Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Cryptocurrency Shill and CNBC "Expert Trader" Jon Najarian Touts Voyager Digital Days Before Bankruptcy

Several years ago I first exposed Jon and Pete Najarian as your typical CNBC charlatans positioned as "experts." See here.

Like all of the other "experts" promoted by the financial media, Jon and Pete Najarian spend most of their time in media-related and marketing activities. By definition alone, this makes them media personalities and marketing hacks, as opposed to true trading or investment experts.

True trading and investment experts spend the majority of their time analyzing trades and investments in order to produce superior results. When you are spending most of your time in media talking about trading or investing, that makes you TV personality. There's no way a TV personality can legitimately claim to be a trading or investment expert. It's a scam designed to herd sheep into the slaughter house.

Note that I'm not talking about the occasional real expert that's interviewed on CNBC and other financial networks. No doubt, there are actually a very small handful of real experts that make their rounds in the media, but their appearances are rare.

The trick used by the media is to toss in one or two real experts into the pool of one or two hundred fake experts in order to convince the audience that these networks only feature true experts. 1

Former football players Jon and his younger brother Pete Najarian are really something else. Jon dresses up like some kind of weird looking superhero wannabe, while Pete looks like a washed up, cheesy WWE wrestler.

As well, both appear to shop at the same strip malls (and perhaps pawn shops) because they're often seen wearing tacky clothing and cheap looking costume jewelry.

There’s nothing wrong with being (let’s call it) frugal.

And not everyone has a good sense of fashion.

But let’s get real.

The Najarians don’t dress this way in real life.

The Najarians are going out of their way to create this weird “he-man,” superhero, wrestler image because they’re targeting that demographic (uneducated, broke, tacky, testosterone-driven manliness).

It’s a great demographic to focus on if you’re running a trading service because males are known to trade stocks much more than females.

And lower-income males are typically desperate to boost their income.

Finally, because they’re not well-educated, this demographic is generally going to be easy to dupe.

It's a really bizarre to imagine these clowns offering trading recommendations.

Like many predators, Jon and Pete Najarian jumped into the "latest, greatest, hottest market" of speculators who were convinced they would strike it rich "investing" in cryptocurrencies.

The majority of crypto speculators are the "low hanging fruit," otherwise often referred to as the "dummies." They were being conned and exploited by the crypto kingpins who were really making all of the money (exchanges, backers of new crypto coins, NFTs, etc., along with Wall Street and venture capital investors who backed many of these projects and even launched crypto projects of their own).

I won't even talk about all of the illegal money being funneled into the crypto industry because it's a topic of discussion that deserves dedicated coverage.

There were also some not-so-dumb individuals how bought into the cryptocurrency pitch. But they too were fooled because their judgment had been warped by greed along with chronic exposure to media.

Jon and Pete have been part of the cryptocurrency pumping cabal on CNBC for quite a while. 2

As ridiculous as these guys look, it's still extremely difficult for me to believe that the Najarians are unaware that all cryptocurrencies are scams. But they don't seem to care as long as they can make money pitching cryptocurrency trading services.

The Najarians have been promoting cryptocurrencies and crypto-related investments for several years, apparently because it enabled them to reach a large audience of suckers looking to strike it rich.

Guess who struck it rich instead?

And guess who got stuck holding the bag when it emptied?

As you might already know, some of the world's biggest con artists went from first trashing cryptocurrencies early on (when the number of participants was relatively small) to promoting them once they saw the audience of suckers explode to huge numbers. Many of these predators who flip-flopped to promote cryptocurrencies once they became big are well-known Jewish con artists.

Take the case of Jewish life coach and motivational speaker, Tony Robbins (real name Anthony Mahavoric) who now claims to be the world's top business strategist.

In my opinion, Tony Robbins is arguably the world's biggest con man.

Robbins went from first characterizing cryptocurrencies as a gamble, "similar to going to a Vegas casino" in 2017 (CNBC), to embracing cryptos a year later after realizing how large the market for crypto sheep had become.

Quite simply, Robbins changed his tune once he began to notice how many people had been sucked in by this scammy industry.

Preditably, Robbins jumped aboard the crypto band wagon once he realized it would be a huge source of potential sheep to herd with his own crypto BS, from ghost-written books, to seminars and other trash.

Fortunately for the public, the crypto industry crashed hard causing Robbins to hold off on becoming the next crypto prophet. But there's always the crypto bubble, right?

Although Robbins is no stranger to scams, his endorsement of cryptos was a stretch even for him given that he has been desperately trying to position himself as a legitimate source of investment insight for over a decade.

