Investment Intelligence When it REALLY Matters.

Investment Intelligence When it REALLY Matters.

World's Top Investment Analyst Debunks Dave Collum's Ridiculous Roth IRA Claims

You might recall that I wrote an article discussing that Dave Collum has been spreading major disinformation about the Roth IRA on a global stage and has been giving reckless investment advice. This all stands to reason once you realize he's a typical gold-pumping, libertarian and pureyor of fear porn and crack pot conspiracies.

See here Cornell's Conspiratorial Crackpot, Dave Collum Giving Terrible Investment Advice

In that article, I promised a more detailed followup and this is it.

A couple of years ago I emailed Collum using one of the email addresses I use to monitor email marketing campaigns of scammers. And I didn't tell him who I was (because I didn't want him to run away).

First, I'm going to post the some of the videos where he has gone on record to explain how he thinks the Roth IRA is always a bad deal and recommended everyone avoid it.

Next, I'm going to post the text of these email exchange. As you will see, I do most of the writing, while Collum responds with his simpleton logic. Note that he never bothers to counter any of my arguments. Like a well-trained con man, he sticks to his script claiming that his argument is all about "marginal versus effective tax rates."

Finally, I'm going to post the actual emails for verification.

I will follow up with a simplified explanation in another article. I will also post a ChatGPT analysis of the email exchange as well as my simplified version.

Let's begin.

Dave Collum - Vegas 2015, Stansberry Research - Dave Tells You How Important He is

Dave Collum 2014 Stansberry Investment Conference On the Roth IRA May 2014

Dave Collum Claims He Found Flaw in Roth IRA Math (April 19, 2023)

First email to Dave Collum:

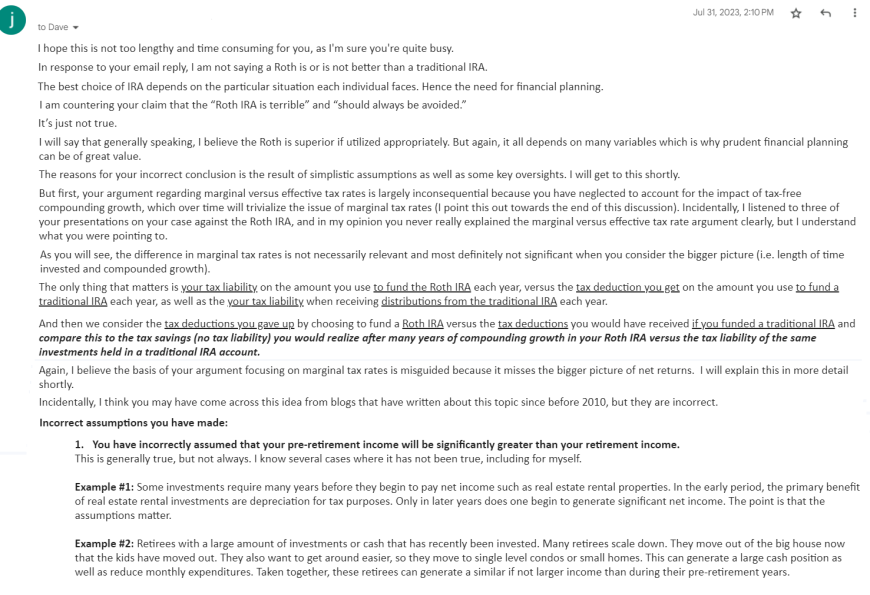

I hope this is not too lengthy and time consuming for you, as I'm sure you're quite busy.

In response to your email reply, I am not saying a Roth is or is not better than a traditional IRA.

The best choice of IRA depends on the particular situation each individual faces. Hence the need for financial planning.

I am countering your claim that the “Roth IRA is terrible” and “should always be avoided.”

It’s just not true.

I will say that generally speaking, I believe the Roth is superior if utilized appropriately. But again, it all depends on many variables which is why prudent financial planning can be of great value.

The reasons for your incorrect conclusion is the result of simplistic assumptions as well as some key oversights. I will get to this shortly.

But first, your argument regarding marginal versus effective tax rates is largely inconsequential because you have neglected to account for the impact of tax-free compounding growth, which over time will trivialize the issue of marginal tax rates (I point this out towards the end of this discussion).

Incidentally, I listened to three of your presentations on your case against the Roth IRA, and in my opinion you never really explained the marginal versus effective tax rate argument clearly, but I understand what you were pointing to.

As you will see, the difference in marginal tax rates is not necessarily relevant and most definitely not significant when you consider the bigger picture (i.e. length of time invested and compounded growth).

The only thing that matters is your tax liability on the amount you use to fund the Roth IRA each year, versus the tax deduction you get on the amount you use to fund a traditional IRA each year, as well as the your tax liability when receiving distributions from the traditional IRA each year.

