Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

Nobody in His Right Mind Would Listen to Jim Rogers

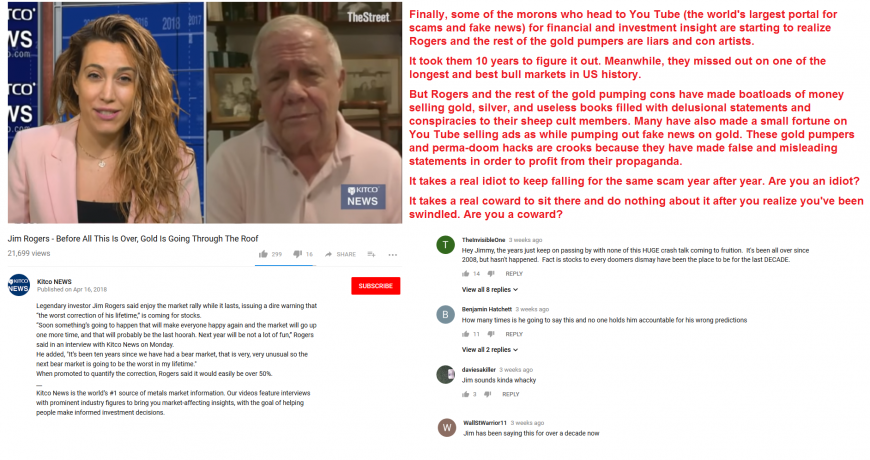

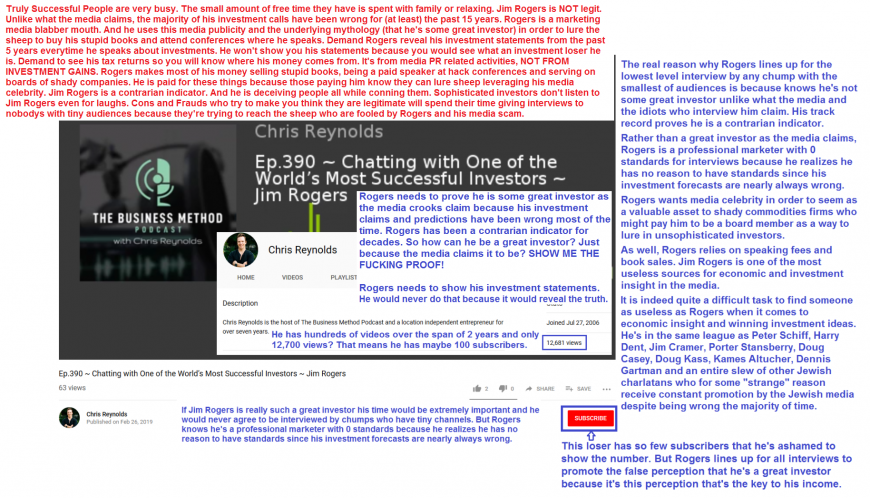

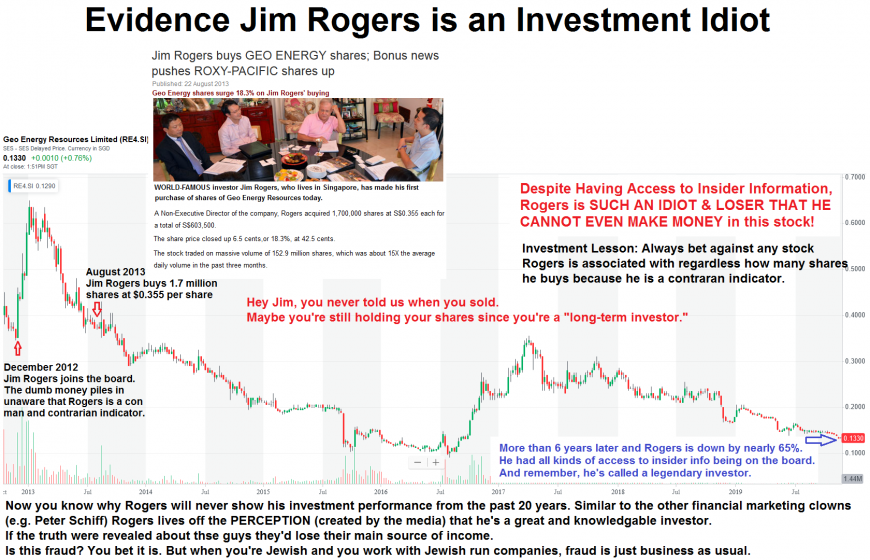

For more than a decade as part of my mission to expose the various tactics used by the financial media to fool main street, I have published numerous articles and videos exposing Jim Rogers as a clown, as well as a very reliable contrarian indicator.

