Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Can You Beat the S&P 500 Index? You Can If You Have Access to Our Research

If anyone claims that no one can beat the S&P 500, you should tell them they haven't seen Mike Stathis' investment research.[1]

Here we provide just one of many examples.

In the very first issue of the Intelligent Investor (May 27, 2009) Mike released his top 3 stocls for long-term growth.

He had never released such a list before that time nor has he released one since. But there's talk that he's working on a new list.

In 2011, we published an article showing the performance of these three stocks since May 27, 2009, but we did not show the stock tickers.

Mike's Top 3 Stocks for Long-term Growth

Then we published an update in 2016 showing the performance.

An Update on Mike's Top Three Stocks for Long-Term Growth

We even offered to disclose the names of these stocks for the paltry sum of $29.95! [2]

Guess what.

We had only 1 taker.

You know the saying. "You can lead a horse to the water but you can't make it drink."

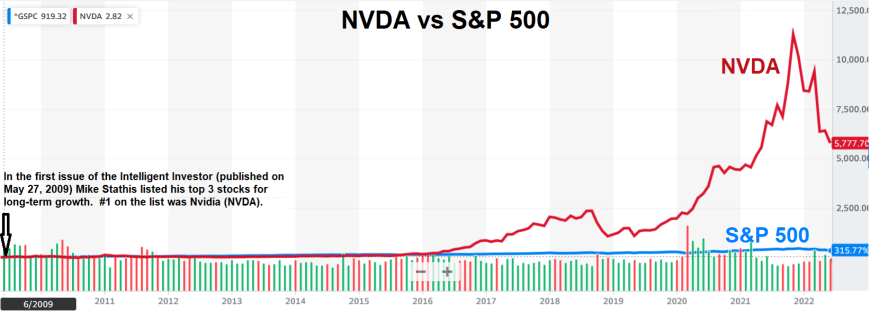

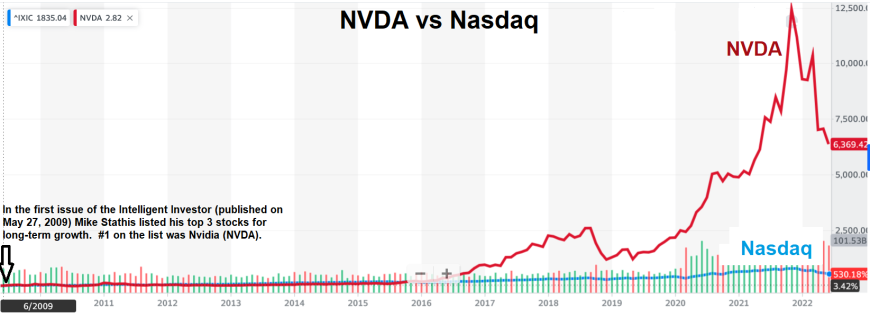

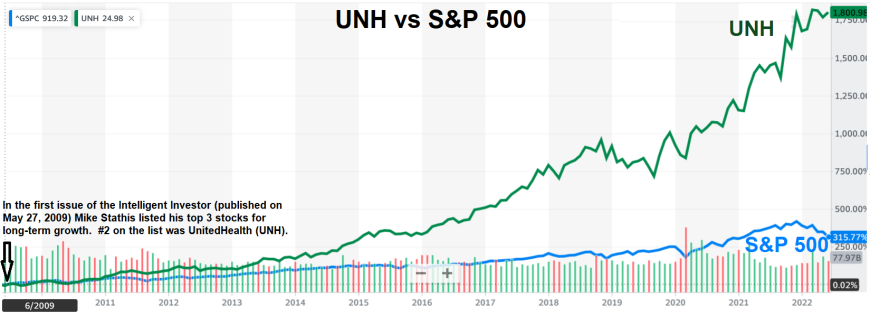

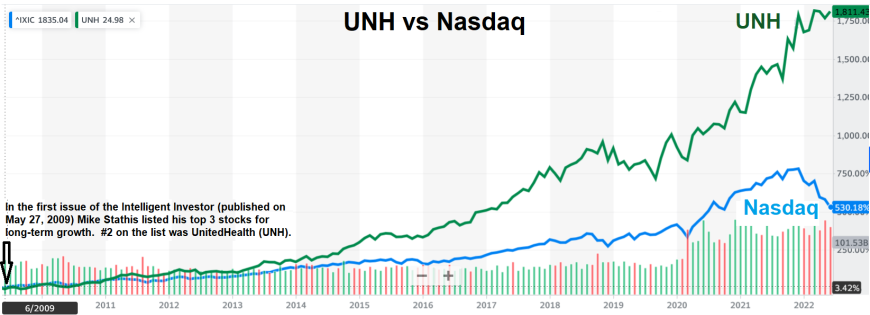

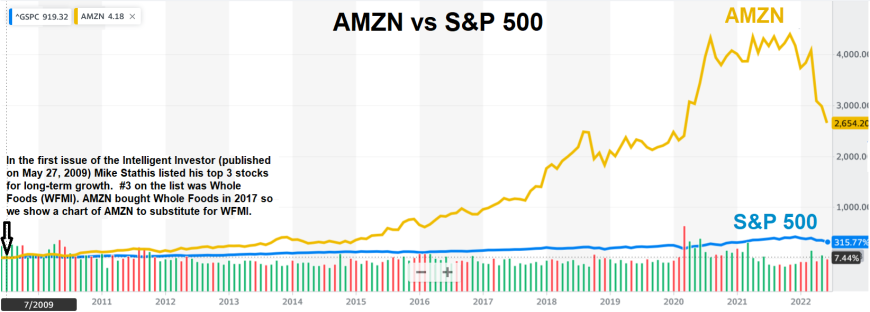

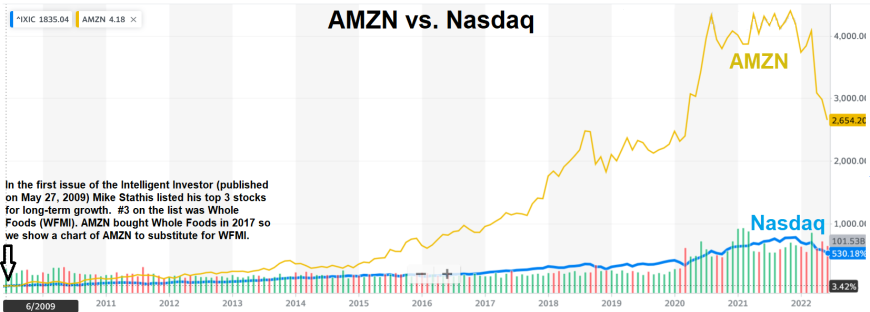

Since that time, to date, each of these 3 three stocks have easily beat the performance of the S&P 500 index and the Nasdaq.

In fact, these 3 stocks outperformed the S&P 500 Index and Nasdaq by the following amounts:

Mike's #1 Pick Mike's #2 Pick Mike's #3 Pick

S&P 500 Index 18x performance 6x performance 8.5x performance

Nasdaq 12x performance 3.5x performance 5x performance

That means Mike's #1 pick for long-term growth returned 18X or 1,800% as much as the S&P 500 Index to date since he published the list in May 27, 2009.

And it also returned 12X or 1,200% as much as the Nasdaq to date since he published the list in May 27, 2009.

Today, we will reveal the names of these three stocks.