And then we consider the tax deductions you gave up by choosing to fund a Roth IRA versus the tax deductions you would have received if you funded a traditional IRA and compare this to the tax savings (no tax liability) you would realize after many years of compounding growth in your Roth IRA versus the tax liability of the same investments held in a traditional IRA account.

Again, I believe the basis of your argument focusing on marginal tax rates is misguided because it misses the bigger picture of net returns. I will explain this in more detail shortly.

Incidentally, I think you may have come across this idea from blogs that have written about this topic since before 2010, but they are incorrect.

Incorrect assumptions you have made:

1. You have incorrectly assumed that your pre-retirement income will be significantly greater than your retirement income.

This is generally true, but not always. I know several cases where it has not been true, including for myself.

Example #1: Some investments require many years before they begin to pay net income such as real estate rental properties. In the early period, the primary benefit of real estate rental investments are depreciation for tax purposes. Only in later years does one begin to generate significant net income. The point is that the assumptions matter.

Example #2: Retirees with a large amount of investments or cash that has recently been invested. Many retirees scale down. They move out of the big house now that the kids have moved out. They also want to get around easier, so they move to single level condos or small homes. This can generate a large cash position as well as reduce monthly expenditures. Taken together, these retirees can generate a similar if not larger income than during their pre-retirement years.

Example #3: Many retirees have multiple sources of retirement income. Some will be making more during retirement than when working.

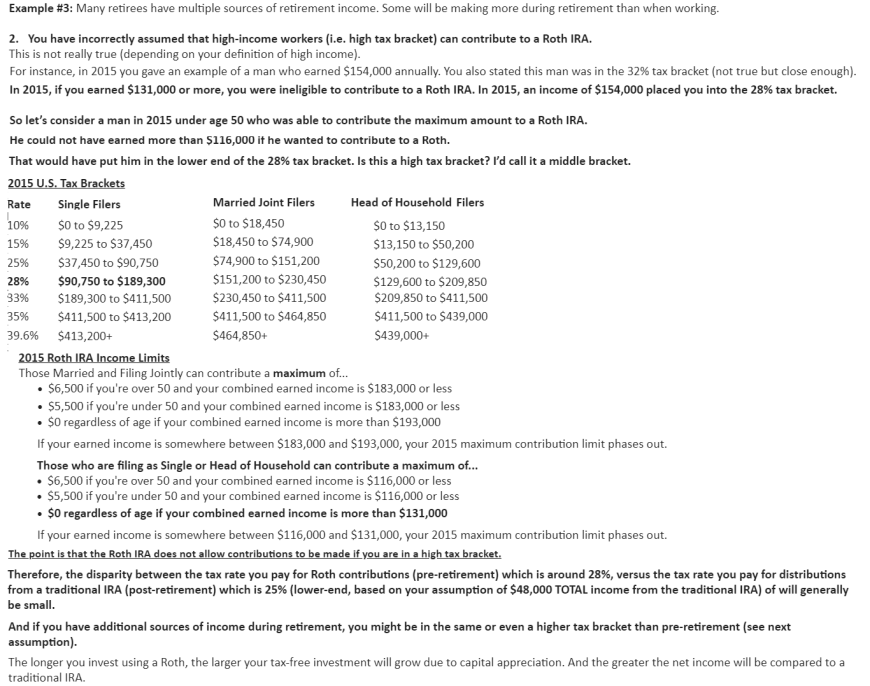

2. You have incorrectly assumed that high-income workers (i.e. high tax bracket) can contribute to a Roth IRA.

This is not really true (depending on your definition of high income).

For instance, in 2015 you gave an example of a man who earned $154,000 annually. You also stated this man was in the 32% tax bracket (not true but close enough).

In 2015, if you earned $131,000 or more, you were ineligible to contribute to a Roth IRA. In 2015, an income of $154,000 placed you into the 28% tax bracket.

So let’s consider a man in 2015 under age 50 who was able to contribute the maximum amount to a Roth IRA.

He could not have earned more than $116,000 if he wanted to contribute to a Roth.

That would have put him in the lower end of the 28% tax bracket. Is this a high tax bracket? I’d call it a middle bracket.

2015 U.S. Tax Brackets (corresponding to the date of the video used to critique him)

Rate Single Filers Married Joint Filers Head of Household Filers

10% $0 to $9,225 $0 to $18,450 $0 to $13,150

15% $9,225 to $37,450 $18,450 to $74,900 $13,150 to $50,200

25% $37,450 to $90,750 $74,900 to $151,200 $50,200 to $129,600

28% $90,750 to $189,300 $151,200 to $230,450 $129,600 to $209,850

33% $189,300 to $411,500 $230,450 to $411,500 $209,850 to $411,500

35% $411,500 to $413,200 $411,500 to $464,850 $411,500 to $439,000

39.6% $413,200+ $464,850+ $439,000+

2015 Roth IRA Income Limits (corresponding to the date of the video used to critique him)

Those Married and Filing Jointly can contribute a maximum of...