His economic and investment commentaries are as predictable as they are repetitive. That wouldn't be much of an issue if these commentaries were remotely accurate and helpful to investors.

Based on my observations after going through hundreds of his interviews over the years, Jim Rogers is one of the worst sources of investment guidance aired by the media.

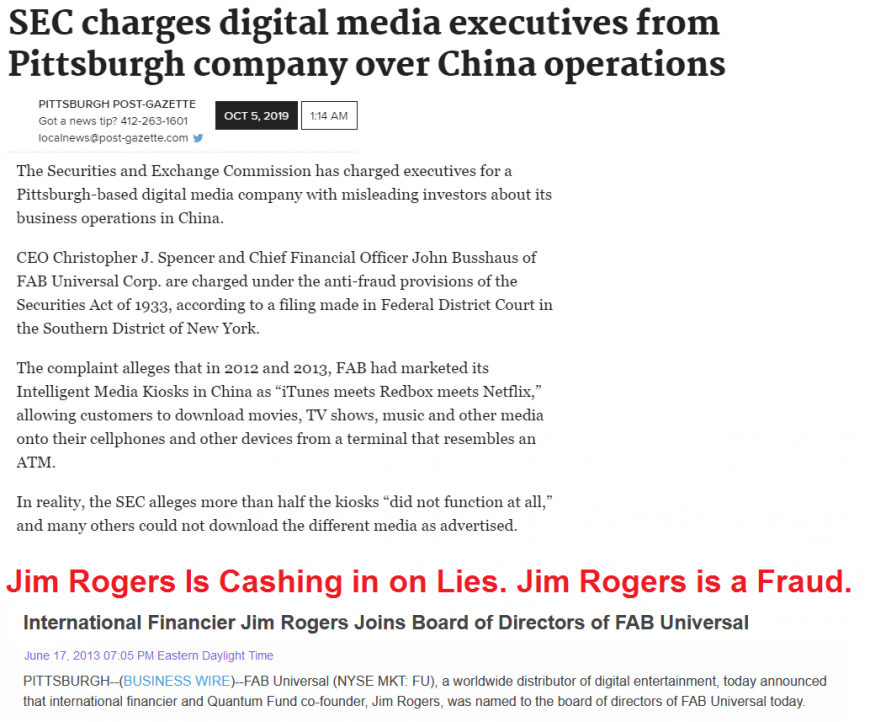

But it's actually worse than that. I have no doubt that Jim Rogers is a con artist who deceives the public by exaggerating things while hiding relavant facts in order to profit. If I am correct, it implies that Rogers is using the media to commit fraud. Thus, the financial media is complicit.

In this article I aim to show sufficient evidence backing my claims. But you are free to form your own conclusions.

Regardless of the conclusions you arrive at, you should ask yourself a critical question.

Despite being completely wrong about so many things for so many years, why is Jim Rogers constantly promoted by the financial media?

While you’re at it, you may as well ask the same of other contrarian indicators like Peter Schiff, Harry Dent and scores of other broken clocks.

Once you figure out the answer to this question you will understand how the media operates.

Remember that the financial media claims that Jim Rogers is an “investment legend.”

According to the financial media, Rogers is a great investor so you should listen to him.

But of course, this is just the hook meant to lure in fish who generate advertisement revenues for the media.

Because Jim Rogers has never disclosed his personal investment performance, we only have what he recommends during his interviews to determine whether or not he is a credible investor. Based on this account, it should be obvious that Rogers is not a great investor. In fact, he's a lousy investor.

Rogers is plastered all over the media on a daily basis, much like hundreds of other Jewish clowns who are also promoted as investment experts despite being wrong most of the time.

This emphasizes once again that if you pay attention to anyone promoted by the financial media you are certain to lose.