Note that the 3rd company on this list was bought out by Amazon, so we posted the performance of Amazon versus the Nasdaq (the appropriate benchmarking index to use) since May 27, 2009 through current (June 28, 2022).

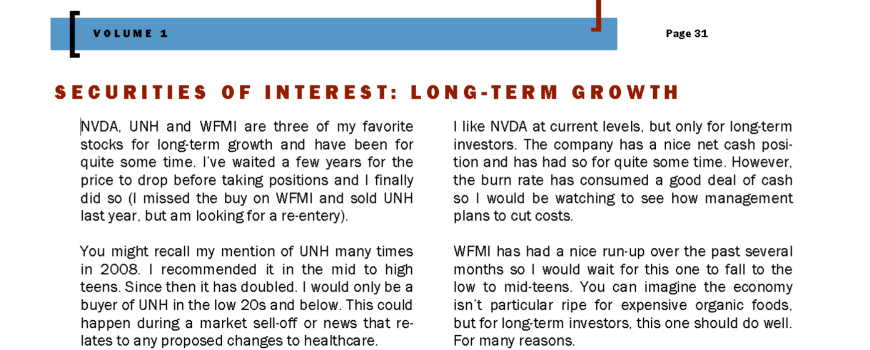

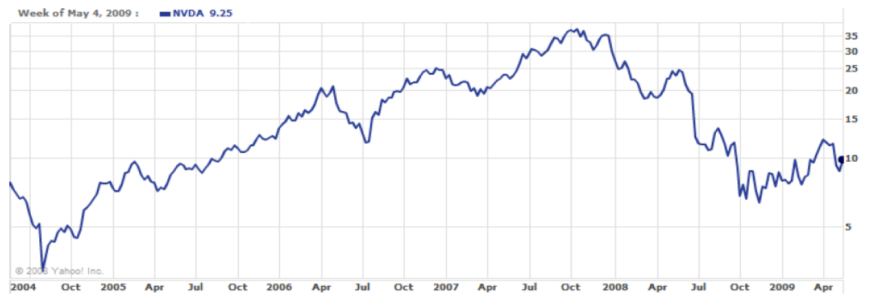

First, we show images of the actual entry taken from the first issue of the Intelligent Investor published on May 27, 2009 revealing this Top 3 list.

Next, we show how these stocks have performed to date since Mike published this list of his top 3 stocks for long-term growth on May 27, 2009.

As you will see, the performance of these 3 stocks DESTROYED that of the S&P 500 Index and Nasdaq since Mike published the report in 2009.

Think about that.

To those who had the chance to purchase this list for $29.95 but didn't, you blew it.

So what are you waiting for? I hope you aren't waiting for another $29.95 offer because it will never come again.

We just did it as an experiment. And it proved that most investors are lazy and foolish.

If you aren't lazy and you want access to the best investment research in the world, subscribe to one or more of our research publications today and lock in your annual rate for life before rates increase.

Or you could always listen to the countless frauds and clowns online.

The choice is yours.

Before you even try to find someone you think might be better than Mike, we recommend spending a good amount of time examining his track record.

You can begin here, here, here, here, here, here and here as a starting point.

[1] The Nasdaq significantly outperformed the S&P 500 Index over the measured period which is to be expected. We used the appropriate benchmark for each stock. Therefore, UNH was compared to the S&P 500 Index, while NVDA and AMZN were compared to the Nasdaq. If we had used the S&P 500 Index as a benchmark for all three stocks, the outperformance would have obviously been even larger.

[2] We recently removed the offer and PayPal link in order to prevent confusion and issues given that we do not accept PayPal anymore and also due to the fact that we are revealing what these three stocks are today for free.