- $6,500 if you're over 50 and your combined earned income is $183,000 or less

- $5,500 if you're under 50 and your combined earned income is $183,000 or less

- $0 regardless of age if your combined earned income is more than $193,000

If your earned income is somewhere between $183,000 and $193,000, your 2015 maximum contribution limit phases out.

Those who are filing as Single or Head of Household can contribute a maximum of...

- $6,500 if you're over 50 and your combined earned income is $116,000 or less

- $5,500 if you're under 50 and your combined earned income is $116,000 or less

- $0 regardless of age if your combined earned income is more than $131,000

If your earned income is somewhere between $116,000 and $131,000, your 2015 maximum contribution limit phases out.

The point is that the Roth IRA does not allow contributions to be made if you are in a high tax bracket.

Therefore, the disparity between the tax rate you pay for Roth contributions (pre-retirement) which is around 28%, versus the tax rate you pay for distributions from a traditional IRA (post-retirement) which is 25% (lower-end, based on your assumption of $48,000 TOTAL income from the traditional IRA) of will generally be small.

And if you have additional sources of income during retirement, you might be in the same or even a higher tax bracket than pre-retirement (see next assumption).

The longer you invest using a Roth, the larger your tax-free investment will grow due to capital appreciation. And the greater the net income will be compared to a traditional IRA.

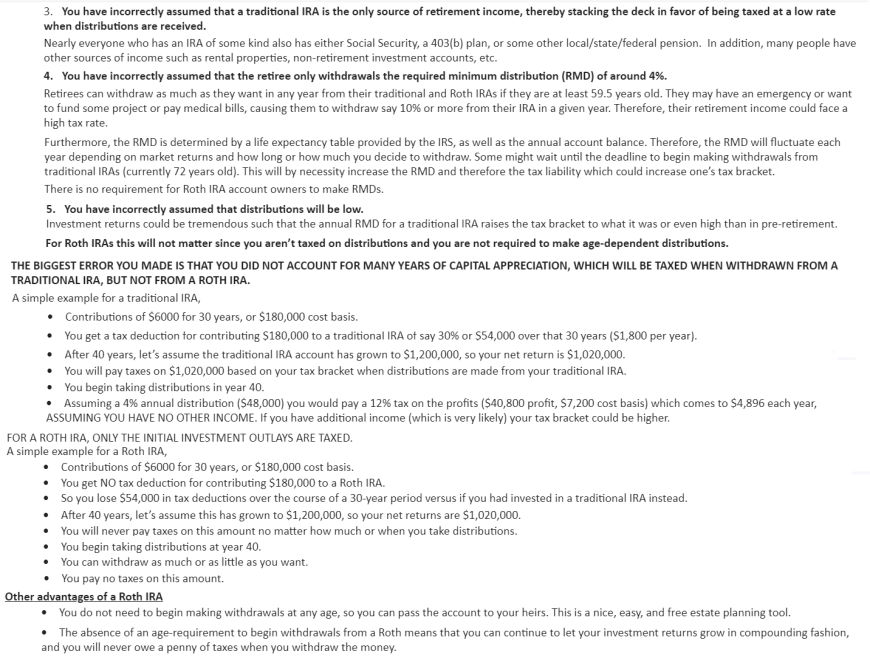

2. You have incorrectly assumed that a traditional IRA is the only source of retirement income, thereby stacking the deck in favor of being taxed at a low rate when distributions are received.

Nearly everyone who has an IRA of some kind also has either Social Security, a 403(b) plan, or some other local/state/federal pension. In addition, many people have other sources of income such as rental properties, non-retirement investment accounts, etc.

3. You have incorrectly assumed that the retiree only withdrawals the required minimum distribution (RMD) of around 4%.

Retirees can withdraw as much as they want in any year from their traditional and Roth IRAs if they are at least 59.5 years old. They may have an emergency or want to fund some project or pay medical bills, causing them to withdraw say 10% or more from their IRA in a given year. Therefore, their retirement income could face a high tax rate.

Furthermore, the RMD is determined by a life expectancy table provided by the IRS, as well as the annual account balance. Therefore, the RMD will fluctuate each year depending on market returns and how long or how much you decide to withdraw. Some might wait until the deadline to begin making withdrawals from traditional IRAs (currently 72 years old). This will by necessity increase the RMD and therefore the tax liability which could increase one’s tax bracket.

There is no requirement for Roth IRA account owners to make RMDs.

4. You have incorrectly assumed that distributions will be low.

Investment returns could be tremendous such that the annual RMD for a traditional IRA raises the tax bracket to what it was or even high than in pre-retirement.

For Roth IRAs this will not matter since you aren’t taxed on distributions and you are not required to make age-dependent distributions.