The fact of the matter is that the media is a criminal industry designed to exploit people who fail to understand that the ad-based content model is a primary component of the Jewish mafia's criminal business model.

Please read through the detailed remarks in the images below to refresh your memory on Rogers' track record.

Individuals who line up for free content are being fleeced by those who fund the media operations via purchase of advertisements.

It's not too difficult to understand. Ad-based content is a complete scam.

Yet even after some of Facebook's scams have been exposed, many people still fail to realize that there is nothing for free. What that means is that free content is guaranteed to exploit you. This lack of understanding reflects the times we live in, whereby the internet has dumbed down the majority of the population.

The media offers the best platform to lure a naive audience. Making money is easy if you're Jewish and you lack morals. All you need to do is blabber away and your Jewish media buddies will give you free promotion with which you can use to sell stupid books, land high dollar speaking gigs, and get paid top dollar for board seats on shady companies that need someone who can reel in the dumb money.

You can even get paid to have your name on some of the worst performing ETFs in the world.

I have just described how Jim Rogers makes his money.

But wait a minute.

I thought Rogers was retired.

That’s what he claims, right?

As you will recall, Rogers’ folklore pitch goes something like this…"after making millions with George Soros in the 1980s, Jim Rogers retired to travel the world.”

Retired means you aren’t working.

Lining up for media interviews, speaking events and holding board positions is Work.

Writing books is also Work.

Although I’m certain Rogers has never come close to having written a single book, he still had to spend time with ghost writers to discuss the kind of bull shit he wanted to communicate to his sheep audience.

And by the way, anytime someone claims to have written a book which was ghost-written but was not disclosed, that constitutes fraud. As you might imagine, much of the entire publishing industry is built on fraud.

But let's not forget another important component to Rogers' con game.

Back in 2007 Rogers claimed that he moved to Singapore because he stated this was the time people should be living in China, just like it was the time people should be living in America decades ago and so on.

It's important to note that Rogers released a book pumping China as a great place to invest in 2005.

So was his move part of a marketing plan to boost book sales? This is certainly possible. I'd say it's likely knowing how marketing clowns like Rogers operate.

As well, when asked why he moved to Singapore rather than China, given his focus on praising China's investment potential, Rogers stated that the pollution was terrible and he couldn't live there.

Think about that for a moment.

How can China be the "place to be" if it's so polluted that even Rogers refuses to live there?

Since Rogers' move to Singapore he has constantly praised the city-state when aired in western media while trashing the USA.

But is Singapore really such a great place to live?

Remember, Rogers is part of the "freedom, liberty, buy gold" libertarian racket, so why would Rogers live in a place that offers very few freedoms like Singapore?

How can the media feed its audience the worn-out intro that Rogers retired years ago when the fact is that he is actually working as an author, a paid speaker, as well as a media and penny stock promotion whore?

