Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Market Guidance: Past, Present and Future

NOTE: Mike Stathis predicted the precise details of the financial crisis in his 2006 book, America's Financial Apocalypse. .jpg)

The Jewish Mafia REFUSED to publish this landmark book because it exposed the widespread fraud committed by the Jewish Mafia.

Instead, the Jewish Mafia published useless marketing books written by their broken clock tribesmen (like Peter Schiff's useless book which was wrong about most things and was written a year AFTER Stathis' book).

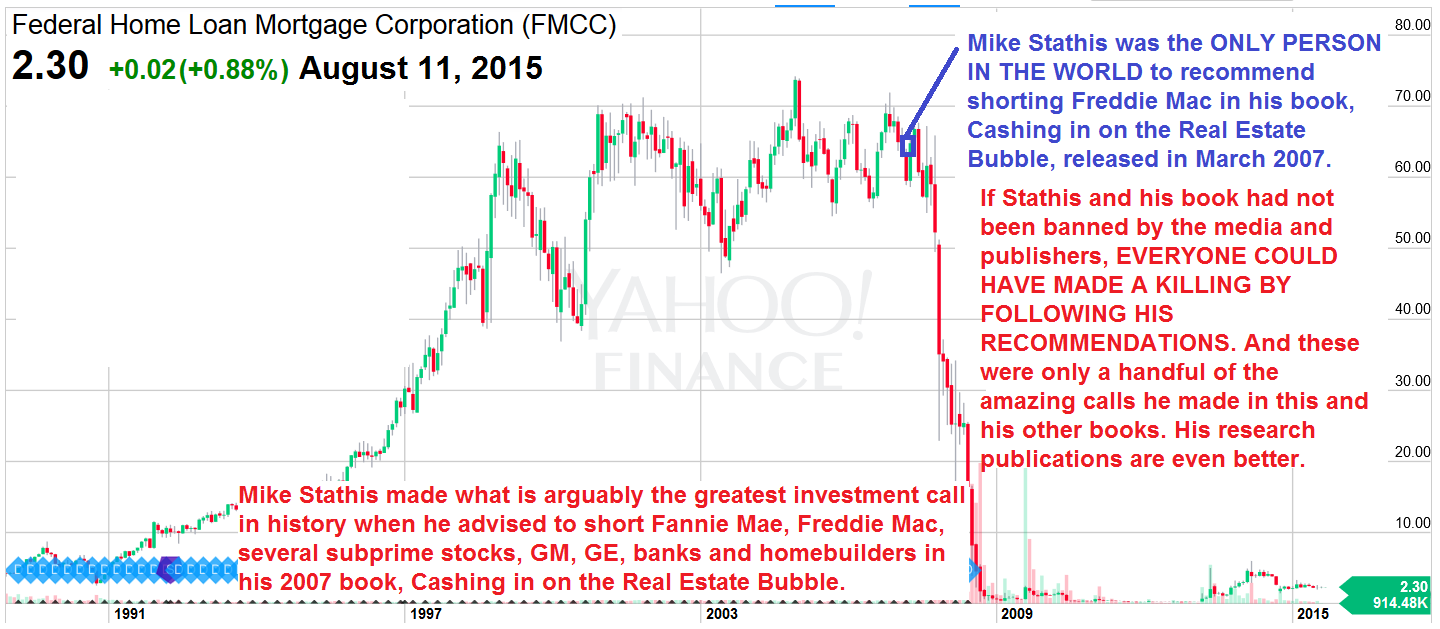

Stathis also released a book focusing on strategies to profit from the real estate collapse in early 2007.

The Jewish media crime bosses prefer to simply ignore those who speak the truth and threaten to expose them as the best way to hide the scams from the public.

In contrast, the Jewish media crime bosses continuously promote Jewish con men and clowns who have terrible track records as a way to enrich them all while steering the audience to their sponsors, most of which are Jewish Wall Street and related firms. Figure it out folks. It's not rocket science.