THE BIGGEST ERROR YOU MADE IS THAT YOU DID NOT ACCOUNT FOR MANY YEARS OF CAPITAL APPRECIATION, WHICH WILL BE TAXED WHEN WITHDRAWN FROM A TRADITIONAL IRA, BUT NOT FROM A ROTH IRA.

A simple example for a traditional IRA,

- Contributions of $6000 for 30 years, or $180,000 cost basis.

- You get a tax deduction for contributing $180,000 to a traditional IRA of say 30% or $54,000 over that 30 years ($1,800 per year).

- After 40 years, let’s assume the traditional IRA account has grown to $1,200,000, so your net return is $1,020,000.

- You will pay taxes on $1,020,000 based on your tax bracket when distributions are made from your traditional IRA.

- You begin taking distributions in year 40.

- Assuming a 4% annual distribution ($48,000) you would pay a 12% tax on the profits ($40,800 profit, $7,200 cost basis) which comes to $4,896 each year, ASSUMING YOU HAVE NO OTHER INCOME. If you have additional income (which is very likely) your tax bracket could be higher.

FOR A ROTH IRA, ONLY THE INITIAL INVESTMENT OUTLAYS ARE TAXED.

A simple example for a Roth IRA,

- Contributions of $6000 for 30 years, or $180,000 cost basis.

- You get NO tax deduction for contributing $180,000 to a Roth IRA.

- So you lose $54,000 in tax deductions over the course of a 30-year period versus if you had invested in a traditional IRA instead.

- After 40 years, let’s assume this has grown to $1,200,000, so your net returns are $1,020,000.

- You will never pay taxes on this amount no matter how much or when you take distributions.

- You begin taking distributions at year 40.

- You can withdraw as much or as little as you want.

- You pay no taxes on this amount.

Other advantages of a Roth IRA

- You do not need to begin making withdrawals at any age, so you can pass the account to your heirs. This is a nice, easy, and free estate planning tool.

- The absence of an age-requirement to begin withdrawals from a Roth means that you can continue to let your investment returns grow in compounding fashion, and you will never owe a penny of taxes when you withdraw the money.

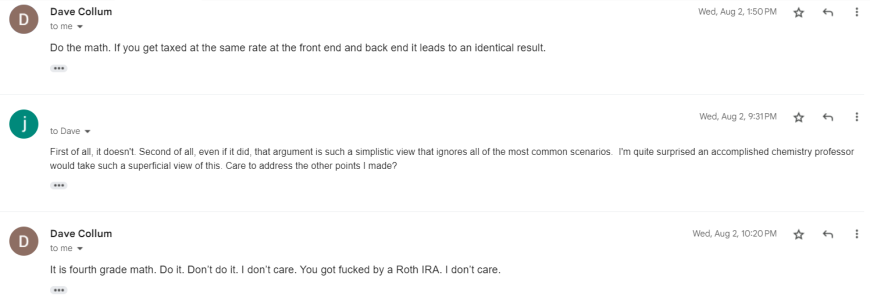

Dave Collum’s Second Response:

Do the math. If you get taxed at the same rate at the front end and back end it leads to the same result.

My response:

First of all, it doesn't. Second of all, even if it did, that argument is such a simplistic view that ignores all of the most common scenarios.

I'm quite surprised an accomplished chemistry professor would take such a superficial view of this.

Care to address the other points I made?

Dave Collum’s Third Response:

It’s fourth grade math. Do it. Don’t do it. I don’t care.

You got fucked by Roth IRA. I don’t care.

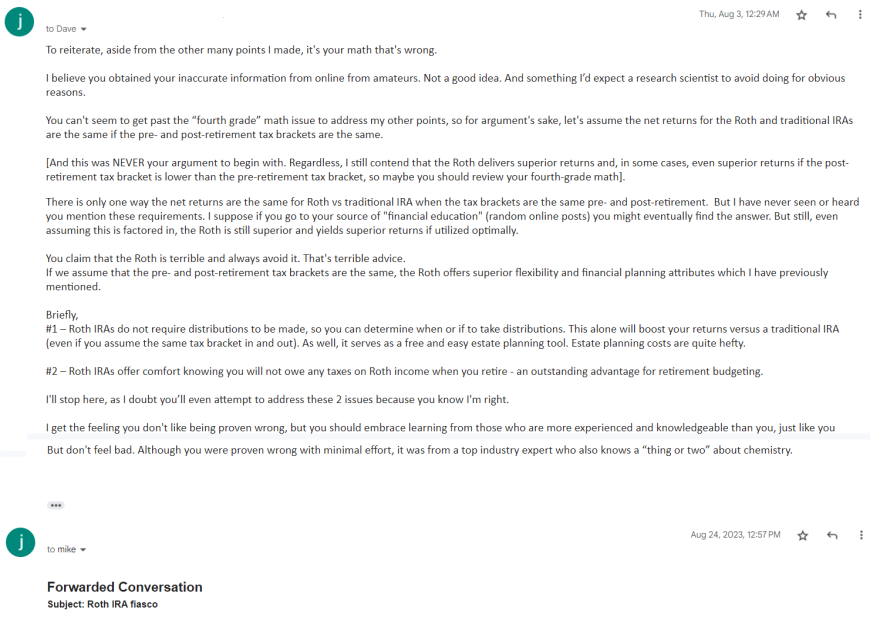

My response:

To reiterate, aside from the other many points I made, it's your math that's wrong.

