Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Opening Statement from the January 2021 CCPM Forecaster

Opening Statement from the January 2021 CCPM Forecaster

Originally published on January 3, 2021

Overview

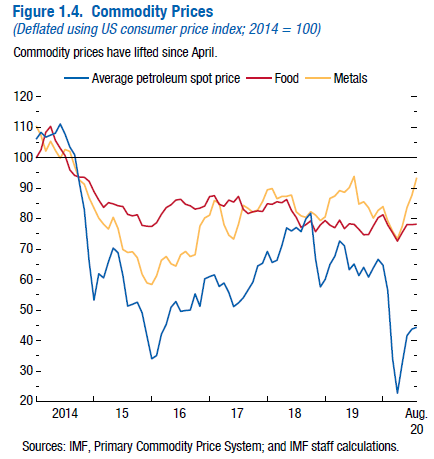

Despite suffering from one of the most severe recessions in history, the global macroeconomic outlook has continued to improve ever since the summer of 2020. Assuming a reasonable rollout of several coronavirus vaccines by summer 2021, we expect demand for commodities to continue to pick up as economies head closer to normal conditions.

While the overwhelming consensus of economists and analysts expected a so-called “V-shaped” recovery, early on we emphasized that a recovery would take much longer than expected. Signs of recovery from the COVID-19 recession only began to materialize by Q3 2020.

Despite overwhelming optimism as expressed by investors, a full economic recovery has a long way to go and will be accompanied by many significant risks. Even the IMF has only recently admitted that 2021 will only provide a partial recovery from the COVID-19 recession which officially began in February 2020.

Interest Rates and Commodity Prices

On September 16, 2020, Fed Chairman Jerome Powell stated the Fed’s intention to keep short-term interest rates at current levels (near 0 percent) until (at least) the end of 2023.

The Fed’s expectations for interest rates rely largely on its estimates for inflation. Accordingly, Powell stated that inflation is not likely to meet the Fed’s target of 2 percent until the end of 2023. Powell also reminded investors that the Fed plans to allow inflation to moderately exceed the Fed’s target in order to compensate for prior periods of low inflation.

USD

We believe the USD will remain weak at least through the first few months of 2021. Whether or not the dollar enters a recovery in the second half of 2021 will depend on several factors.

Oil

After entering a bearish trend in March 2020, continued weakness in the USD helped to put a bottom in oil prices after collapsing to multi-decade lows. As you will recall, on April 20, 2020 the May 2020 WTI crude oil futures contracts collapsed to -$40.

Although oil demand is expected to firm up from 2020, pricing remains largely under the control of OPEC. As you might recall, in July 2020 after economic lockdowns caused oil pricing to collapse, OPEC agreed to cut oil output to lows not seen since 1991.

Prior to the latest wave of COVID-19 outbreaks, members of the OPEC+ alliance planned to reduce daily production cuts from 7.7 mbpd to 5.8 mbpd. But by early December 2020, despite positive news regarding coronavirus vaccines, members of the OPEC+ alliance tentatively agreed to reduce daily production cuts by only 500,000 bpd, or from 7.7 mbpd to 7.2 mbpd moving into 2021. These agreements are expected to be finalized when members meet on January 4...