For more see Tony Robbins - Another Con Man Who Promoted Cryptocurrencies

By promoting cryptocurrencies as lucrative trading and investment vehicles, Jon and Pete Najarian cashed in big at the expense of those who trusted them as "experts."

This perception of the Najarians as trading "experts" was created after having received tens of millions of dollars in free promotion from CNBC. For around two decades. Jon and Pete have been featured on CNBC as "experts" discussing stock trades.

Over the past several years Jon Najarian served as one of the cryptocurrency kingpins on CNBC as he promoted trading and even investing on these scammy vehicles.

Despite the fact that much of what Jon and Pete discuss on CNBC is almost always generic and usually useless for those looking to make trades (for example, they don't provide specific trade setups, exit prices, or risk management considerations) the fact that they are blabbering away in front of a camera fools gullible investors to think they are knowledgeable "experts" because CNBC keeps claiming that they are over and over.

I won't even get into the fact that CNBC and other media firms should not even be covering trading of any assets. I'll save this discussion for another time.

Think about it. If CNBC and other financial networks feature credible experts like Warren Buffett, then surely Jon and Pete Najarian must also be "experts" if they are featured on the same networks, right?

Moreover, this conclusion must especially be true given that they've received daily airtime on CNBC for close to two decades, right?

It's only true if you lack the most basic abilities to think critically.

After all, if they aren't experts, why would CNBC feature them so much, right?

By now you probably know why the Najarians and other clowns positioned as "experts" are featured in the financial media. I've revealed the answer many times for over a decade.

I'll sum it up in one sentence. The financial media deceives its audience by claiming they are featuring real experts in order to command higher prices for advertisements because the advertisers (which are mostly from the financial industry) will land more customers after the media's "experts" steer them into the gutter.

Using their clout as "experts" (paid shills) on CNBC and other media platforms, the Najarians position their dodgy trading service, Market Rebellion as a great source for cryptocurrency and stock trading.

But if it's such a great trading service, why do they refuse to post the results?

You should know the answer to that. I'm willing to bet that the performance of Market Rebellion's trading service sucks just as bad as the Najarian's previous online trading service, Options Monster.

But we will never know just how bad their trading services have been since they have always refused to publish third-party audited results.

The Najarians have a long history of promoting their sketchy (to say the least) online trading services by leveraging their TV celebrity status. For instance, you might want to look into the controversial past of the Najarians' previous trading website, Options Monster to help you understand what these guys are all about. 3

The enormous media exposure received by Jon Najarian enabled him to lure countless suckers who forked over thousands of dollars in exchange for cryptocurrency trading recommendations from his company, Market Rebellion.

Note that Market Rebellion began recommending cryptocurrencies soon after it was launched in 2020. 4

More on Market Rebellion in the future, but for now you can check here.

Let's not forget that before Market Rebellion was launched Jon Najarian served as a paid shill for the now jailed Jon "Crypto King" Caruso.

Najarian made several videos for his previous trading service Investitute to promote its Las Vegas event featuring a slew of Jewish con artists in addition to Caruso.

The videos were posted on Najarian's twitter along with what seemed like an endless number of tweets telling everyone about Caruso and other trading "experts" (all Jewish of course) that would be at his dog-and-pony clown show event.

It's critical to note that Caruso was running a crypto Ponzi scheme at the time Najarian was paid to promote him. I find it hard to believe Najarian didn't at least suspect Caruso was up to no good given the typical excessive Ponzi scheme-like returns Caruso was claiming, as he sought to lure more suckers into his scam.

But money talks if you're a dishonest, money worshipping scum bag. Such characters typically ask no questions as long as they are being paid. I suppose they believe they have no culpability because they aren't the ones carrying out the scam, but this just isn't the case.

Interestingly, in addition to having deleted hundreds of tweets in order to erase all his association with Caruso, Najarian also changed the name of his company Investitute, to Market Rebellion in 2020, just months after the Vegas event featuring Caruso and soon after Caruso was arrested.

I previously wrote about this debacle. See here.

Did Jon Najarian learn his lesson after mysteriously escaping possible civil and/or criminal repercussions from his involvement with Caruso?

Nope.

Instead of backing off from the scammy cryptocurrency industry, Najarian continued to promote all kinds of cryptocurrencies and cryptocurrency "assets" on CNBC as well as through his Market Rebellion website, where he offered educational courses on cryptos along with numerous crypto trading services.

Why didn't Najarian learn his lesson after what seems to me to have been a narrow escape from some type of legal action?