I believe you obtained your inaccurate information online from amateurs. Not a good idea. And something I’d expect a research scientist to avoid doing for obvious reasons.

You can't seem to get past the “fourth grade” math issue to address my other points, so for argument's sake, let's assume the net returns for the Roth and traditional IRAs are the same if the pre- and post-retirement tax brackets are the same.

[And this was NEVER your argument to begin with. Regardless, I still contend that the Roth delivers superior returns and, in some cases, even superior returns if the post-retirement tax bracket is lower than the pre-retirement tax bracket, so maybe you should review your fourth-grade math].

There is only one way the net returns are the same for Roth vs traditional IRA when the tax brackets are the same pre- and post-retirement (you must invest the amount you saved from a regular IRA deduction into an IRA so that it grows tax deferred, but this is not possible).

I have never seen or heard you mention these requirements. I suppose if you go to your source of "financial education" (random online posts) you might eventually find the answer. But still, even assuming this is factored in, the Roth is still superior and yields superior returns if utilized optimally.

You claim that the Roth is terrible and always avoid it. That's terrible advice.

If we assume that the pre- and post-retirement tax brackets are the same, the Roth offers superior flexibility and financial planning attributes which I have previously mentioned.

Briefly,

#1 – Roth IRAs do not require distributions to be made, so you can determine when or if to take distributions. This alone will boost your returns versus a traditional IRA (even if you assume the same tax bracket in and out). As well, it serves as a free and easy estate planning tool. Estate planning costs are quite hefty.

#2 – Roth IRAs offer comfort knowing you will not owe any taxes on Roth income when you retire - an outstanding advantage for retirement budgeting.

I'll stop here, as I doubt you’ll even attempt to address these 2 issues because you know I'm right.

I get the feeling you don't like being proven wrong, but you should embrace learning from those who are more experienced and knowledgeable than you, just like you expect of your students.

But don't feel bad. Although you were proven wrong with minimal effort, it was from a top industry expert who also knows a “thing or two” about chemistry.

I always put my money where my mouth. I’m not always right but backing my claims with money forces me to carefully consider my claims.

Now if you are up to making an official wager on your claim that the Roth IRA is terrible and should always be avoided, versus my claims (see my original explanation), we can take this to another level. I propose a $10,000 wager.

When you’re ready to proceed, we can arrange for an escrow account to be set up at a mutually agreeable law firm along with an escrow agreement. After that we will agree on random selection of 3 screened professional financial consultants who will judge the debate.

More on Dave Collum

- Cornell's Conspiratorial Crackpot, Dave Collum Giving Terrible Investment Advice

- Dave Collum, Cornell's COVID Conspiracy Crackpot Chemist and Investment Disaster

- Cornell's Crackpot Chemist Dave Collum Gives Terrible Advice, Promotes Weird Conspiracies

- Dave Collum Loves to Talk About Things He's Clueless About

- Dave Collum is a Total Crackpot Liar, Conspiracy Loon, and Hypocrite

- Dave Collum Promotes John Hussman as a Credible Expert. Let's Look at Hussman's Funds

- Dave Collum Promotes Jeff Gundlach & Peter Schiff. Let's Look at their Funds' Performance

- Dave Collum Admits Zero Hedge Type Nut Job Conspiracies Are Not Good for Young People

- Cornell University's Reputation Destroyed by Conspiracy Crackpot Chemist Dave Collum

Articles on Gold and the Gold Pumping Syndicate

- Why Hyperinflation Isn't Coming To The U.S.

- Understanding the Proper Use of Gold and Silver

- The Importance Of China To The US Economy

- Understanding Manipulation of Gold by the Media

- Gold Charlatans Strike It Rich While Their Sheep Get Fleeced (Part 1)

- Gold Charlatans Strike It Rich While Their Sheep Get Fleeced (Part 2)

- Gold Charlatans Strike It Rich While Their Sheep Get Fleeced (Part 3)

- Gold Charlatans Strike It Rich While Their Sheep Get Fleeced (Part 4)

- Gold Charlatans Strike It Rich While Their Sheep Get Fleeced (Part 5)

- China Has Increased US Treasury Holdings By Over 2000%

- Blast From The Past - Peter Schiff Was Wrong

- Understanding Manipulation of Gold by the Media

- The California Gold Rush of the Twenty-First Century

- Dismantling John Williams' Hyperinflation Predictions

- The Best Video Ever Created Exposing The Gold Pumping Scene

- Manipulation of Gold and Silver Prices

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 1)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 2)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 3)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 4)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 5)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 6)