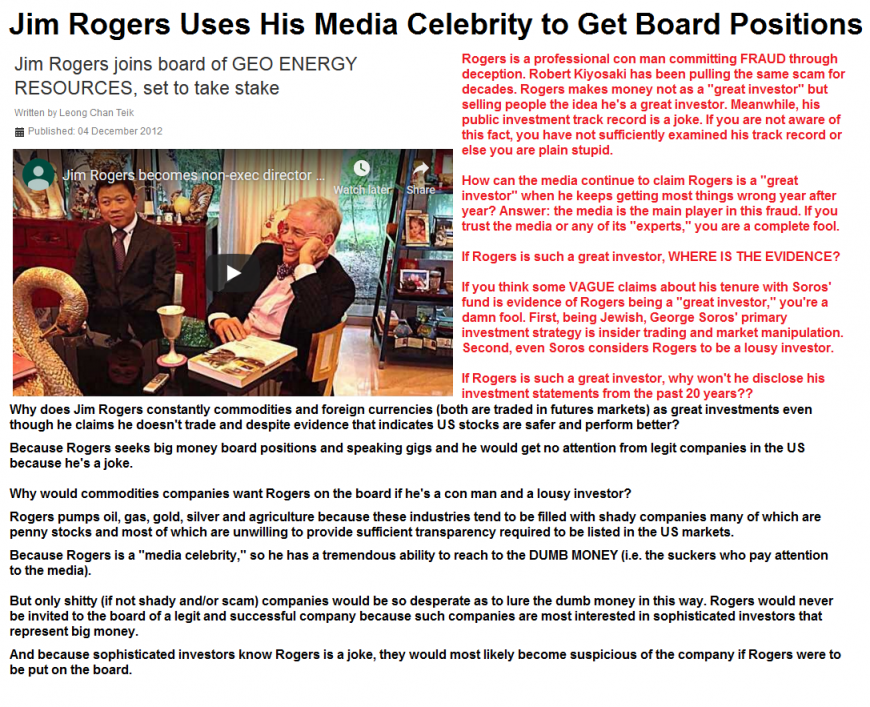

Furthermore, does the media ever mention that Jim Rogers is pumping his consistently wrong economic and investment narratives in order to build support for his ETFs, land high paying board positions (for shady companies) and paid speaking gigs in the very industries he pumps?

Of course not.

So why is the Jewish-run financial media able to get away with this kind of fraud?

Take a guess who runs the legal and justice system.

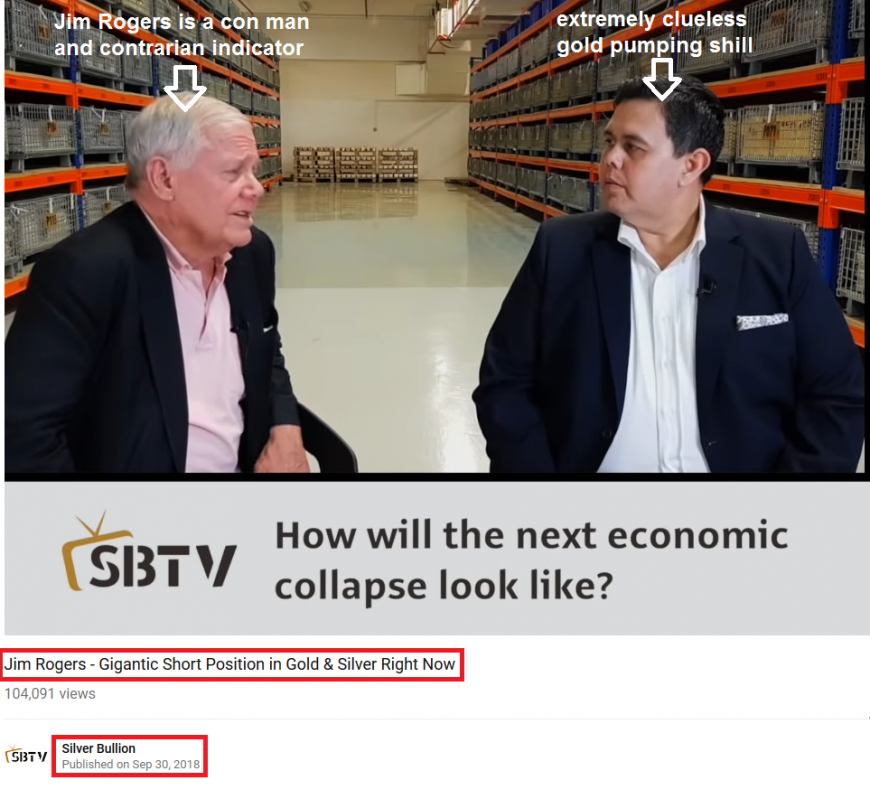

If you watch the video below you will note at the 3-minute mark Rogers states that he does not trade because he's a "terrible trader."

He claims to be a long-term investor.