GREED. Similar to every other so-called "expert" promoted on CNBC as a great source of investment insight, Jon Najarian appears to be a relentless money worshipping dirt bag who has no limitations when it comes to extracting money from people.

Voyager Digital, a Jewish-run and Jewish-funded crypto trading platform was among one of the cryptocurrency investments promoted by Jon Najarian and his scammy Market Rebellion trading service.

And remember that Najarian used CNBC to reach millions of people while promoting this scam. Without CNBC, Najarian would have been extremely limited in his ability to reach people who may have fallen for his BS.

Watch the first video below where Najarian even stated that Voyager was one of the few remaining cryptocurrencies he owned on July 1, 2022.

This served as a confidence boost or perhaps an implied endorsement of Voyager to those who might have been worried about its ability to survive.

The next day Voyager suspended trading, deposits, and withdrawals (second video).

A few days later on July 6, Voyager filed for bankruptcy protection (third video).

CNBC: Crypto is a 24/7 asset and can drive you crazy: MarketRebellion's Jon Najarian (July 1, 2022)

CNBC: Crypto firm Voyager suspends trading, deposits and withdrawals (July 2, 2022)

CNBC: Crypto broker Voyager Digital files for bankruptcy (July 6, 2022)

But of course Najarian was not the only CNBC "expert" (dirt bag) to shill for Voyager.

Fellow Jewish tribesman and con man, Mark Cuban was shilling even harder for several scammy cryptocurrencies, including Voyager.

I hope to cover Cuban in a separate piece devoted entirely to him.

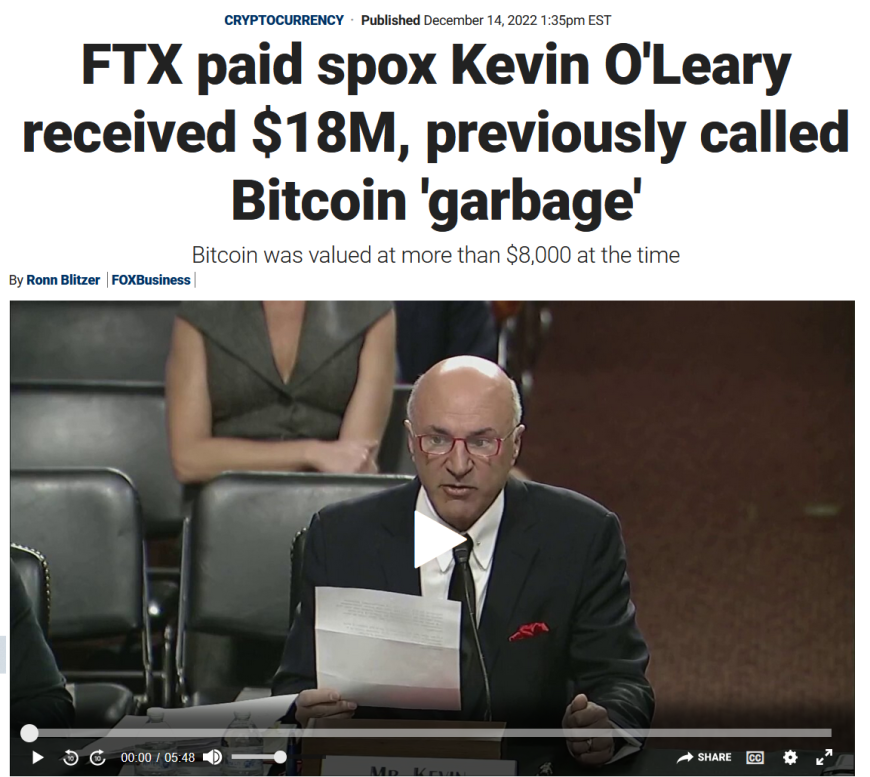

And then of course we have Kevin O'leary, another Jewish con man promoted by the Jewish-run media as an "expert." In addition to his long history of less than honest and even scammy behavior, O'Leary was a big promoter of cryptocurrencies.

O'Leary is one of the many kosher con artists featured on CNBC's fake TV show Shark Tank. O'Leary went from initially trashing cryptocurrencies to promoting and endorsing them once he realized he could make a fortune as a shill for cryptocurrencies, NFTs, and crypto exchanges like the now defunct FTX. 1

It seems likely that O'Leary initially trashed bitcoin and other cryptocurrencies in the beginning because he viewed them as possible competition towards his overpriced and deceptively marketed EFTs.

