Invest Intelligence When It Realy Matters

Invest Intelligence When It Realy Matters

Broken Clock Gold Pumper Peter Schiff Tries to Create Bank Runs Using Disinformation

After having monitored and documented Peter Schiff's media appearances for more than fifteen years, I have accumulated extensive evidence pointing to Schiff as a broken clock and fear-mongering huckster who scares people into making terrible investment decisions using an arsenal of ridiculous rhetoric and bad investment advice.

But of course, Schiff would not be able to reach millions of people if it weren't for the financial media which provides him with unfettered access to main street. This points to another critical issue which I have addressed for many years.

Top Expert on 2008 Financial Crisis, Mike Stathis Analyzes 2023 Banking Crisis

I have devoted a remarkable about of time, effort and energy towards exposing Schiff's disinformation and fear-mongering tactics in order to provide a public service to main street investors.

I felt it was necessary to clarify the realities about Schiff and his track record because he is plastered all over the financial media as an 'expert" for which investors should listen to and can trust. But this perception is out of touch with reality.

In my opinion, no investor should ever listen to anything Schiff has to say unless their intention is to use what he says as a contrarian indicator.

Futhermore, I certainly would not trust Schiff's motives nor his judgment. But that's just my opinion. You can decide for yourself whether or not to listen to what he says and whether to trust his motives and judgment.

Before making your decision, I urge you to check the hundreds of articles and videos I have published on Schiff over the years.

Once you become familiar with his track record I'm confident you will conclude that one of the worst moves you can make is to send Schiff's firm money to invest.

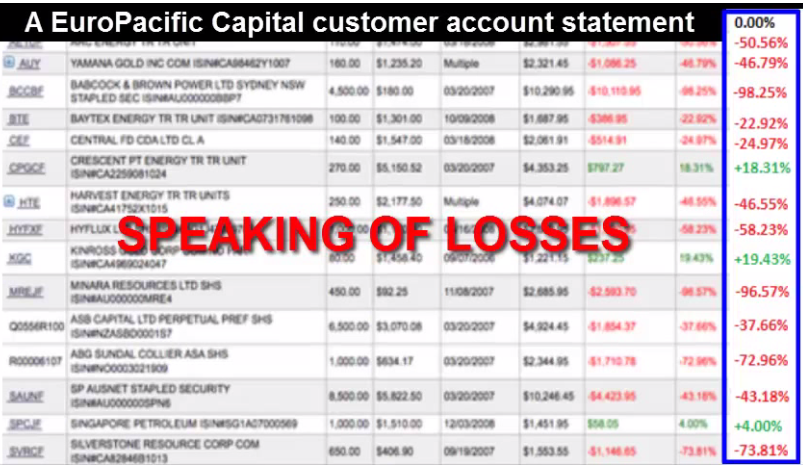

This is a client statement from Peter Schiff's investment company, Euro Pacific Capital from the end of 2008. Based on this statement, you can see that this customer lost much more than the S&P 500 Index over the period he/she had invested with Schiff's investment firm.

For those who aren't familiar with Schiff's M.O., I'll break it down for you.

Schiff creates fear-mongering narratives which lead (naive and unsophisticated) investors to believe they can make a great deal of money buying gold, risky small cap mining stocks listed in foreign markets, exchanging U.S. dollars for euros, exchanging U.S. dollars for gold, buying and holding individual stocks from developing nations such as China and Brazil, and other risky investment moves for which his firm stands to benefit by charging high commissions and fees.

Even worse than the high fees charged by Schiff and his firm is the performance of his investment recommendations.

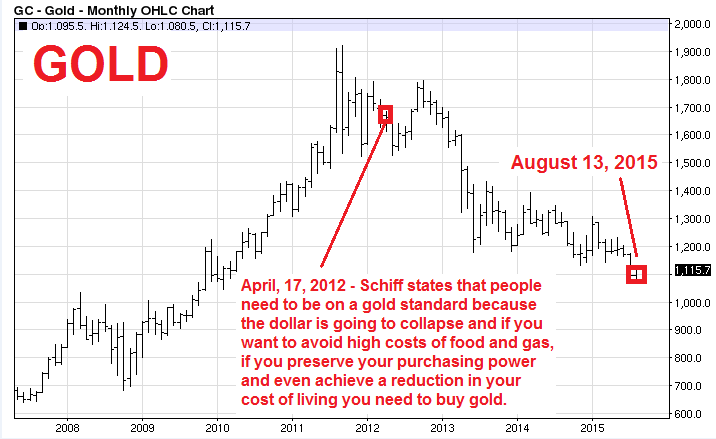

The following images were taken from a video Schiff made in 2012. The images highlight Schiff's fear-mongering and broken clock narratives designed to scare people into his grasp.

