberg monkeys post this so as to make you think he is a credible source. And this tactic usually works because most people are naive and trusting.

When the typical viewer reads that he used to work at recognizable firms they instantly think of Nenner as someone who is credible.

In the past I have discussed how the media constantly makes false claims about its "experts" in order to get you to tune in since tuning in means more ad revenues.

I have also pointed out many times in the past that Wall Street firms have their fair share of clowns that in some cases rival the fringe copywriting industry scam artists.

Furthermore, we do not know whether these claims about Nenner's prior work history are completely true. For instance, Nenner may have worked as a chump at these firms. Remember that as a Jew, Nenner will be virtually guaranteed to land a job at any Wall Street firm. So he could have been hired to hold a token position simply because he was Jewish.

Alternatively, Nenner may have worked at a firm that was acquired by one Merrill or Goldman only to then be forced out soon after. So can you say that you worked at Merrill or Goldman if you really didn't?

The bottom line aside from being confident that Nenner never held a position of influence at these firms is that he is clueless. And his track record confirms this. At the end of the day, the only thing that matters is whether you have credibility and whether you have established a solid track record. Nenner has failed at both.

The only question I have at this point is which came first? The chicken or the egg?

That is, did Nenner begin his stock market collapse and gold pumping rants before he began receiving mass promotion in the "alternative media," or were his market collapse and gold pumping rants responsible for his warm welcome into the world of "alternative media" hucksters?

I'm confident I know the answer to this question.

And by now, I think you also know the answer.

Finally, note that the media NEVER reveals the full truth about its experts. It cherry-picks things in order to make these clowns seem legit.

For instance, when the various Jewish-run media entities promote Peter Schiff as some sort of "expert" they often list or mention that he worked at Lehman Brothers. But has anyone in the media ever mentioned he was suspended from the securities industry and "let go" by Lehman for being brought up on charges of defrauding customers by the National Futures Association?

Of course not!

This is all too common a theme in the financial media. Many of the regular pundits and "experts" aired on financial networks have in one form or another been booted out of the financial industry. Some have been kicked out of the industry while others were fired. The rest have failed on Wall Street (e.g. Jim Cramer, Max Keiser, the Najrarian knuckle heads, Josh Brown, etc.).

But instead of revealing the REAL reason why they went off to work in the media they make it sound as if they were successes on Wall Street and decided to "retire."

Folks, retiring means you no longer work, unless you are working for free.

Because they are deceiving people in order to generate financial gain, this qualifies as fraud.

In the past I've also pointed out how CNBC promotes Josh Brown as some expert while never mentioning that prior to launching his BS marketing campaign as the "reformed broker," he was branch manager of a firm that was shut down by FINRA for defrauding customers.

Now you know why he claims to be "reformed." By definition, if you claim to be reformed that implies that you were doing something really bad before. But then again, claiming you are reformed does not mean it is true. Remember that a tiger never changes its stripes.

The list goes on. As I've stated before, you can bet that just about every single financial "professional" on CNBC either has a very checkered past or else is a complete clown. Often you'll see clowns who have a checkered past. And that's putting it mildly. You can take that to the bank.

I'd be very interested to learn the deatils of Nenner's departure from his previous firms. I'm willing to bet he was fired. If so this is huge since you don't find many Jews getting fired from the Jewish-run financial industry unless they are complete screw-ups or else they cost the firm huge clients or a collapse in reputation as a result of something they did. Former chief economist of the now defunct Bear Stearns, Larry "cocaine" Kudlow's plight serves as a great example of this.

As I have shown many times over, it's critical to keep in mind that the media is completely controlled by a gang of very racist Jewish scum bag pedophiles who use their control over media for the benefit of Jews and only Jews. That's precisely why you only see Jewish individuals promoted as experts in the media.

The main problem is that these experts are con artists, shills, broken clocks and/or idiots with lousy track records.

It's ironic how the Jewish mafia loves to claim whites discriminate when the fact is that there is not a larger force on earth that discriminates against people than the Jewish mafia.