See here for more on O'Leary's overpriced, deceptively marketed ETFs.

Kevin O'Leary's is a Scam Artist and His ETFs Are Terrible and Come With Huge Fees

Kevin O'Leary Exposed as a Huge Con Man and Scam Artist by Leading Investment Expert

Con Artist Kevin O'Leary Breaks Federal Trade Commission Law Again

Similar to Kevin O'Leary, Mark Cuban and other Shark Tank con artists, fellow kosher charlatans Jon and Pete Najarian jumped aboard the crypto scam band wagon in order to extract money from people who were led to believe they are credible and honest sources to be trusted.

Where did people get the idea that the Najarans were credible?

Answer: from the criminals on CNBC who promote them on a daily basis as "experts," along with many other kosher media firms which also promote them as "experts."

It's like I've been saying for more than a decade, the single best thing a person can do to improve their life in all aspects and especially as an investor, is to avoid all media.

I define media as anything that contains ad-based content. That includes Facebook, YouTube and every other portal that sells ads.

As far as being honest, I have no idea how any sane person with an IQ over 70 who have ever seen these two clowns would conclude they're remotely honest. Perhaps this points to something about the intelligence level of the typical CNBC audience.

Has CNBC ever called out Jon Najarian for aggressively promoting and shilling for cryptocurrency scams like Voyager Digital?

Of course not.

Has CNBC ever apologized to its audience for promoting scammy crypto pumper Jon Najarian as an "expert"?

Of course not.

CNBC is a criminal organization committed to carrying out scams for and in conjunction with Jewish-controlled Wall Street along with the Jewish dominated cryptocurrency industry.

Meanwhile, CNBC supports its tribe of dishonest con artists and money worshippers by providing them with unlimited access to media exposure for which they use to herd sheep into the poor house via deception, disinformation, and various scams.

1 I have previously explained that Warren Buffett's investment success came in the first half of his investing career (1965-1997) when there was very little competition among funds, access to the capital markets was quite limited, and a large percentage of the gains (possibly the majority of gains depending on the time frame under consideration) made by Berkshire Hathaway were the result of private market transactions. Meanwhile, the more recent performance of Berkshire Hathaway has not been so impressive.

Moreover, I have also discussed the fact that Berkshire Hathaway's performance is always compared to the S&P 500 Index (even though this index is not an accurate or appropriate benchmark for Buffett's fund) because it takes on much more risk than the S&P 500, is not always fully invested, buys fixed income, commodities, and as previously mentioned also buys private companies. For instance, Berkshire also receives many special investment deals unavailable to the public.

Even the most broadly applied or generous comparisons between Berkshire Hathaway and the S&P 500 Index are skewed because Berkshire does not pay dividends or distribute income. This in and of itself is quite strange considering that Berkshire Hathaway is considered a value fund. If you inspect the top holdings of Berkshire you will see that most pay nice dividends. So why aren't these dividends distributed to shareholders in the form of cash as with the case with all value funds?

The dividends received by Bershire through its investments are reinvested back into Berkshire Hathaway, making the performance appear to be better than it really is when compared to the performance of the S&P 500 Index.

You will rarely if ever see the performance of Berkshire Hathaway (which reinvests its dividends) compared to the performance of the S&P 500 Index with reinvested dividends. Therefore, on the most basic level Buffett is utilizing an edge that's not often if ever discussed by the dishonest and criminal financial media.

Finally, you are not likely to hear anyone (unless they heard it from me first) discuss the fact that one of Berkshire's most powerful advantages is that it has access to a continuous source of cash flows through its ownership of insurance giant Geiko. Having access to a large and predictable stream of incoming cash provides a tremendous benefit.

First, it enables Berkshire to lower the cost basis of the fund's investments. And because Berkshire primarily invests in safe blue chip stocks, so long as cash keeps coming into the fund (from Geiko) Buffett can keep buying as his holdings decline in price, but the costs basis of the fund's positions will also decline.

Second, having access to a predictable and reliable stream of incoming cash enables the fund to avoid one of the pitfalls seen in many funds which is accurately predicting and dealing with net redemptions.

None of these characterisitics resembles the S&P 500 Index. Of course there is much more I could discuss about Berkshire but I will save it for another time.

All of these considerations aside, Warren Buffett is a very accomplished investor. The problem is that he's also the most overrated investor in U.S. history.

So when you see a real expert in the media like Warren Buffett (which is quite rare) the audience will be inclined to assume that the other "experts" featured on the network are true experts, especially when the hosts of the show tell you that they're "legendary, brilliant," and so forth.