And remember that the financial media is a prime player in this deceit because it gives Schiff air time which enables him to spread this nonsense to millions of people.

To give you an idea of the extent of Schiff's fear-mongering nonsense, for many years after the 2008 financial crisis he was claiming the U.S. would enter hyperinflation.

As part of this fear-mongering pitch, Schiff also claimed that the U.S. dollar would become worthless, and the stock market would collapse.

And he made these claims year after year, as inflation remained tame, the and U.S. dollar continued to soar along with the U.S. stock market.

So what was Schiff "solution" to investors? Buy gold (from him of course) in order to protect you from the hyperinflation he was so certain would occur.

Schiff even pitched the "Valcambi gold bar" back in 2013 as a way to "protect the value of the dollar" during a very dark period of hyperinflation.

But of course hyperinflation never materialized.

At the time schiff began marketing the Valcambi bar, gold was selling for just under $1,700/ounce. All you had to do to "protect the value of your currency" was send Schiff $1,700 for every Valcambi bar you wanted, along with a ridiculously huge 8% fee.

Within months after Schiff began pitching the Valcambi bar, gold plummetted by some 30% and remained at those price levels for several years. So instead of protecting the value of your dollars, the value actually collapsed if you bought the Valcambi gold bar.

But that was okay for Schiff because he got paid his massive 8% commissions.

Buying gold is Schiff's solution to everything because he's a gold salesman.

Get that? Schiff is a salesman. He's a stock broker.

He's NOT an economist and he's NOT an analyst.

And he's NOT a fund manager.

Anyone who claims otherwise is simply lying or completely ignorant.

As early as 2009 I was exposing Schiff's ridiculous nonsense and began explaining why it's impossible for the U.S. to experience hyperinflation.

By now it should be clear that anyone who takes Schiff seriously has never checked his track record, or else is extremely stupid.

Meanwhile, anyone who promotes Schiff as an expert or even as a legitimate financial professional is clearly either very stupid or else a paid shill.

After facing a potential avalanche of lawsuits from customers of Euro Pacific Capital who lost large amounts of money as a result of listening to his terrible advice, by 2013 Peter Schiff switched his company's business from separately managed accounts to mutual funds (in my opinion) in order to shield him and his company from potential litigation.

After all, it's extremely difficult to successfully sue mutual funds for damages if you lose money.

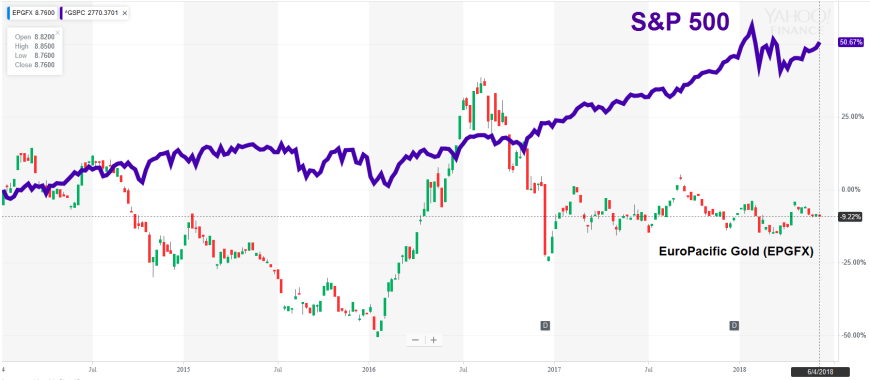

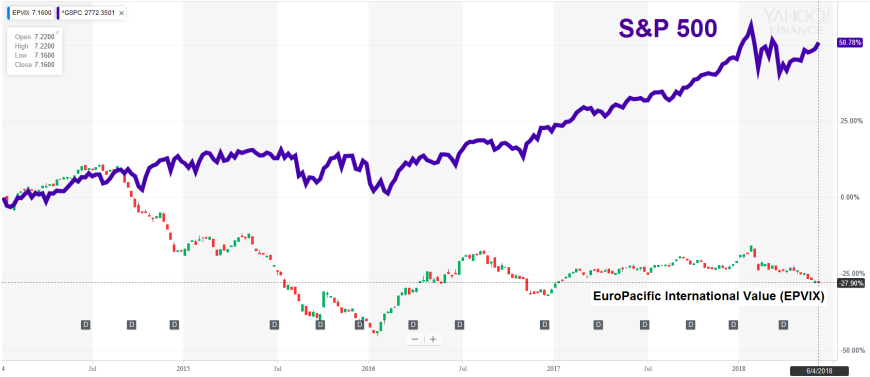

Unfortunately for Schiff, ever since he made that shift everyone can now see how bad his performance has been.