- Golden Dreams & Delusions: The Story about Gold You Haven't Heard (PART 7)

- Debunking the Myth that China is Selling U.S. Treasury Securities

- We Predicted The Market Selloff Yet Again

- Comprehensive List of Gold Hacks

- Mike Shows How Gold Pumpers Have Screwed Those Who Fell for Their Lies

- Gold Pumping Charlatans Promote Coronavirus Fake News to Pitch Gold

- Greg Hunter (Promoter of Gold-Pumping Con Artists) Said Gold is Cheap on Aug 11, 2011

- The Gold Price Paradox

- Two Images Illustrate Why Gold is Owned by Dummies

- Revisiting Another Gold-Pumping Doomsday Idiot: John Williams

- Kitco Senior Gold Analyst Agrees With My Views On Gold

- The California Gold Rush of the Twenty-First Century

- Manipulation of Gold and Silver Prices

- The Dow-Gold Ratio Scam and the Pricing of Gold in Foreign Currencies Scam

- Top 20 Gimmicks and Lies of Gold Charlatans - 100 pg e-book

- The Best Video Ever Created Exposing The Gold Pumping Scene

- Mike Explains Why Gold and Bitcoin Price Target Predictions Are Bogus (Jan 10, 2021)

- Gold and Deflation (Part 1)

- Gold and Deflation (part 2)

- Gold Charlatans Too Stupid to Realize Fear Mongering Spawned Formation of Cryptocurrencies 1

- Gold Charlatans Too Stupid to Realize Fear Mongering Spawned Formation of Cryptocurrencies 2

- Kitco: The CNBC of Gold

- An Alternative Way to Play Gold

- Patrick Byrne's Deep Capture Blog Promotes Gold Pumpers and Fake News

- "It is a Fact that All Gold Dealers are Con Men" - Mike Stathis

- Gold Charlatans Running Out of Excuses as the Dow Hits a New High

- EXPOSED: Paid Off Gold Pumping Con Man Dupes YouTube Sheep

- Gold Has NO Intrinsic Value. This is a FACT Based on Finance and Economics.

- Mike Exposes the Gold Money Mind Control Scam

- Peter Schiff Calls Social Security a Ponzi Scheme While Pitching Gold

- Lesson of the Day: Dissecting Gold Propaganda from Peter Schiff

- Broken Clock Gold Pumper Peter Schiff Tries to Create Bank Runs Using Disinformation

- EXPOSED: Jim Sinclair and (Select) Gold Pumping Websites

- Why Gold and Silver Aren't Investments

- Mike Stathis Exposes Jim Rickards and His Gold Pumping Shit Book

- Peter Schiff's Terrible Track Record on Gold and US Economy 2009 - 2014

- Ron Paul: Tool of Controlled Opposition and Gold Pumping Clown

- Mike Explains Why You Should Not Use Gold to Hedge Against Market Decline

- Michael Pento, Another Gold Pumping, Doomsday Clown

- Remember Who Keeps Telling You to Buy Gold

- John Rubino, Promoter of Fear-Mongering, Gold-Pumping, Fake News Syndicate of Con Artists

- Blast from the Past (2014): A Few Notes About Gold Con Men

- The IRS Might Be Interested in What Gold Pumping Clown John Rubino Has to Say

- Bonehead Financial Planner & Friend of Robert Kiyosaki Recommends Schiff's Useless Gold Fund

- Blast from the Past (2014): This One Video Sums Up the Gold-Pumping Con Artist Movement

- Steve Bannon Whores for Very Shady Birch Gold to Con Suckers

- Scam Artist Chris Greene AMTV Uses Alex Jones Tactics to Sell Gold and Crypto Trash

- Market Sanity: Another Kosher Scam for Fear-Mongering Broken Clock Cons and Gold-Pumping Charlatans

- Is Goldmoney is a Scam? Listen to What a Customer Has to Say.

- VIDEO: Survey Says Gold Bugs Are Uneducated, Low-Income Sheep

- VIDEO: More "Gold is Money" Brainwashing from Peter Schiff

- VIDEO: Is Gold a Ponzi Scheme? Listen to Marc Faber's Answer

- Stathis Discusses the Fate of Gold and the Global Economy

- Perhaps the Biggest Joke of All of the Gold Pumping Scam Artists

- Consumer Finance Clown Robert Kiyosaki Pumps Gold As a Way to Sell Disinfo Books