These hosts often even mischaracterize or simply lie about the track record of its "experts" in order to convince the audience that they should tune in to listen to what their "experts" have to say because they can lead you to easy riches.

Very few people will bother to document the track record of the recommendations of these "experts" or go through and scrutinize their fund and it's performance because they don't feel the need to because they are "experts."

It's also important to point out that hedge funds never post their annual returns on a consistent basis to the public. They post their returns usually when they are great.

Don't you think that all hedge fund managers interviewed by the media should be required by the network that interviews them to provide third-party audited historical returns for their funds prior to being interviewed? And don't you think the media should show its audience these performance results?

There are several different levels of con artists and idiots promoted by the financial media as "experts." At the highest level are a few guys like Warren Buffett. But even Buffett's accomplishments and skills have been greatly exaggerated by the media, as previously discussed (in brief). This has led to the sheep effect whereby everyone is convinced that Buffett is the world;s greatest investor. And if you challenge that belief, most people will think you're either clueless or crazy.

The fact is that the performance of Berkshire Hathaway has never been properly characterized by anyone in the financial media because the industry uses Buffett as a foundation of its credibility. Thus, any real criticism or scrutiny of Buffett or his performance would be bad for the media's business of duping its audience.

Built on this foundation of rarely interviewed top-level experts are lower-level experts who are legitimate, but only appear in interviews in order to manipulate their investment holdings and/or for free marketing and never provide any valuable insight or knowledge. However, one could argue that their motivation for appearing in media in order to manipulate securities calls into question whether their expertise is more slanted towards securities manipulation.

A great example of a lower-level expert is Bill Ackman. Ackman is certainly a successful and credible fund manager. But he has on more than one occassion made appearances in the financial media in order to manipulate investments for his benefit. There are quite a few of these fund managers that appear in the media. All the media has to say is that they manage such and such amount of money, and they're great investors, rattle off one or two great calls they have made in the past, and the audience will believe the guest is a true expert.

Below guys like Ackman are Wall Street analysts who have agendas set forth by the firm they work for. On the other hand, an experienced investor can sometimes filter past the BS to determine what's valid and relevant. The problem is that many retail investors think they are able to accomplish this, but that's rarely the case.

The problem with listening to Wall Street analysts is that you really have to already know what's going on in order to spot the spin. And you also need to have an insider understanding of how Wall Street works in order to avoid the many pitfalls of listening to analysts. This is not something many retail investors are able to do. It's even very difficult for seasoned professionals to accomplish.

The next lower level includes small shops that feature an "analyst" or "chief investment officer," etc. More often than not, in this case we are talking about boiler room garbage. But the media calls them "experts." And these "experts" often fool the audience because they know what phrases to use while delivering generic and useless insight at best, or ridiculous disinformation at worst.

And then you have guys who are featured on scammy shows like Charles Payne's show from FOX Business. Payne is linked with penny stock and other scammers. You aren't likely to spot this on his show, but if he or his buddies gets your email you'll see a world of difference, causing you to really question why certain people are featured on his show.

The same applies to Jim Cramer. Cramer uses CNBC as a conduit for TheStreet and RealMoney, his investment newsletter publishing boiler rooms. In fact, many of the con men from the financial media come from these publishing boiler rooms.

However, Cramer's Mad Money also represents a complex assortment of all of the above scenarios and some i have not discussed. Quite simply, deciphering Cramer and his garbage is beyond the scope of this article. But you might want to check a few articles I wrote several years ago to give you a flavor for the various disinformation scams run by Cramer and CNBC.

2 Based on what I have seen, Pete Najarian appears to be much less directly involved promoting cryptos compared to his brother Jon. However, I am willing to bet that Pete is directly involved with Market Rebellion's crypto trading services.

On the other hand, based on what I have seen, neither Jon nor Pete provide much if any trading recommendations. They have employees who provide most of the recommendations. This makes sense given that the Najarians are sales and marketing meatheads as opposed to trading experts.

3 Upon checking Market Rebellion, I no longer see any crypto trading services. This might be as a way for Najarian to try to distance himself from this scam industry, similar to what he did by deleting tweets and renaming his trading company Market Rebellion (from Investitute) after John "Crypto King" Caruso was arrested for running a crypto Ponzi scheme.

4 Recall that Market Rebellion was formed after Najarian shut down his other trading service called Investitute as a way for his to hide his association with the "Crypto King" scammer. If you click on the Investitute URL you will see that it redirects you to marketrebellion.com https://investitute.com.