.png)

__________________________________________________________________________________________________________________

Mike Stathis holds the best investment forecasting track record in the world since 2006.

So why does the media continue to BAN Stathis?

.png)

Why does the media constantly air con men who have lousy track records?

These are critical questions to be answered.

You need to confront the media with these questions.

Watch the following videos and you will learn the answer to these questions:

You Will Lose Your Ass If You Listen To The Media

.png)

.png)

.png)

Despite the strong closing bounce off the new intraday low of around 7400 reached on Friday, it’s likely the Dow has further downside. These lows may not occur for another 12-18 months. Alternatively, they could occur at any time. The timing is impossible to predict in advance. The important thing to focus on is the likelihood that the market will head lower down the road. You should adjust your investment strategy to reflect this scenario.

As I first reported in the 2006 edition of my book America’s Financial Apocalypse, the fair value of the Dow Jones Industrial Average was around 5500 by least-squares analysis (chart below). This was a very rough estimate that could be raised to as high as 6500.

While I mentioned I would “not be shocked to see the market collapse to this level,” I felt it was unlikely. I felt a series of crashes would push the Dow down to the 10,000 level where it would trade sideways for many years, only to mount a series of devastating crashes thereafter. Thus, even I am a little surprised how badly things have deteriorated in such a short period of time.

[Now you hear about the self-proclaimed experts talking about the same analysis as I discussed in 2006, as if it were timely. You know who they are - the same clowns on TV who want you to think they warned you of this mess early on, when the fact is they were bullish up until a couple of months ago. Just check their track records and you will see for yourself. They rely on the fact that most investors have short memories.

I wonder how many of these guys reference my book and why they refuse to acknowledge my forecasts. I suppose they don’t feel they need to since I’m not part of the mainstream media con artists. I know for a fact my book made it to many mutual and hedge fund managers because I was contacted by some who specifically made me promise not to disclose their praise for my book, most likely because they did not want their clients to know this catastrophe was coming.]

However, since the release of this book, I have cautioned investors many times about a collapse down to the 9000 then 8000 and finally 7800 levels. Now I am telling you to watch out below. As you will see shortly, I expect considerable short-term upside before reaching new lows.

But you should note that the Fed and Treasury’s responses to the financial crisis have assured there will be even more devastating crashes down the road, most likely just as the market appears to be headed for another strong bull run. When this will occur I cannot say. But you can bet it’s going to happen. You can’t create trillions of dollars out of thin air without harsh consequences down the road. The effects will be even worse when you hold down interest rates for a prolonged period.

With the Dow hovering around 8000, the problem is that there have been absolutely no signs of capitulation whatsoever. What that means is that the Dow could fall much lower from current levels. Even worse, we are still at the early stages of the economic fallout. Consumers have not fallen yet and hedge funds have only begun to fail. Hundreds of corporations will file for bankruptcy and thousands of banks will fail. The results of the holiday season should begin another downward turn. I invite you to check back to a couple of articles I wrote a few months ago to serve as guidance for your investment strategy. See here and here.

So is this 5500-6500 level possible? Certainly. In fact, we know that during reversion to the mean, the stock market almost never goes exactly back exactly to the mean. Instead it overshoots. What this means is that the Dow could go lower for a period prior to gravitating around the mean. Keep in mind that as time passes, the market fair value will increase based upon the slope of the chart.

Just from studying this basic chart alone, common sense would lead one to conclude that the stock market is headed for an additional 10 to 15-year period of poor performance. When you consider the economic data, things look much worse.

If you think this isn’t possible, you’ve most likely been watching too much TV or listening to Wall Street. Just ask Japan about this possibility.

Have a look at the 20-year performance of the Nikkei 225 below. After reaching nearly 40,000 in 1989, the Nikkei is still down by over 75%. But as you can see, it didn’t crash over a short time period. It has been in a downward trend since 1989.