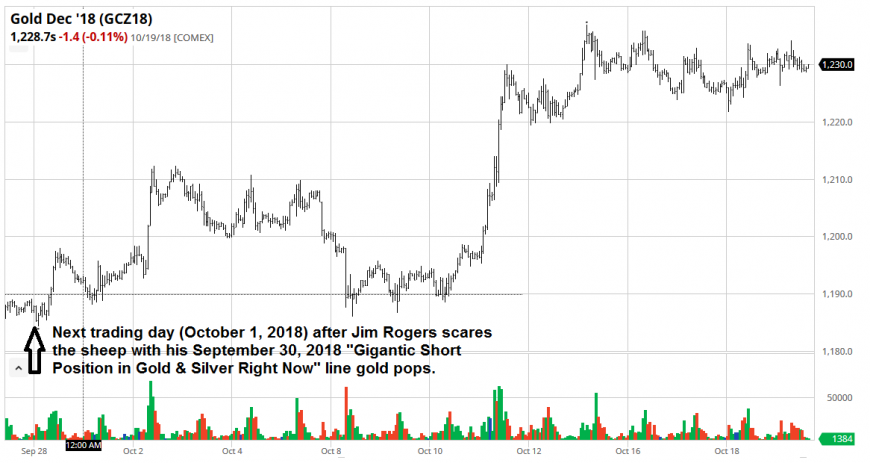

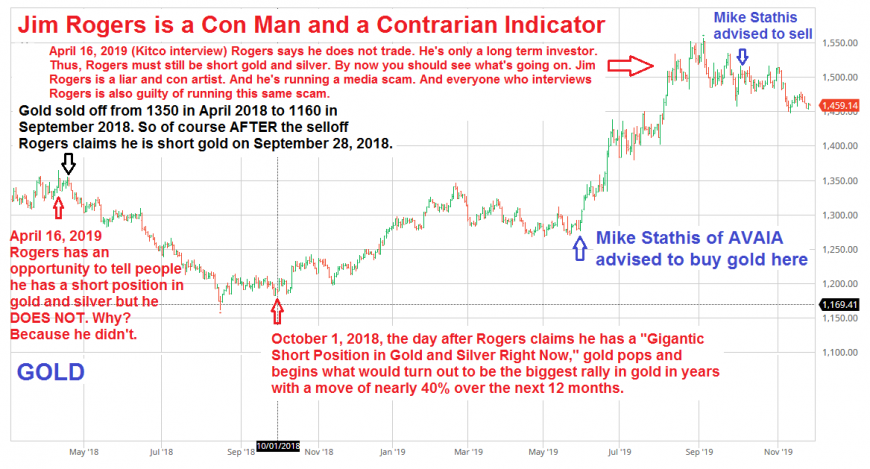

But then a few months later Rogers claims he has a "gigantic short position in gold and silver"...conveniently after both metals collapsed.

Not once has Rogers shown evidence of any positions he has claimed to hold. Given that he supposedly runs his own money in a fund, that seems a bit odd. Quite frankly, I don’t believe anything that comes out of his mouth because the man is a pure con artist. Hence, you should assume that he is lying until he shows evidence of his claims.

First, it's important to understand that entering a short position in any security is considered a very risky and speculative trading strategy.

Shorting securities is NOT a long-term investment strategy.

Think about it. Shorting is NOT a long-term strategy.

And it's not even an investment strategy.

Shorting securities is a trading strategy.

And it’s a very speculative trading strategy according to all securities regulators.

Therefore, because Rogers always claims he is a long-term investor and does not trade, simple logic leads us to conclude that Rogers lacks the most basic understanding of investment principles, or else he is a complete liar.

And let's not forget something about Rogers I've pointed out in the past.

Rogers has been pumping commodities as the place to be while specifically focusing on agricultural commodities for several years.

During that time commodities have suffered a massive long-term collapse in price. And agriculture commodities have been among the worst hit.

So if you listened to Rogers you clearly lost your ass unless you used him as a contrarian indicator.

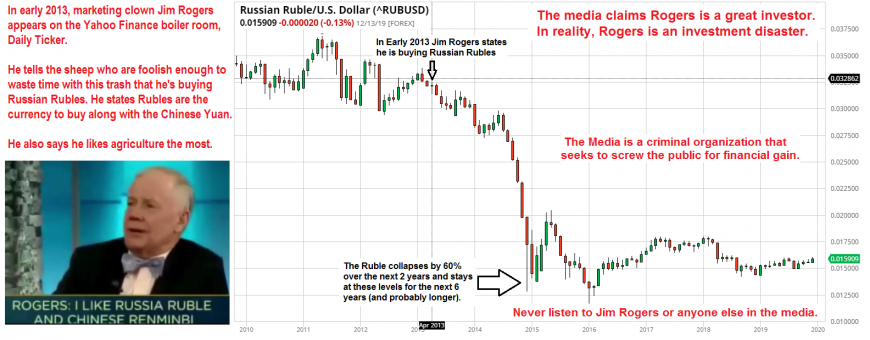

Rogers has also been promoting other speculative transactions, such as "investing" in the Russian Ruble.

