Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Bill Miller's Top Value Pick in 2022 Was Tupperware (TUP) Proving He is Clueless

Those who are unfamiliar with me can find out more about my credentials, my background, as well as my investment research track record here, here, and here.

Examine Mike Stathis' unmatched track record of predicting the 2008 financial crisis, enabling investors to capture life-changing profits by checking here, here, here, here, here, here, here, here, here, here, here, and here.

-------------------------------------------------------------------------------------------------------------------------------------

Perhaps you remember Bill Miller. From 1991 through 2005, Legg Mason’s Bill Miller was (allegedly) the only mutual fund manager to have beaten the S&P 500 Index each year for that 15-year period (allegedly).

That should have been a warning sign alone. Instead, everyone called him a genius.

It turns out that Miller was no more of a genius than any of the hacks on CNBC. After the 2008 financial crisis, Miller’s fund collapsed into the bottom quintile in 1, 3, 5 and 10-year performance.

It turns out that Miller was no more of a genius than any of the hacks on CNBC. After the 2008 financial crisis, Miller’s fund collapsed into the bottom quintile in 1, 3, 5 and 10-year performance.Mutual Fund Disasters: The Rise and Fall of Bill Miller

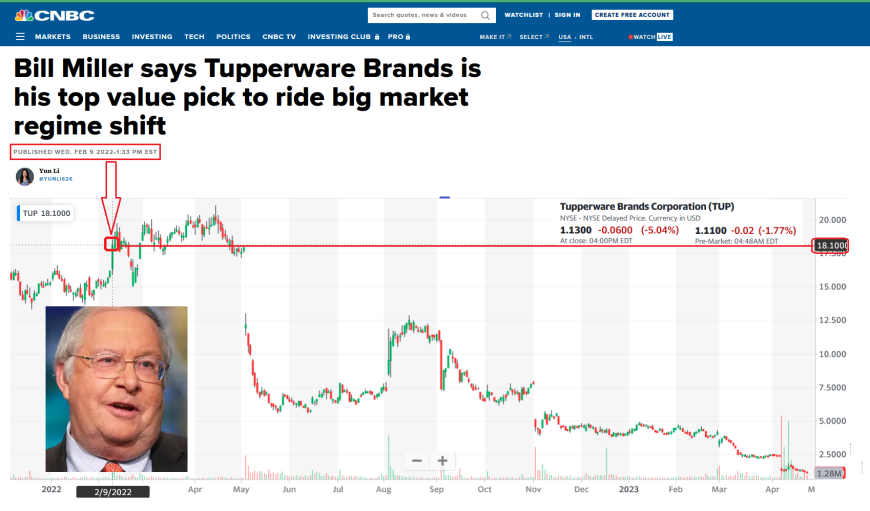

And now we see more of Miller's genius via his top pick for 2022, TUP.

Miller should sign up for our Securities Analysis & Trading Webinar series because Mike actually covered TUP a few years ago in order to determine if it offered any upside.

Although Mike guided subscribers to huge gains from a trade in shares of TUP, he hasn't touched the stock since because the situation has turned from bad to really, really bad.

Incidentally, Mike will be providing an analysis on TUP in an upcoming Securities Analysis & Trading Webinar session. Perhaps someone should notify Miller.

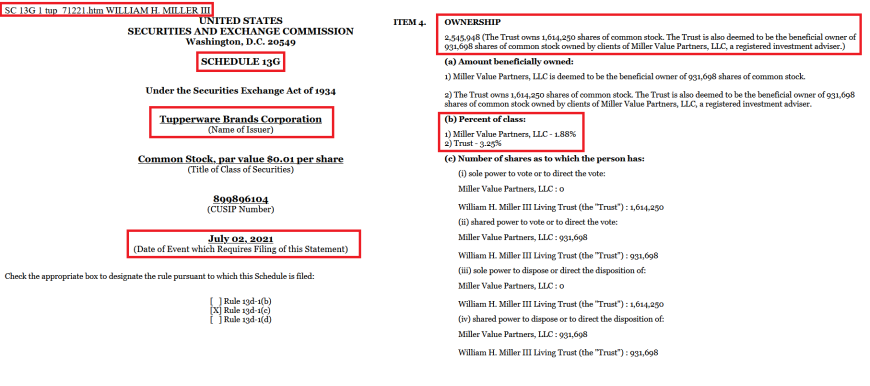

The amazing thing is that Miller has been riding his huge position in TUP all the way down for years.