- Gold, Currencies and US Market Forecast Update

- Gold and Oil Outlook and Guidance - Jan 9, 2015

- More Proof that Gold Bugs are Clueless

- Brief Statement About Gold Charlatans and Their Victims

- Veterans Today Promotes Gold Charlatans and Doomsday Idiots

- Mr. Gold Scam Man

- Stathis Shows the Reality Behind Gold-Pumping Doomsday Charlatans

- Aussie Destroys the Gold-Pumping Con Men

- Lynette Zang is Another Jewish Gold Pumping Disinfo Con Artist

- Precious Metals Con Man Mike Maloney Uses Fake News to Sell Gold and Silver

- Mike Maloney Uses Fake News, Lies and Scare Tactics to Sell Gold

- Lessons from Fear-Mongering, Currency Collapse, Hyperinflation, Gold-Pumping Charlatans

- Gold Pumping Fraud and Liar, Lindsey Williams Warned Dollar to Lose Reserve Currency Status (2011)

- Jewish Scammer Chris Greene Pushes Christian Theme to Peddle Gold, Cryptos and Other Trash

- Exposing More BS from Gold Dealers (first published Jan 2015)

- Lynette Zang Pitching Disinfo and Fear-Mongering in Order to Sell You Gold

- Venezuela & Gold. Critical Lessons for Gold Bugs

- Only Scam Artists and Idiots Tell You to Buy Gold Instead of Stocks

- Gold Pumping Fraud and Liar, Lindsey Williams Warned Dollar to Lose Reserve Status (2011)

- John Rubino, Promoter of Fear-Mongering, Gold-Pumping, Fake News Syndicate of Con Artists

- Is This the Best Video Exposing the Gold Pumping Con Artists?

- Peter Schiff Exposed and the Truth About Gold

- Peter Schiff Gets Robert Kiyosaki to Pitch His Gold Fund

- Why the Gold Bugs Got it All Wrong

- Stathis on Commodities, Gold and Treasury Yields

- Failed Chiropractor Bo Polny Claims to be the Top Gold and Bitcoin Forecaster

- YouTube Real Estate Clown George Gammon Changes to Doom Porn /Gold Pumping for Views

- Paul Craig Roberts, Enemy of the People and Gold Pumping Charlatan

- Peter Schiff's Valcambi Gold Destroys Customers' Purchasing Power

- Ron Paul is a Paid Doomsayer for Gold Companies and Con Artists

- Lost Audio Archives: Gold is NOT Insurance They are Lying to You

- Mike Discusses GameStop, the SEC and Gold Pumpers

- Guess Who Nailed The Most Recent Gold Trade AGAIN

- Mike Stathis Nails The Latest Gold & Silver Trade (Jan-Feb 2015) Updated

- Stathis Nails The Gold & Silver Selloff AGAIN - Jul - Sep 2014

- March 25, 2013 Gold Analysis & Forecast

- August 5, 2013

- August 19, 2013 Update

- The REAL Precious Metals Expert Shows You How it's Done

- Stathis Nails the Gold & Silver Trade AGAIN

- August 2012 - We Nailed The Gold Breakout

- The Best Video Ever Created Exposing The Gold Pumping Scene

- Fool's Gold (Part 1)

- Fool's Gold (Part 2)

- Fool's Gold (Part 3)

- Dow-Gold Ratio Scam and Pricing of Gold in Foreign Currencies Scam

- Patrick Byrne's Deep Capture Blog Promotes Gold Pumpers and Fake News

- Another Gold-Pumping YouTube Scam Artist Exposed

- Seek Justice Against Gold and Silver Con Men and More (originally recorded on Nov 6, 2014)

- Mike Sheds More Light on the Gold Pumping Syndicate

- Wall Street Pumps Gold to Lure the Doomsday Morons

- Mike Stathis Exposes the Tactics Used by the Gold Doomsday Crime Syndicate

- Mike Stathis Nails the Gold and Silver Trade Again (Oct - Nov 2015)

- Gold Pumping Fear Mongering Mind Control

- The Dark Future of Gold, Silver, the EU, China and the Doomsday Douchebags

- Jim Sinclair: Exposed as a VERY Shady Gold Pumping Clown

- Addressing More Myths about Gold and Silver

- Is This the Best Video Exposing the Gold Pumping Con Artists?

- Gold Propaganda from Raymond Dalio

- The Best Video Ever Created Exposing the Gold Pumping Scene

- Gold Pumping Snake Oil Specialist Lynette Zang Preaches the Hyperinflation Hoax

- MUST-WATCH Video if You Own Gold

- EXPOSED - Jim Sinclair and (Select) Gold Pumping Websites

- YouTube Doomsday Con Men, Conspiracies, Media Fraud, Gold Lies, and IMF Puppets (2014)

- Future Money Trends Scammer Ameduri Promotes Adrian Douglas Who Claims Gold to $57,000

- Gold Pumping Charlatan David Morgan Makes Money Preaching Fear and Disinformation

- Is Mike Maloney a Gold and Silver Pumping Con Man and Fake News Fraudster? You Decide

- Mike Stathis Exposes Tactics Used by Gold Pumping Crime Syndicate

- The Doug Casey Scam Explained: Luring Suckers into Gold Penny Stocks

- Is Gold and Silver Pumper David Morgan a Bozo or Con Man? Watch This and Decide for Yourself

- John Stadtmiller of RBN: Jewish Shill for Gold Fraudsters, Pitching Hyperinflation Hoax

- Casey Research, Stansberry Research, Agora Financial - Fear-Mongering, Gold-Pumping Cons

- Which of the Gold Pumping Clowns Claimed Gold Would Double and Silver Would Triple in 2016?