Simply check the ticker symbol of his funds and you can see for yourself how his funds have performed versus the S&P 500 Index since inception.

Note: the following charts were created a few years ago but you can update them and see for yourself how bad the performance is.

Needless to say, anyone who has examined Schiff's track record should be able to easily conclude that he should never be relied upon for investment advice.

The problem is that most people don't check track records because they are too lazy, too stupid, or too confident.

In the first video (below) we learn that Schiff doesn't seem to understand why Silicon Valley Bank failed, nor does he understand the current situation with banks.

Schiff also claims that the current banking crisis is going to be much worse than the 2008 financial crisis, as if he understands the true cause(s).

As one example of Schiff's poor understanding of the 2008 financial crisis, he claims the Federal Reserve caused the crisis instead of Wall Street. This is absolutely false.

Schiff won't tell you what most people already know; that Wall Street caused the 2008 financial crisis, because Schiff is part of the investment cabal, so he wants to protect his tribe.

Peter Schiff didn't predict the 2008 financial crisis. And his clients certainly didn't profit from it.

Even his book Crash Proof (released in 2007) didn't show investors how to profit from the financial crisis.

The book failed to explain with any detail how a financial crisis might happen. The book was wrong on nearly all fronts.

Similar to his other books and those (ghost) written by other broken clock charlatans, Crash Proof is a marketing tool designed as an investment book which was used to lure suckers to buy gold from him as well as to send him money to invest in high-commission and often risky foreign stocks.

In contrast to Schiff's failure to predict the 2008 financial crisis and position readers of his marketing book Crash Proof to profit from it, I predicted the crisis with remarkable detail in my landmark book, America's Financial Apocalypse published in late-2006. See here and here.

And my predictions and recommendations enabled investors to make huge returns.

The release of America's Financial Apocalypse led to me being black-balled by the entire media industry because the inner circle of crooks don't want working-class Americans and main street investors to know the truth.

The media works to deceive the public while helping corporate America and Wall Street profit at the expense of main street. Washington politicians pull the same stunt.

I also released another book in early-2007 called Cashing in on the real Estate Bubble. This book was focused on showing investors several ways to make large amounts of money from the bursting of the real estate bubble, with a focus on shorting stocks.

To my knowledge, there have been no books before or since then that have offered such detailed and accurate analyses on the financial crisis, while providing numerous ways to make huge profits.

Therefore, if there is a person best positioned to understand the current banking crisis, it's the person who best and most accurately predicted the 2008 financial crisis. That person is me. See here and here.

You should note that unlike every so-called "expert" featured in the financial media, I have no agendas. I'm not selling gold, silver, stocks, bonds, or real estate.

And I'm not trying to get you to invest with a brokerage firm or an investment fund.

I don't even sell advertisements because ad-based content can never be trusted because it is designed to benefit the advertisers at the expense of the audience.

Therefore, I have no misaligned interests.

Right now, although the "experts" in the media claim to know what's going on and how bad things will get, the reality is that no one knows how bad the current banking crisis will get because it depends on several variables.

But will tell you this. Even assuming the worst possible scenario plays out, unlike what Schiff claims, the current banking crisis will pale in comparison to the 2008 financial crisis.

If you don't understand why this is the case, then you've been listening to fear-mongering clowns who have mischaracterized the current banking crisis and/or who truly don't understand the 2008 financial crisis and the impact it had on the global economy.

In the video below Schiff goes on to claim that the Fed's backstop for banks (i.e. releasing cash and cash equivalents which adds debt to its balance sheet) is going to cause high inflation.

This is complete nonsense. As you will recall, Schiff claimed for more than a decade that the Fed was going to cause hyperinflation.

Instead of stating the reality, Schiff uses the opportunity of a crisis in order to twist and spin reality into fear mongering hyperbole.

Schiff tries to convince people to pull their money from banks and to use that money to buy gold. He claims that money you have in banks is going to be "inflated" away since (as he claims) the Fed is going to worsen inflation by helping the banks. Therefore, he recommends to remove your money from the banks and buy gold because it's a "store of value" (according to Schiff)...

What Schiff refuses to tell his sheep is that the best and most certain way to make money with gold is to be a gold dealer. That's why he's a dealer...