You shouldn't think that Miller just started buying TUP at the beginning of 2022.

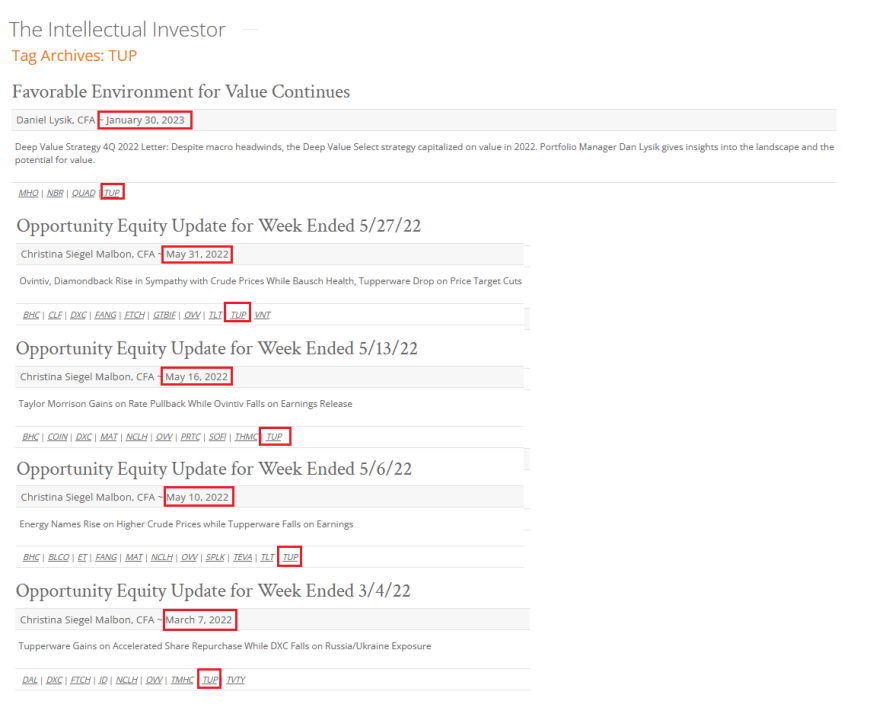

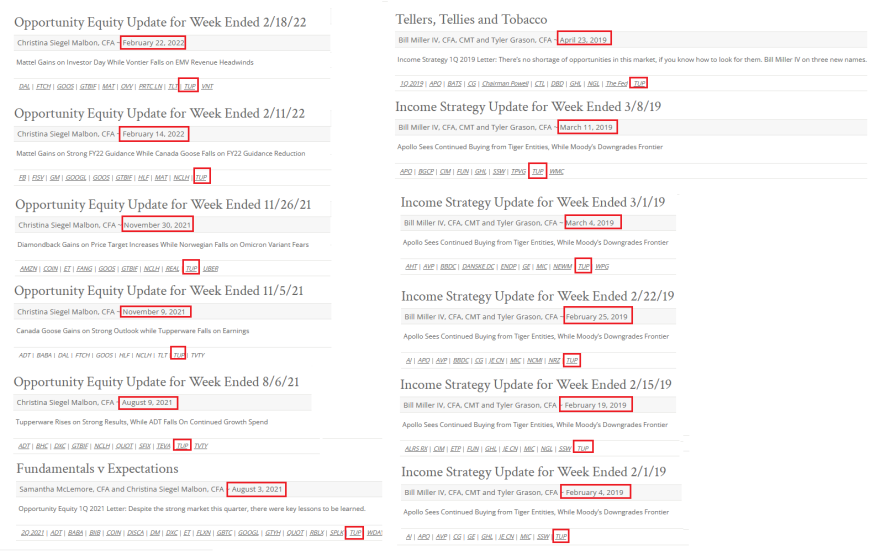

As you can see below, he has owned TUP for most weeks since the middle of July 2018.