- Dispelling Common Myths About Gold, Silver and Related Topics

- From Failed Real Estate Agent to Fear-Mongering Gold Pumper - Jeremiah Babe

- Failed Chiropractor & Contrarian Indicator, Bo Polny Claims Top Gold and Bitcoin Forecaster

- Liberty and Finance Religious Scam - Jewish Cons Use God to Pump Gold to Religious Zealots

- Mike Exposes Penny Stock Pump and Dump Scam Goldmining

- Twin Airheads on JewTube Pretend to be Investment Experts to Advertise for Gold

- Mike Shows How Gold Pumpers Have Screwed Those Who Fell for Their Lies (Video 1)

- Mike Shows How Gold Pumpers Have Screwed Those Who Fell for Their Lies (Video 2)

- Jewish Mafia Uses Legal Means to Create Gold Stock Pump and Dump

- Jewish Gold Pumpers, Libertarians and Cryptocurrency Scam Artists

- Hyperinflation in Venezuela Lessons from Gold Charlatans

- Real Estate Clown George Gammon Changes to Doom Porn and Gold Pumping to Get Views

- Blast From the Past (2014): Stathis Exposes the Gold Pumping Syndicate

- Exposing More Lies about Gold Pumping Con Men

- World's #1 Precious Metals Analyst Reveals How Sheep Are Being Conned by Gold Pumpers

- Blast From the Past (2014): Stathis Exposes the Gold Pumping Syndicate

- YouTube Ad Fraud: Gold Pumping Clown Claim Stock Market is Rising Because Fed Buying Stocks

- Economics Professor Tells the Truth About Gold to a Mike Maloney Cult Member

- Patrick Byrne's Deep Capture Blog Promotes Gold Pumpers and Fake News

- MUST-WATCH Video if You Own Gold

- Stathis Nails the Gold & Silver Trade AGAIN

- The Quote of the Year Goes to Charles Munger When Speaking about Gold

- Fat Dancing Guy Competes with Gold-Pumping Losers for Laughs

- Peter Schiff Using Amateur Bloggers to Write His Gold Propaganda

- EXPOSED: Gold and Silver Manipulation by Gold-Pumping, Doomsday Douchebags

- August 5, 2013 Gold & Silver Forecast

- Gold Analysis & Forecast from March 25, 2013

- Mike Stathis Educates CNBC Morons on Gold

- Blast from the Past: World's Best Video Exposing Ridiculous Claims Made by Gold Hucksters

- Mike Stathis Nails Latest Gold & Silver Trade (Jan-Feb 2015) Updated

- Mike Exposes the Grand Scheme of Gold Pumpers and Other Con Men

- Gold Pumping Doomsday Losers Exposed Again!

- Send in the Gold-Pumping Clowns

- Blast from the Past: Mike Stathis versus the Gold Pumping Syndicate

- Take a Look at Some of the Fake News Gold Pumping Scam Artists on YouTube

- Blast from the Past: Exposing the Gold Pumping Syndicate

- Blast From the Past: Gold Doomsday Scam Artists

- Only the Most Ignorant Stooges Fail to See Why Gold Dealers Hate Cryptocurrencies

- Is the Digital Nomad Scam Any Different from the Gold Pumping Scam?

- Where is Gold Headed? Exposing Fear-Mongering, Broken Clock, Clowns & Con Artists

- Blast from the Past: Gold & Silver Manipulation Exposed

- Blast from the Past: Gold Pumping Losers Exposed

- Blast from the Past: Survey of Gold Pumping Cons & Clowns on YouTube

- Top Wall Street Strategist on Why Retail Investors Should NEVER Own Gold (March 2016)

- Gold Pumping, Fear-Mongering Con Man Now Cryptocurrency Con Man - Chris Greene (AMTV)

- Gold Pumping Blogger and All-Around Idiot Launches His Own Cryptocurrency Scam

- More YouTube Idiots & Gold Pumping Con Artists Exposed - Greg Mannarino

- Lost Videos - Exposing Gold-Pumping Charlatans Alex Jones, Gerald Celente and Ted Anderson

We Have the Competitive Advantage Investors Need

> Mike Stathis is the Only Person Who TRULY Predicted the 2008 Financial Crisis

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #1

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #2

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #3

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #4

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #5

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #6

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #7

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #8

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #9

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #10

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #11

> Mike Stathis' Research Provides Investors With a Huge Competitive Advantage: Exhibit #12