Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Peter Schiff Finally Backs Off from His Ridiculous Hyperinflation Claims After 15 Years of Being Wrong

In the first video (below) Peter Schiff finally backs off from his prior claims that the U.S. would enter hyperinflation.

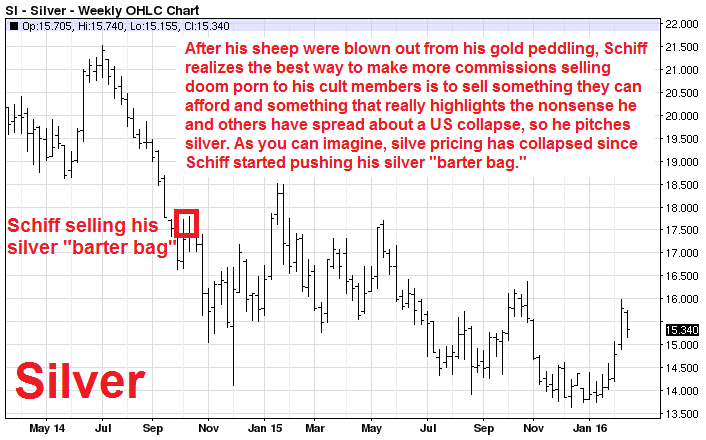

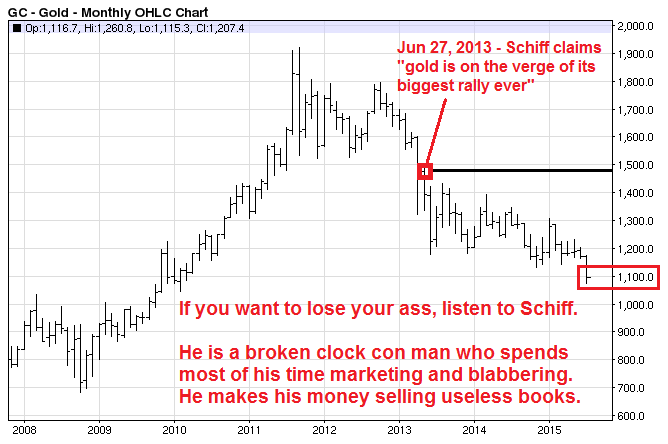

As you might recall, Schiff was scaring people for many years with these ridiculous claims in order to sell his shiny rocks which he continues to claim is "real money."

Schiff also scared many people out of the U.S. stock market which went on to soar during the longest bull market in history.

In this recent video, he's claiming hyperinflation is now his "worst-case" scenario.

But Schiff wasn't claiming hyperinflation was his worst-case scenario over the past several years.

He was actually predicting hyperinflation as a certainty since at least 2009.

See the second video for evidence of this.

Ask yourself whether you think the claims made by Schiff constitute fraud or not.

Before you answer, you might want to check the video (below) where Schiff was promoting the everso ridiculous Valcambi CombiBar as a form of currency.

Do you believe Schiff should face penalties from securities regulators for any of the claims he's made in the past?

I certainly do. And I do know a bit about securities laws.

So why was Schiff able to get away with this nonsense?

It's called Jewish Privilege.

If you don't understand what this means, you have much to learn.

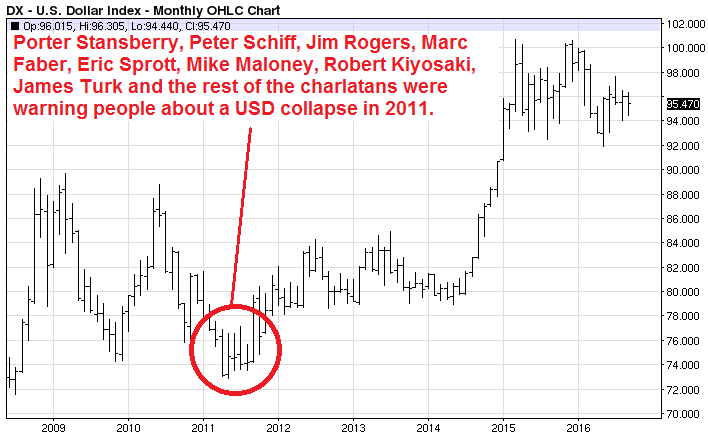

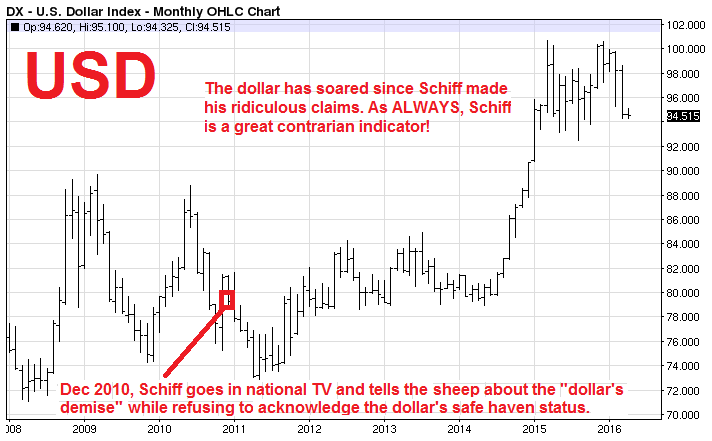

Even as Schiff tries to weasel out of his hyperinflation claims, his predictions about the U.S. dollar and gold will be proven wrong, just as they have in the past.

If you listened to the great contrarian indicator Peter Schiff, you LOST YOUR ASS.

And I'm willing to bet that if you listen to Schiff in the future, the results will be no different.

1.png)