The first problem with that "advice" is that there is no such thing as "investing" in currencies. Foreign currencies are traded using futures contracts. And trading securities is a speculative strategy, so once again Rogers contradicts himself.

Second, the Russian Ruble is a very volatile currency because it's linked to a very volatile economy (Russia). Therefore, trading (a very risky manuever) Rubles (a very risky currency) is consider very risky.

Moreover, for several years now Jim Rogers has been telling the public that he has been investing in the Russian stock market.

At this point you might want to ask Rogers why he promotes Russian investments so much.

The answer is simple.

Rogers holds paid board positions in several shady Russian commodities companies.

This also explains partly why he is always pumping commodities as a great investment, despite evidence that confirms this is terrible advice.

If the media actually sought to promote individuals with excellent track records, Rogers should have been barred many years ago due to his long track record of terrible and risky calls that are unsuitable for the majority of investors.

But we already know that the last thing the media wants is to air reliable experts who can actually help retail investors.

The media only cares about partnering up with Wall Street and other charlatans like Rogers who steer their audience into the poor house.

In return, Wall Street pays big bucks for ad deals because many of the individuals who act on the recommendations of clowns like Rogers end up causing these individuals to suffer huge losses, so naturally financial firms will line up to pay big money to advertise to these victims.

This also explains why the media never discusses risk or suitability.

The media wants more dumb money to enter the capital markets.

Take a guess who the recipient is of most of this dumb money.

That’s right. The media’s top customer. Wall Street.

And let's not forget another point that I've brought up in the past.

There is no way to "invest" in commodities. Investors who deal with commodities trade futures contracts.

You can purchase certain stocks and ETFs that have exposure in certain commodities. But that does not necessarily mean that your "investment" will perform well if the commodity it seeks to track increases in price because there are too many complexities and variables.

Just take a look at Rogers’ commodity ETFs.

The only way to make money with commodities is to buy the futures contracts. But you have to trade the contracts because most commodities do not have contract expirations that are of sufficient duration to take advantage of a macrotrend.

Even if you find commodities that have longer expirations, the open interest is most likely going to be quite small. That means you are likely to get stuck in these contracts due to low liquidity.

As well, you’re going to pay high prices for long contract expirations.

Notice I said "trade."

There is no such thing as investing in commodities. It's an oxymoron.

Trading involves technical analysis.

And for commodities, technical analysis is up utmost importance.

So, if Rogers doesn't trade and is bad at timing as he points out (perhaps this is his way of adding a disclaimer), how can he claim to be a great commodities investor?

Trading is NOT investing. Trading is speculation.

Although Rogers rarely if ever tells you, he gets paid for his name to be on a few commodites ETFs.

Rogers is no dummy.

He knows it would be too obvious that his agenda of promoting commodities is tied to being paid as a marketing whore if he were to mention the Rogers series of commodity ETFs.

He lets others in the media mention that.

And he knows they are going to do it.

The problem is that commodity ETFs are terrible investments because they're made of futures contracts which are constantly rolling over.

And this not only generates a large amount of fees (which are hidden) but it also causes pricing to readjust such that sizable gains are lost.

But this entire argument assumes that commodities have performed well over the past decade. The problem is they haven't.

If you listened to Rogers, you lost your ass.

Meanwhile, Rogers gets paid no matter how commodities perform because he gets licensing deals with the ETFs.

This scam isn't much different from what the gold pumpers do.

In fact, Rogers is also a gold pumper who makes money from speaking fees and other BS regardless where the price of gold goes.

Folks, these mouth pieces are screwing you with BS.

And while you lose your ass because you fall for them, they're cashing in big time regardless how wrong they are.

At the end of the day it's the naive and lazy investors who have empowered con artists like Rogers and the army of gold charlatans.

If more investors checked the track records of those they follow, they would lose less money.

Wait a minute.

Hey Jim, I though you didn't know how to trade.

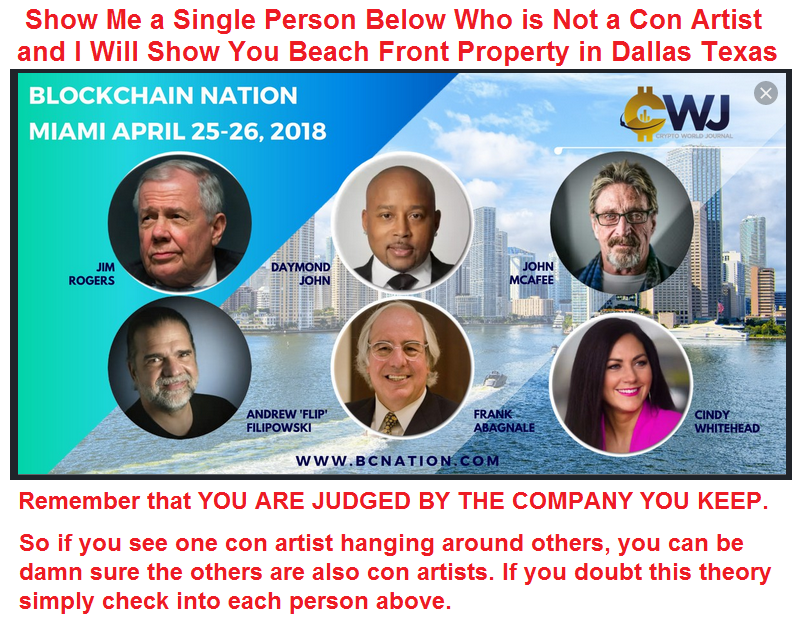

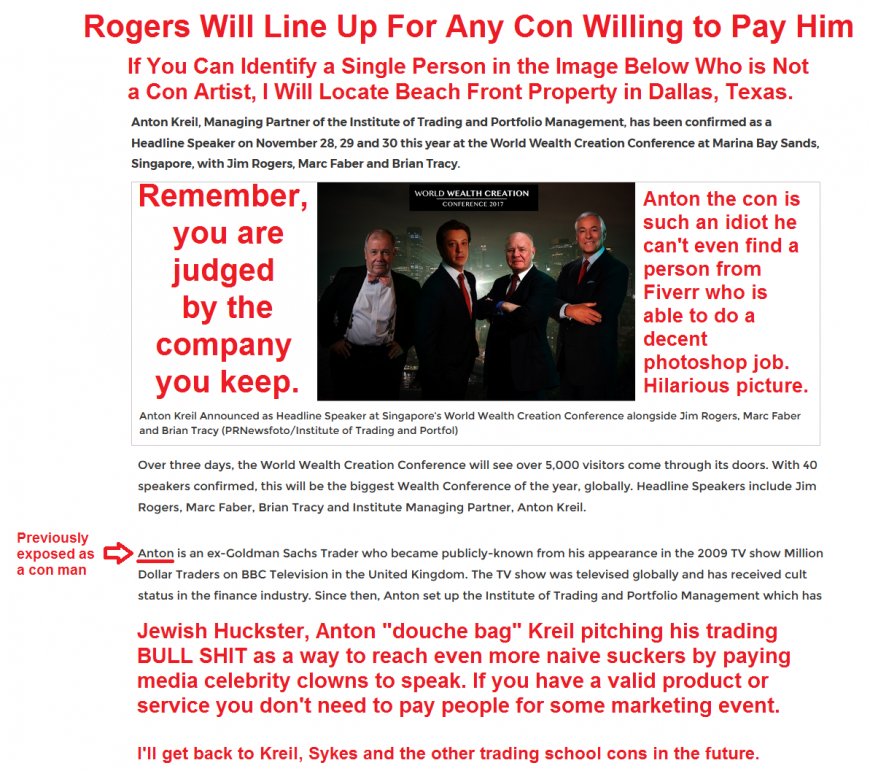

So why are you appearing at this bozo trading conference (see the image below)?

Anything for a buck, right Jim?

The lady below is stating the obvious, but she has not quite put the pieces of the puzzle together to realize what's going on.

In order to really see what's going on you have to understand the criminal nature of the media. Once you understand the media, it becomes much easier to realize that guys like Rogers continue to be interviewed because the public is too stupid to understand the media scam.

Our Chief Investment Strategist, Mike Stathis is the World's Best Investment Analyst.

Intelligent Investor Market Forecaster Dividend Gems CCPM Forecaster

Profit While Learning from the World's Top Investment Analyst (Track Record is Here)